Financial Data Validation Workflow

Why automate?

Cflow Automation Benefits:

Pre-Defined Validation Rules:

Check for anomalies like out-of-budget entries, duplicate records, or inconsistent categorization.

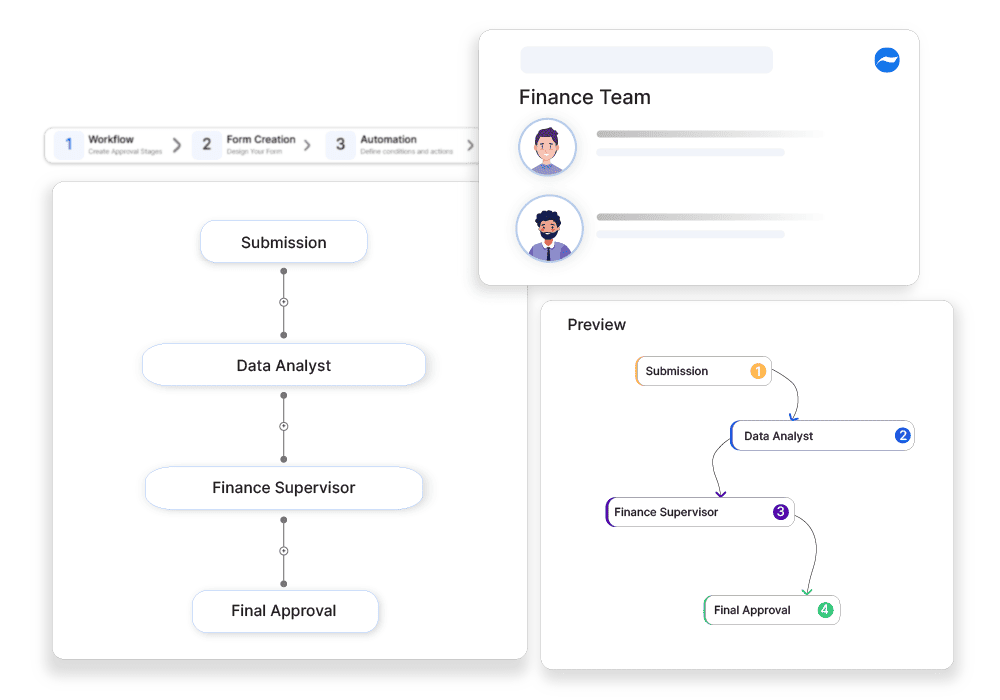

Multi-Level Approval Flow:

Send flagged data entries to appropriate department heads or finance controllers for correction.

Improved Data Quality:

Structured review ensures only clean and verified data reaches final reports.

Quick Error Detection:

Cflow reduces manual effort by instantly flagging mismatches or missing data fields.

Frequently Asked Questions

What is the financial data validation workflow?

A structured method to ensure the accuracy and integrity of financial data.

What are the main challenges in financial data validation?

Detecting inconsistencies, managing large data volumes, and maintaining compliance.

How can institutions streamline the financial data validation workflow?

By using AI-driven anomaly detection, automating data checks, and implementing real-time validation systems.