Employment Practices Liability Claim Approvals

Why automate?

How Cflow Can Help Automate the Process:

Automated Claim Verification:

The verification and cross checking of employment practices liability claims against policy coverage and company policies details. Automated verification ensures that only legitimate and valid claims are approved, which reduces the risk of errors and speeds up the process.

Compliance and Regulatory Management:

Cflow helps insurance companies stay compliant by incorporating automated compliance checks, which ensures that employment practices liability claims are compliant with legal and regulatory requirements. These automated checks make sure each claim is handled as per industry standards, thus, reducing the risk of non-compliance and potential lawsuits.

Real-Time Tracking and Reporting:

With Cflow, insurers can gain real-time visibility into each stage of the EPLI claim approval workflows. Insurance managers can quickly identify and solve any issues without any delay or error. All stakeholders stay informed on the status of the claim.

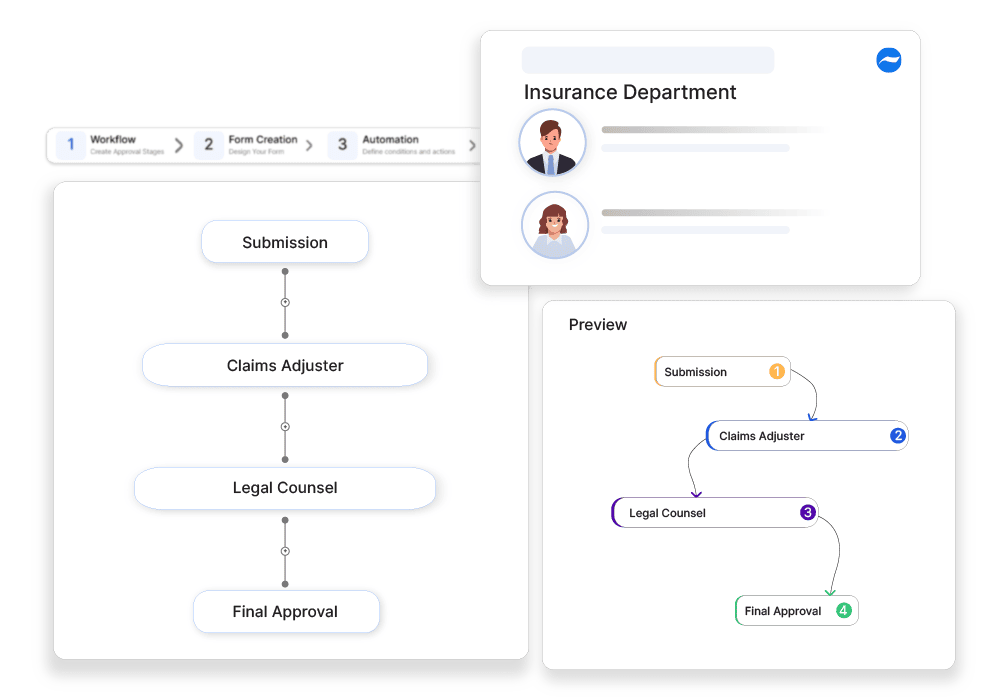

Customized Workflow Creation:

The visual workflow builder in Cflow allows insurance companies to customize their workflows. These customized workflows include automated steps for gathering documents and verification of data to ensure accurate processing of claims.

Frequently Asked Questions

What is an employment practices liability claim?

A claim covering legal expenses from employee lawsuits related to discrimination, wrongful termination, or harassment.

What are the main challenges in employment practices liability claims?

Prolonged legal proceedings, disputes over evidence, and reputational damage.

How can businesses ensure smooth employment practices liability claims?

By maintaining HR compliance, conducting regular training, and keeping detailed employee records.