Cash Inflow-Outflow Balancing Process

Why automate?

Cflow Automation Benefits:

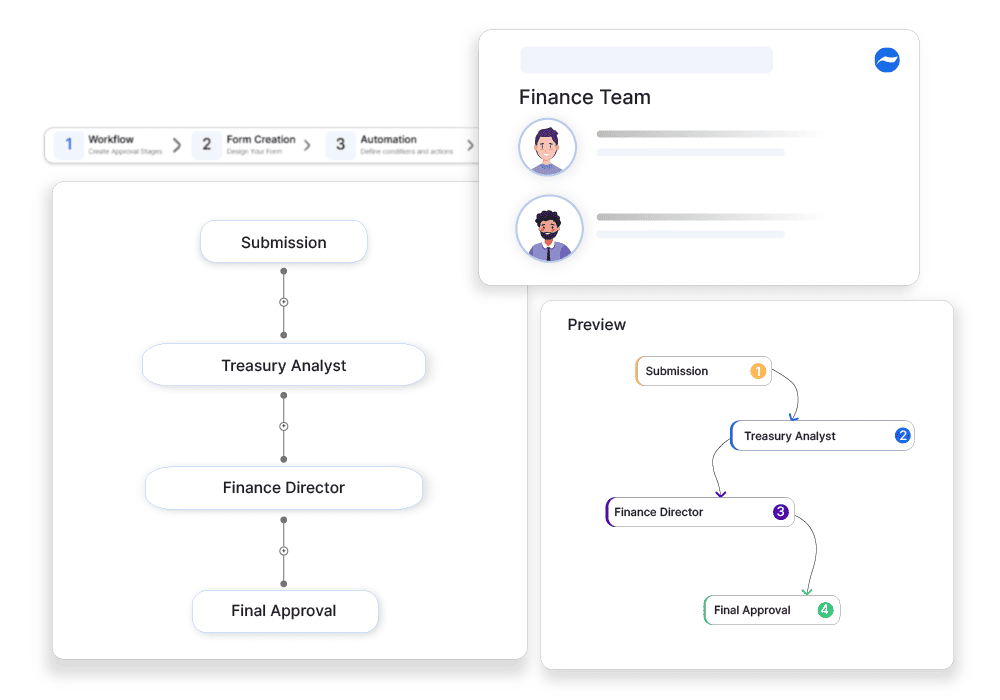

Forecast Update Routing:

Changes in receivables, payables, or major expenses are submitted and reviewed before impacting cash flow.

Real-Time Visibility:

Cflow tracks pending approvals and cash positions to support accurate decision-making.

Disbursement Controls:

Set rules to delay or fast-track payments depending on cash availability.

Reduced Financial Stress:

With better alignment between inflow and outflow, teams avoid unnecessary borrowing or payment delays.

Frequently Asked Questions

What is the cash inflow-outflow balancing process?

A financial process to ensure that incoming cash is sufficient to meet outgoing financial obligations.

What are the main challenges in balancing cash inflows and outflows?

Managing unpredictable cash fluctuations, optimizing payment timing, and ensuring liquidity during low-revenue periods.

How can institutions streamline the cash balancing process?

By using automated cash flow forecasting tools and setting predefined liquidity thresholds.