Get Real-time Insights and Complete Control of your Bottom Line with Financial Management Software

Finance and accounting – why are they so important for a business? The key to running a successful business lies inefficient financial management and understanding and controlling the numbers of your company. All the business activities are accurately recorded and analyzed by financial systems. Understanding the how, where, and why of business cash flow helps you make better decisions and avoid business risks. Financial management software helps businesses navigate efficiently through financial activities.

Not only businesses but financial management systems are also required to manage personal finances as well. Personal finance software helps individuals master the basics of financial management that helps manage money more efficiently and meet long-term financial goals. Finance software that helps manage personal finances can also take care of budgeting and expense tracking. Whether it is business or personal financial software systems, they need to provide features like expense tracking and control, budgeting, and real-time financial updates.

What is a financial management system?

What is financial management software? According to Gartner, the financial management system (FMS) is the software and process that an organization or individual uses to manage assets, income, and expenses efficiently. Software to keep track of finances reduces financial errors and ensures compliance with accounting standards.

Software used in financial accounting:

enables businesses to budget confidently and control finances more efficiently. Financial management tools help businesses make informed financial decisions. Intuitive decision-making ensures optimal resource utilization for achieving organizational objectives. Financial management helps create a conceptual and analytical framework for better decision-making. What are the types of financial decisions that companies need to make? Financial decisions are either long-term or short-term decisions.

There are 4 main financial decisions that businesses need to make:

- Capital budgeting or long-term investment,

- Capital structure or financing decision,

- Dividend decision, and

- working capital management decision.

Investment decision:

long-term investment decisions are called capital budgeting decisions. These decisions involve large amounts of money. Short-term investment decisions are called working capital decisions. Levels of cash, inventory and receivables are determined based on investment decisions. A bad capital budgeting decision impacts the financial fortune of the company adversely, and a bad working capital decision affects the liquidity and profitability of a business.

Financing decision:

this decision revolves around the amount of finance that needs to be raised from various long-term sources like equity shares, preference shares, debentures, bank loans, etc.

Dividend decision:

this decision is concerned with deciding how much of the profit earned by the company should be divided among shareholders.

Working capital management:

the management of a firm’s short-term or current assets like inventory, cash, receivables, and short-term or current liabilities are classified as working capital management decisions.

What are the indicators for implementing finance management software for your business? Small scale or start-up businesses may be able to manage well with manual accounting and finance systems. As the business expands, there is a proportional increase in the volume and complexity of financial transactions. Here are some strong indicators that your business needs financial management software:

- Complex financial processes: expanding and large-scale businesses need to manage complex financial transactions within short time durations. Doing this manually is not efficient and is prone to errors and delays.

- Tedious processes: manual verification and validation of financial data and transactions eat up the productive time of the finance and accounting team, as a result, they are unable to focus on strategic activities.

- High volumes: finance teams are overwhelmed by the sheer volume of financial tasks as the scope of business increases.

- Manual errors: validating and verifying financial data manually is prone to errors and inconsistencies. Financial documents prepared manually are riddled with errors.

- Limited visibility: manual processes do not provide complete visibility into financial processes.

In addition to the above indicators, using software for finance management improves the efficiency of business operations. Software used in finance enables accounting teams to track and manage financial data accurately.

The best financial software in the market is SaaS-based financial management software that meets the evolving digital needs of the digital world. SaaS-based financial management systems are comprehensive, mission-critical, and integrated solutions focus on innovation.

Elements of Financial Management

Financial management:

is all about organizing business objectives, planning financial task management, and ensuring financial stability. Most financial management systems can be broken down into four elements. Understanding the main elements of finance management helps in designing the software as per unique business requirements.

Planning:

This step focuses on identifying the steps that align with the business or individual’s objectives. Understanding the long-term business and personal goals is a must for designing the financial management system. Each business goal must be evaluated for profit maximization, business growth, and expansion of services. All of these business initiatives require strong financial planning to get there. Finance budgeting, role allocation, and customer research are some of the elements of financial planning.

Controlling:

every part of the business must be aligned to the established business plan. Appropriate KPIs must be set to measure organizational goals. To have good control over the finances of a business, the KPIs must be clearly established, and the staff must be made aware of the role they play in achieving KPIs.

Organizing and directing:

effective resource utilization is essential for the success of business goals. Resources include material assets and tools, staff, roles, technology, and software. Optimal utilization of these resources helps achieve financial goals easily.

Making decisions:

financial decisions need to be made keeping in mind all the business possibilities and options. Once all the alternatives and potential plans are established, decision-makers must choose from the available options that closely match business goals and objectives. Decisions must coincide with the rest of the planning, controlling, and organizing.

The implementation of the financial management system must be done in phases or categories to ensure complete alignment with the chosen plan. Tools used in financial management improve long-term and short-term business performance by streamlining financial management. Several tools are available for the manager in financial planning, which eliminates accounting errors and minimizes redundancy in record keeping.

Types of Financial Management Systems

Depending on the main purpose of the software, financial management systems are divided into 3 types: financial accounting, managerial accounting, and corporate finance systems. A brief look at the types of financial software systems is given below.

Financial accounting:

these systems provide financial information in the form of balance sheets, income statements, and statements of cash flows. This information is provided to creditors, taxing authorities, and investors. A financial management platform provides financial information in the form of monthly reports that empower decision-makers with data related to business and market trends.

Managerial accounting:

these systems provide information internally to businesses and individuals. Managerial accounting information is not made available to the public, it is only available for internal use. Management (decision-makers) can request for specific accounting information to be provided in a specific format to make informed decisions.

Corporate finance:

corporate finance lies outside of normal accounting information systems. Under the umbrella of corporate finance are systems for budgeting, financial forecasting and analysis, performance metrics, and others. Information from a centralized accounting information system is extracted to make necessary reports. The main intent of corporate finance software tools is to provide a road map to a company’s finance activities.

The financial activities included in common financial systems are different. Each of the activities in finance management assists companies to manage various finance and accounting functions. A small business may have different financial management needs when compared to a larger organization. Finance software needs to be flexible and scalable to suit a company’s requirements.

The core functionality of Financial Management Software

Finance software delivers accurate information across the organization. The following finance functions are provided by finance management software:

Ledger management:

general and sub-ledgers are managed by finance software, thereby, eliminating the need for additional hardware and middleware. This reduces installation and implementation costs considerably.

Accounts payable and accounts receivable:

complete automation of the accounts payable and accounts receivable functions helps deliver better budgeting forecasting, and planning systems. Detailed tracking of all assets and liabilities is possible with a financial management solution.

Asset management:

the value and condition of assets must be known for managing inventory. Financial management software requires operational and capital data that describes asset information in detail. Even data related to the appreciation and depreciation of assets is provided by the asset inventory management system.

Collection management:

collection and management of data related to suppliers and customers is an important capability of finance management software. A comprehensive collections management system enables easier ranking of customers, the establishment of collection strategies, managing collection payments, and initiating late-stage collections for bankrupt customers.

Reporting and analytics:

finance systems enable retrieval, organization, and analysis of financial data from financial management solutions for deeper insights into a company’s operational performance and financial situation. Embedded native reporting solutions in finance software enable effective finance management. Multi-dimensional reporting platforms, self-service reporting, and data visualization capabilities are some of the must-have functionalities of finance systems.

Risk management:

finance solutions offer internal controls and audit tools that monitor and protect companies from internal and external theft and fraud. Segregation of duties and payment rules is possible with finance software.

Employee expense management:

generating and processing employee expense reports is an important capability of finance software. Employees must be able to make self-service entries and map expenses to projects and travel accounts.

Core Benefits of Finance Software

Software applications for finance provide tools for governing expenses, income, and assets. The ultimate goal of financial management solutions is to maximize profits and protect financial data from fraud and theft. Here are the main advantages provided by financial management applications:

Error-free financial transactions:

modern companies require more than just digital bookkeeping with spreadsheets, they should help finance teams maintain financial control, shorten invoicing cycles, minimize accounting errors, and ensure compliance with tax laws and regulatory requirements. Financial management systems empower finance teams with all these capabilities and also help them optimize daily, monthly, and yearly cash flow.

Accurate financial data:

financial software must enable organizations to reduce the redundancy of data, make better budgeting and forecasting decisions, and categorize expense management. Financial management systems can be integrated into other banking systems for seamless communication of data.

Tax and audit compliance:

financial management systems standardize financial processes across the organization. Standardization improves tax and regulatory compliance of the business.

Data systems and security:

one of the major drawbacks of manual finance and accounting systems is the lack of data security. Finance management systems offer the highest degree of data security and integrity across the organization. Critical finance data is safeguarded against theft, fraud, and other criminal mischiefs.

Scalability and flexibility:

financial management systems can easily and rapidly scale up to growing business needs across markets and geographical boundaries. The introduction of new products or services by the business entails changes in the finance and accounting processes. Finance management systems can easily adapt to new product or project requirements of the business.

Seamless integration:

in larger organizations, finance systems are part of the enterprise resource planning (ERP) system that connects financial and other business data across inter-department, inter-company, and inter-division boundaries. Financial systems must be able to seamlessly integrate with ERP systems for consolidating finance data and aligning corporate processes.

Personal Finance Software

Personal money management software and apps help you master the basics and become more efficient in managing your money and discover ways to meet long-term financial goals. Best personal budget software can help you meet current financial needs, track expenses, and master budgeting techniques. Some advanced personal finance management tools help with investment portfolio management. Personal finance software for Mac or the best home bookkeeping software for Mac helps you make better sense of your personal budget, gain better control over household spending, or even check your credit score.

The best personal finance software has everything to do with personal finance goals, income, and expense comparison, and creating daily, monthly, and yearly budgets. The personal finance management software industry is witnessing rapid growth over the past decade. Finance management tools have been created for managing every stage, personality type, and control. Unlike financial management solutions for businesses, personal finance management solutions allow you to share your data with preferred tax and accounting software. Personal finance software can be customized to suit online and offline requirements.

Features to look for in personal finance and accounting software:

Desktop or mobile usage: having personal finance software that allows users to log and track outgoings through mobile apps makes more sense than a desktop-only solution. Ideally, the software must support desktop and mobile usage.

Easy integration: the ideal personal finance software must work in tandem with other packages, for seamless exchange of expense data and easy tax filing.

Reporting capability: getting monthly and yearly reports from the software helps you manage money and track spending more efficiently.

Help and support: some personal finance solutions come with free support, while others have it as part of the paid subscription plan. You can decide on how much help you need depending on your comfort with the software.

Choose the personal finance software depending on the nature and scale of your income and expense. What is the best personal finance software? The best personal finance software 2022 are listed below:

- Quicken – this is ranked as the best personal finance management tool.

- Mint – this is ranked as the best software for personal budgeting

- YNAB – this is best suited for habit spending

- Mvelopes – best suited for zero-based budgeting

- TurboTax – best suited for personal tax

- Future Advisor – helps make informed investment decisions

- Personal Capital – gives best investment advice

- Tiller Money – for efficient spreadsheet management

Best Financial Management Software

Financial management software comes in all sizes and types, managers need to understand the purpose and features of each software to choose the solution that works best for their business. Capterra has put together a list of the best financial management software and its features for businesses to choose from. Here are the top 5 financial management software from that list:

1. NetSuite:

one of the most popular finance software that provides a comprehensive list of features for efficient and effective finance management. The pre-configured and customizable dashboard in the software gives real-time reporting across financials, sales, inventory, and orders. Businesses can accelerate the financial close process while maintaining global accountancy standards. Financial tools required to monitor, adapt and grow businesses are provided by NetSuite.

2. Anthem:

this finance software is best suited for small and medium educational institutes looking to digitize manual record-keeping. Student admission data, student information, fee collection, payroll, and expense data can be easily and accurately maintained by using Anthem. This software can be used on smartphones and PCs. Users can easily track the overall performance of branches, simplify cash management, and analyze student enrollment and financial trends with the software.

3. Caflou:

this is a digital cash flow management software that provides complete control over business and finances. Users can keep track of past and planned cash flows with Caflou. Businesses can monitor and analyze income and expenses by customers, payment categories, and suppliers using the software. The user interface is simple and intuitive and enables centralized management of clients, projects, and tasks.

4. FreshBooks:

easy to use and cost-effective invoicing and accounting solution for businesses of various sizes and types. Business performance can be monitored through straightforward dashboards and reports provided by the software.

5. Wrike:

this software is best suited for project financial management. Tools for budgeting, time tracking, and analytics are provided in Wrike. You can create a project budget, set preferred currencies, control user access, and add default hourly rates, all in one place with the software.

Future of Financial Management Software

According to the NextMsc report, the personal finance management solution industry which was valued at 0.94 billion USD in 2019 is predicted to reach 1.80 billion by 2030. Delivering a cloud-based financial management solution helps organizations gain a competitive edge in a digital economy. In the future, advanced technology like artificial intelligence can be integrated with finance management software for intuitive management of finances. Automation of financial management saves time, money, and resources, and improves the efficiency of finance operations.

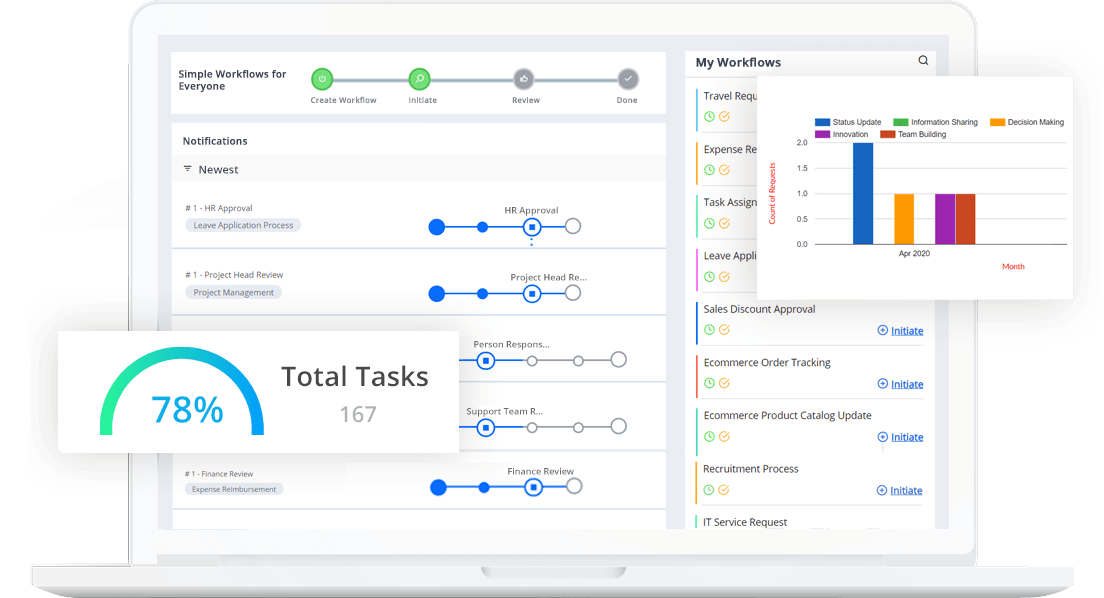

Cflow from Cavintek is a workflow automation software that is capable of quick and efficient automation of key business workflows. From procurement to finance to HR – all the critical business workflows can be automated by Cflow. To know more about automation capabilities that Cflow brings into your finance management workflow, sign up for the free trial today.