Supplier Credit Limit Monitoring

Why automate?

Cflow Automation Benefits:

Credit Limit Threshold Alerts:

Cflow automatically flags when spend is nearing supplier credit limits.

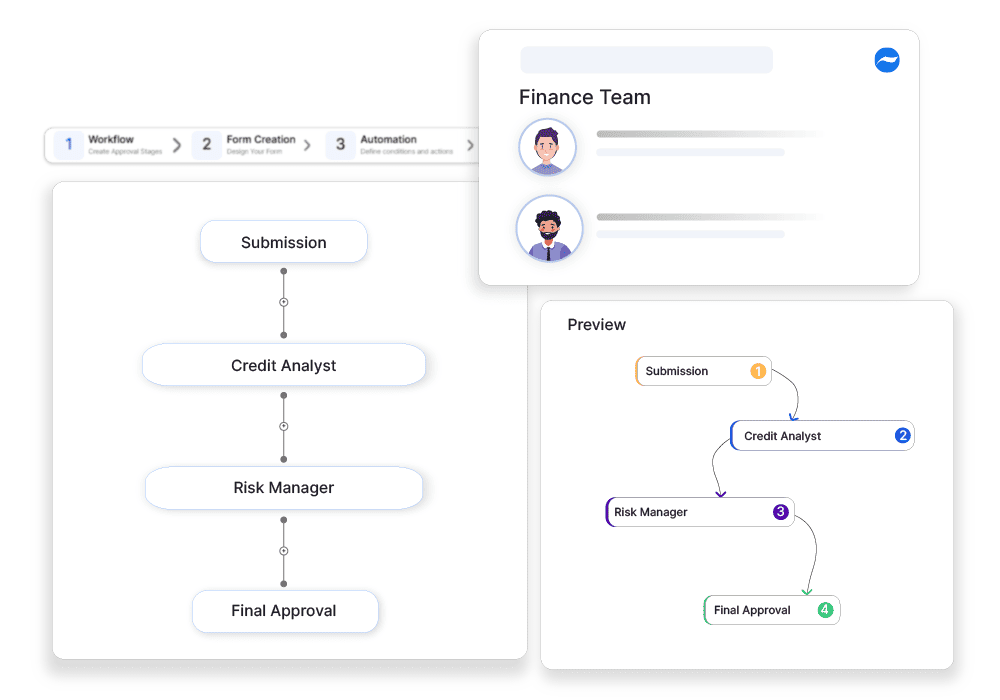

Override Request Routing:

Exception requests are sent to finance and procurement for review before approval.

Improved Spend Monitoring:

Track all supplier credit usage in real-time, reducing procurement risks.

Risk Mitigation Logs:

Document all limit reviews and approvals to support future supplier negotiations.

Frequently Asked Questions

What is supplier credit limit monitoring?

A process to track and manage credit limits granted by suppliers to avoid overexposure and financial risk.

What are the main challenges in supplier credit limit monitoring?

Maintaining up-to-date credit data, avoiding over-reliance on supplier credit, and managing unexpected credit reductions.

How can institutions improve supplier credit limit monitoring?

By using automated credit tracking systems and setting alerts for approaching credit thresholds.