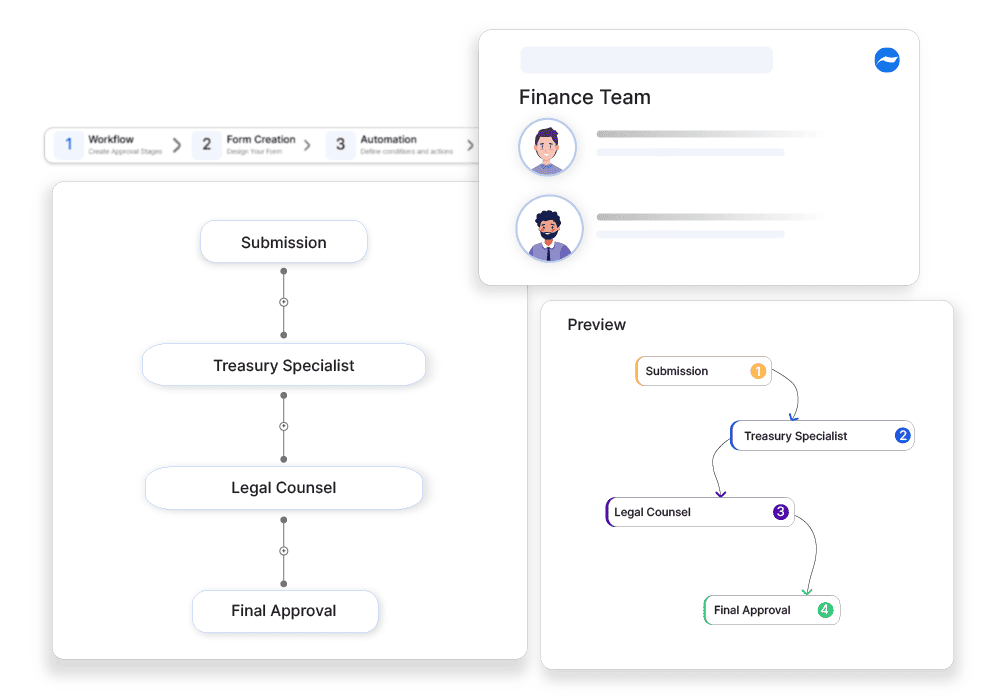

Cross-Border Payment Authorization System

Why automate?

Cflow Automation Benefits:

Geo-Based Approvals:

Route payment approvals through regional finance or compliance heads based on country-specific rules and risk categories.

Regulatory Compliance Enforcement:

Ensure all necessary KYC, tax, and international documentation is submitted before payment approval.

Timely Transactions:

Reduce turnaround time by eliminating email-based approvals and streamlining authorization steps in one platform.

Audit-Ready Documentation:

Keep every cross-border payment trail securely stored for future reference and regulator audits.

Frequently Asked Questions

What is the cross-border payment authorization system?

A process that ensures secure and compliant approval of international transactions.

What are the main challenges in cross-border payment authorization?

Managing exchange rate fluctuations, ensuring regulatory compliance, and preventing fraud.

How can institutions streamline the cross-border payment authorization system?

By implementing automated payment screening, real-time transaction monitoring, and multi-currency payment gateways.