Accounts Payable Approval Workflow

Why automate?

How Cflow Can Help Automate the Process:

Centralized Invoice Processing:

Cflow offers centralized vendor invoice processing to ensure accurate capturing of necessary information such as payment terms and amounts. This significantly reduces administrative resulting in a standardized approval process.

Automated Three-Way Matching:

Vendor invoices are automatically matched with their corresponding purchase orders and reports in Cflow. This flags any potential discrepancies ensuring payments are done accurately and prevents overpayments.

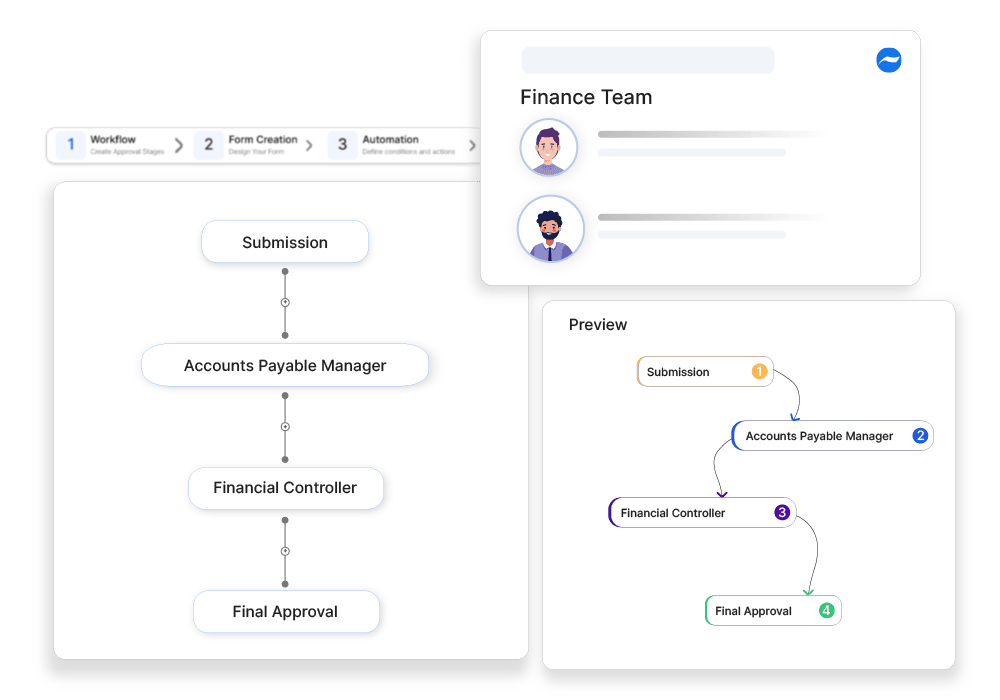

Streamlined Approval Workflows:

The transactions involved in the accounts payable are routed through specific predefined workflows comprising members from finance and procurement teams. This is to make certain of a thorough review and timely approvals for accurate and timely payments.

Detailed Reporting and Vendor Management:

In Cflow users can have detailed reports on the accounts payable approvals. The report details invoice statuses, payment histories, and vendor performance. This transparency facilitates better financial oversight, improves vendor relationships, and offers insights into payment trends and potential risks.

Frequently Asked Questions

What are the best practices for managing accounts payable?

Automated invoice matching, vendor negotiations, and scheduled payments.

What causes delays in accounts payable processing?

Invoice discrepancies, missing approvals, and budget constraints.

How can companies prevent late payment penalties?

By setting up early payment discounts and automated payment scheduling.