Treasury Workflow Standardization

Why automate?

Cflow Automation Benefits:

Template-Based Treasury Tasks:

Design workflows once and apply them across teams for recurring treasury activities.

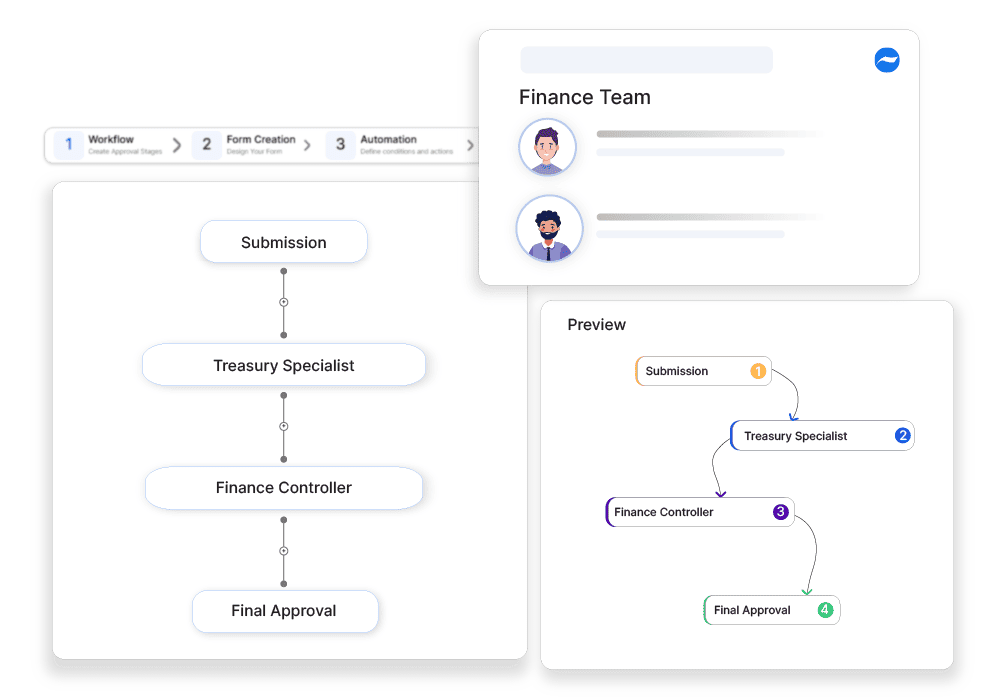

Centralized Approval Structure:

Route approvals through defined roles, improving accountability and reducing delays.

Risk Mitigation:

Enforce dual-control rules and segregation of duties through workflow settings.

Better Liquidity Visibility:

Real-time reporting ensures treasury teams have updated views into cash flow operations.

Frequently Asked Questions

What is treasury workflow standardization?

A process to create uniform procedures for treasury operations, improving efficiency and compliance.

What are the main challenges in treasury workflow standardization?

Integrating multiple financial systems, ensuring compliance with global regulations, and managing liquidity risk.

How can institutions streamline treasury workflows?

By implementing treasury management software, defining clear process guidelines, and automating cash flow tracking.