Automated Tax Compliance Workflow

Automated Tax Compliance Workflow

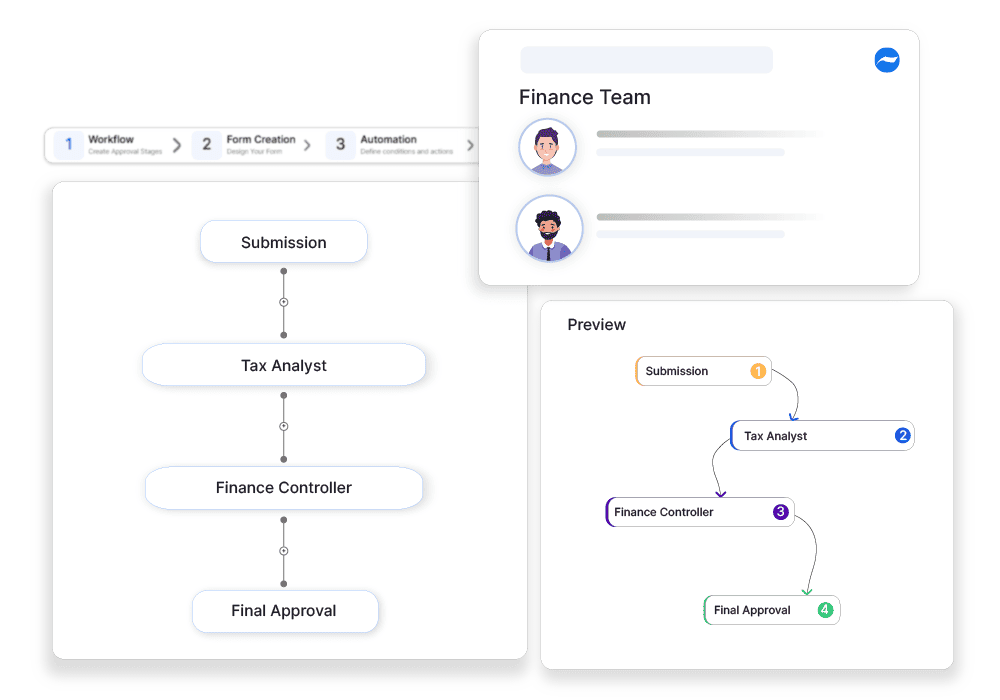

Automate tax compliance workflows to eliminate errors and ensure regulatory adherence across jurisdictions.

Why automate?

Managing tax compliance involves collecting relevant financial data, applying the correct tax rules based on jurisdiction, validating exemptions, and submitting timely returns. Manually handling this process is not only time-consuming but also prone to error, especially for businesses operating in multiple locations. Tax law changes, data discrepancies, and reporting delays can result in penalties and strained relationships with authorities. Cflow transforms this critical function by automating tax workflows and ensuring compliance with evolving tax codes. Cflow allows finance teams to define compliance rules, schedule filings, and route returns for approval automatically. It helps capture real-time updates, verify that documentation is complete, and alert users of missing inputs or filing deadlines. Through workflow tracking and documentation trails, businesses can prepare audits more confidently and reduce the risk of non-compliance. The system’s flexibility supports multiple tax categories including VAT, GST, sales tax, and local levies—making it easy to manage obligations across various regions.

Cflow Automation Benefits:

Filing Deadline Reminders:

Cflow sends automated alerts for upcoming tax submissions, reducing the chances of late filings and associated penalties.

Multi-Jurisdiction Support:

Cflow handles multiple regional rules, ensuring taxes are calculated and applied accurately per local regulations.

Real-Time Data Checks:

Cflow validates financial inputs against compliance rules before they’re routed for filing, catching inconsistencies early.

Audit-Friendly Documentation:

Cflow keeps a digital trail of tax-related approvals and updates, enabling a smoother audit process and regulatory reporting.

Frequently Asked Questions

What is the automated tax compliance workflow?

A structured process that ensures tax obligations are met using automation tools.

What are the main challenges in automated tax compliance?

Managing complex tax regulations, integrating tax software with financial systems, and keeping up with policy changes.

How can institutions streamline the automated tax compliance workflow?

By using AI-powered tax software, real-time data validation, and automated filing systems.