Multi-Currency Reconciliation Process

Why automate?

Cflow Automation Benefits:

Currency Rate Validation:

Ensure each transaction uses the correct exchange rate for the reporting period.

Discrepancy Flagging:

Cflow highlights mismatches between internal and external records in real-time.

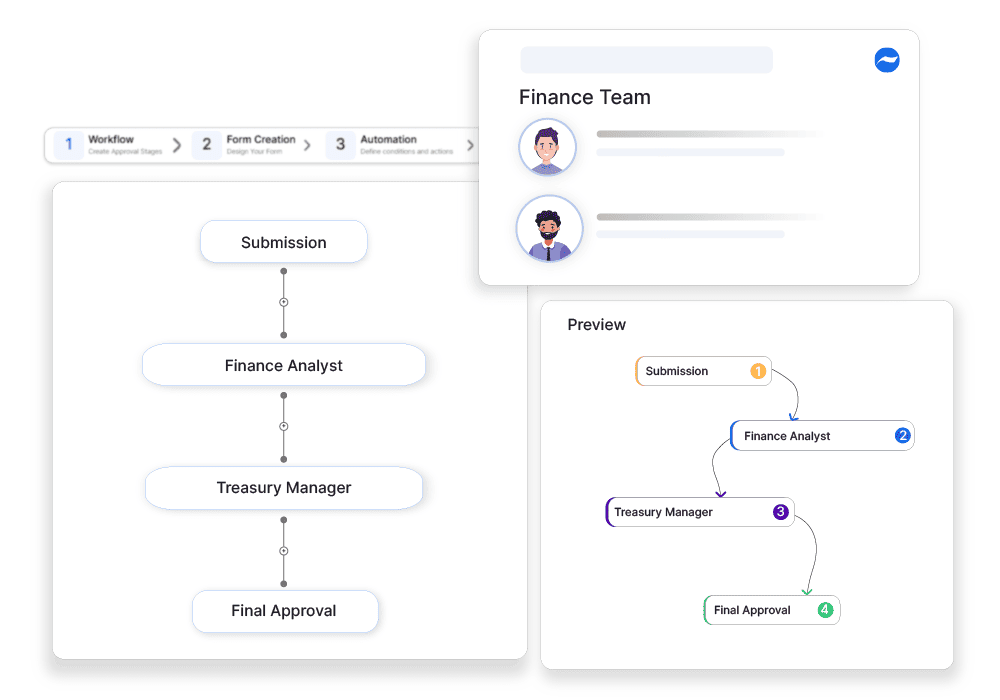

Treasury Review Routing:

High-value or high-variance transactions automatically escalate to treasury leads.

Close Cycle Acceleration:

Reduce reconciliation delays with structured reviews and audit-ready approvals.

Frequently Asked Questions

What is the multi-currency reconciliation process?

A process to match and verify financial transactions across different currencies to ensure accounting accuracy.

What are the main challenges in multi-currency reconciliation?

Managing fluctuating exchange rates, preventing currency mismatches, and ensuring real-time data accuracy.

How can institutions streamline multi-currency reconciliation?

By using automated reconciliation tools, integrating foreign exchange monitoring systems, and setting standardized currency conversion policies.