Escrow Payment Approvals

Why automate?

How Cflow Can Help Automate Escrow Payment Approvals

Automated Condition Verification

The terms and conditions required for approving escrow transactions are automatically verified in Cflow for quick processing and release of funds. This helps reduce the risk of errors and ensures that payments are made only when all terms are satisfied.

Centralized Escrow Documentation

The centralized platform in Cflow facilitates easy storing and management of all documents related to escrow payments. This ensures that all necessary documentation is easily accessible and properly recorded, providing a clear audit trail.

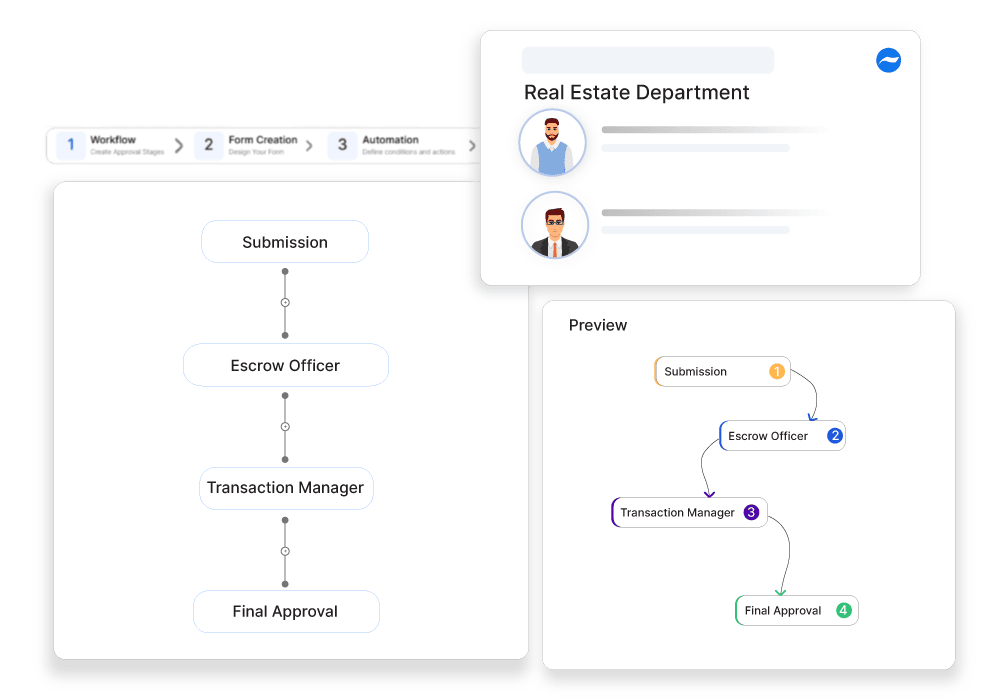

Streamlined Approval Workflow

Streamlined escrow payment approval workflows in Cflow route requests to appropriate authorities in legal and finance teams for review and approval. This ensures that all necessary approvals are obtained promptly, reducing delays in the transaction process.

Real-Time Payment Tracking

With Cflow, real estate managers can track escrow payments in real-time. The intuitive user interface in Cflow allows all parties to monitor the status of funds and approvals. This way all stakeholders are on the same page and transactions are completed efficiently without any delays.

Frequently Asked Questions

What is an escrow payment approval?

A process where a financial institution reviews and authorizes the release of funds held in escrow.

What challenges arise in escrow payment approvals?

Miscommunication between parties, incorrect payment amounts, and delayed fund transfers.

How can organizations streamline escrow payment approvals?

By automating payment tracking, ensuring accurate documentation, and providing clear payment instructions.