Working Capital Ratio Analysis

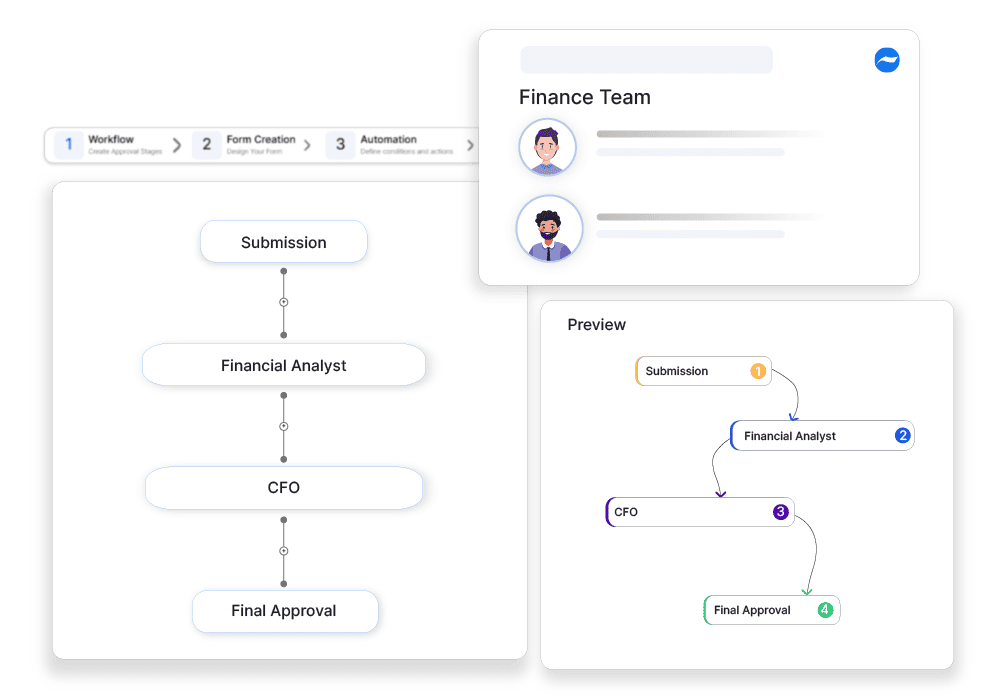

Why automate?

Cflow Automation Benefits:

Automated Data Collection:

Request real-time updates on current assets and liabilities for accurate ratio calculation.

Trend Analysis Workflows:

Highlight changes in ratios and route for CFO-level review and commentary.

Proactive Alerts:

Set minimum threshold alerts to trigger investigation or corrective actions.

Improved Financial Agility:

Respond faster to liquidity issues through structured, timely reviews.

Frequently Asked Questions

What is working capital ratio analysis?

A financial process to evaluate an organization’s short-term liquidity by comparing current assets to current liabilities.

What are the main challenges in working capital analysis?

Managing cash flow fluctuations, optimizing receivables and payables, and ensuring financial stability.

How can institutions enhance working capital ratio analysis?

By integrating real-time cash flow monitoring, optimizing inventory management, and using financial forecasting tools.