Fire Insurance Claim Approvals

Why automate?

How Cflow Can Help:

Automated Claim Verification:

Cflow can automatically verify fire insurance claim details and ensure compliance with policy terms. This will significantly reduce manual errors and streamline the process.

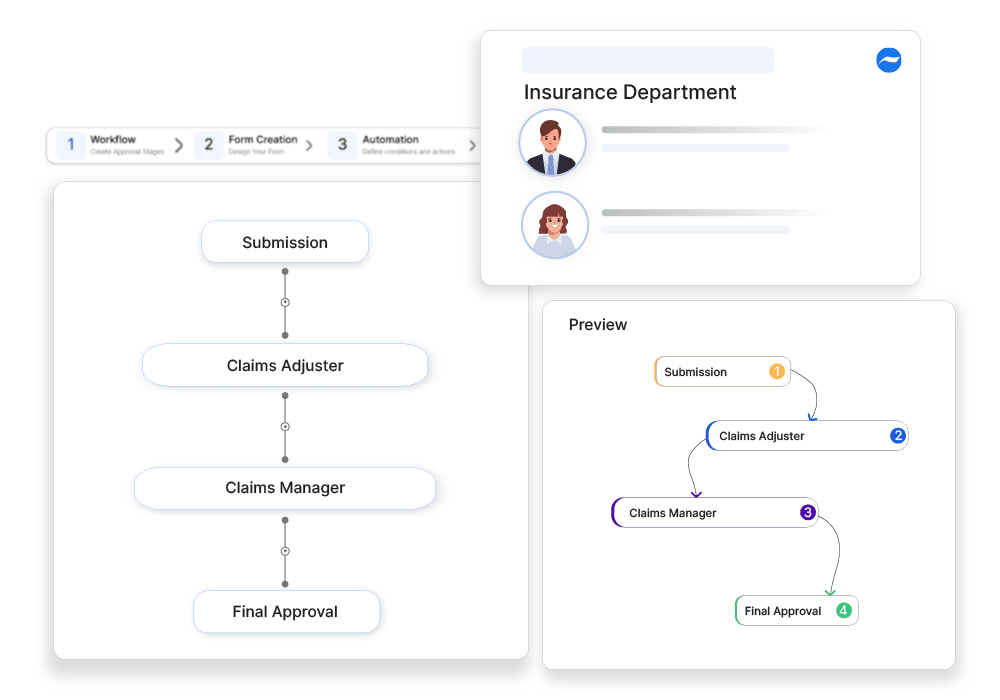

Efficient Workflow Management:

On Cflow, users can create custom workflows for managing fire insurance claim approvals seamlessly. This will minimize processing times and improve accuracy.

Compliance and Record Keeping:

Cflow will ensure all fire insurance claims comply with regulatory requirements and company policies. This will help maintain accurate records for audit purposes.

Enhanced Communication:

Cflow provides timely updates and confirmations to policyholders. This way, users can improve satisfaction with transparent and efficient claim processing.

Frequently Asked Questions

What is a fire insurance claim?

A claim filed for compensation due to property damage or loss caused by fire incidents.

What are the main challenges in fire insurance claim approvals?

Determining the cause of fire, claim investigations, and disputes over policy coverage.

How can businesses ensure smooth fire insurance claim approvals?

By conducting fire risk assessments, maintaining property documentation, and working with certified adjusters for accurate evaluations.