Tax Treaty Compliance Review Process

Why automate?

Cflow Automation Benefits:

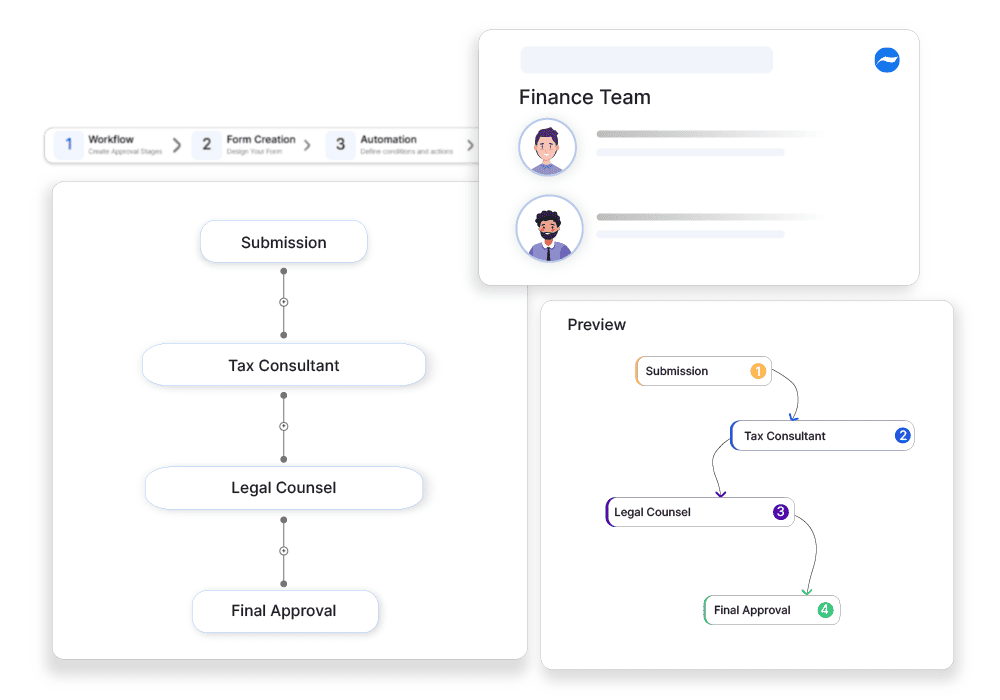

Country-Specific Review Flows:

Ensure treaties are applied only where documentation meets the applicable jurisdiction’s standards.

Document Validation Routing:

Tax forms and income declarations are reviewed and approved before filings.

Risk Mitigation:

Avoid misapplications that trigger audits or penalties.

Compliance Logs:

Maintain traceable records of all treaty-related decisions for future audits.

Frequently Asked Questions

What is the tax treaty compliance review process?

A structured approach to ensuring compliance with international tax treaties to prevent double taxation and optimize tax benefits.

What are the main challenges in tax treaty compliance?

Keeping up with changing tax laws, properly interpreting treaty provisions, and ensuring accurate documentation.

How can institutions improve tax treaty compliance?

By integrating tax compliance software, conducting periodic treaty reviews, and working with international tax experts.