Understanding the Functions of Accounting

Key takeaways

- Financial accounting deals with the recording of transactions that are needed for the preparation of trial balance and final accounts of the company.

- The five types of accounting include financial, cost, management, tax, and social.

- Principles of financial accounting include revenue principle, expense recognition principle, matching principle, cost principle, and objectivity principle.

- Financial accounting is important because it is a legal requirement, it represents financial stability, improves transparency and compliance, and helps make data-driven decision-making.

- The main functions of accounting are analyzing financial data, preparing budgets, cost control, detecting and mitigating risks, accounts payable and receivable, payroll, reporting financial analysis, compliance and tax audits, and determining profitability, liquidity, and solvency.

Finances are the core of any business venture and without adequate financial management tools, your business cannot optimize the resources, struggles with tax payments, and ineffective business operations. This is why you need a solid accounting team with professionals who can keep a constant eye on the financial flow of your business and keep you aware of your business’s financial health progressively.

Accounting is the standard practice of recording financial transactions in your business systematically and maintaining the information comprehensively. Over time, the investment that you make in your financial management resources pays for itself.

Table of Contents

Types of Accounting

Accounting refers to the business process that systematically and comprehensively records business events and transactions and translates them into financial data.

The accounting profession is a well-established and evolving field that includes various specialized designations, prominent firms, and career opportunities across different industries and niches.

The data provided by this function enables business leaders to make informed decisions. With the aid of a global accounting outsourcing service provider, businesses can ensure that accounting functions, such as tracking financial transactions and providing updated financial data, are handled efficiently.

The 2 roles of accounting are to provide updated financial data and track all financial transactions.

The accounting function is classified into 5 types.

1. Financial accounting:

This type of accounting software records the transactions that are needed for the preparation of the trial balance and final accounts. This is one of the main functions of accounting.

2. Cost accounting:

This is the accounting discipline that deals with costs. Costs imply the unit cost of goods and services provided by the organization. The data provided by cost accounting helps the management fix the price of goods/services, control costs and provide relevant information for making strategic buying decisions.

3. Management accounting:

As the name implies, a management accounting system provides the necessary information for the management to make strategic business decisions. The accounting data provided revolves around funds, costs, profits, and losses. The effect of financial statement decisions on the business and performance of the entities may be learned with the data provided in management accounting.

4. Tax accounting:

The transactions related to tax and its payment are recorded in tax accounting.

5. Social accounting:

This type of accounting is also referred to as social responsibility accounting. Social accounting, also known as social responsibility accounting, tracks the social and environmental impact of business activities. This branch of accounting software is a recent development due to the rapid economic and technological improvements that have increased the company’s scale of operations. Social accounting reveals the facilities provided by the entity to society, like medical, housing, and educational assistance.

Accounting System

An accounting system is the foundation of a business’s financial management, encompassing the processes, procedures, and controls used to capture, process, and report all financial transactions. This system ensures that every business transaction is accurately recorded and organized, providing a reliable source of financial information for both internal and external stakeholders. A robust accounting system is essential for preparing financial statements, including the balance sheet, income statement, and cash flow statement, which collectively offer a comprehensive view of a company’s financial position, performance, and cash flows.

By systematically tracking and documenting financial transactions, the accounting system enables businesses to monitor their financial health, comply with regulatory requirements, and make informed decisions. The accuracy and timeliness of financial data generated by the accounting system are critical for assessing profitability, managing cash flow, and evaluating the overall financial position of the company. Whether a business is small or large, an effective accounting system is key to ensuring transparency, supporting strategic planning, and maintaining financial stability.

Accounting Software

Accounting software plays a pivotal role in modern business operations by automating and streamlining essential accounting functions. These applications are designed to handle the recording of financial transactions, preparing financial statements, and managing accounts payable and receivable with greater speed and accuracy than manual methods. Accounting helps businesses secure financing and find investors by providing proof of financial viability. By leveraging accounting software, businesses can enhance the efficiency of their financial reporting processes and ensure compliance with generally accepted accounting principles (GAAP) and international financial reporting standards (IFRS).

One of the main advantages of accounting software is its ability to integrate seamlessly with other business systems, such as payroll and inventory management, creating a unified platform for managing financial resources. This integration supports a wide range of accounting functions, from financial accounting and managerial accounting to cost accounting, enabling businesses to analyze their financial health and make data-driven decisions.

Popular accounting software solutions like QuickBooks, Xero, and Sage offer customizable features to suit the unique needs of different organizations. When choosing accounting software, businesses should consider factors such as user-friendliness, scalability, and the ability to support accurate financial reporting. By adopting the right accounting software, companies can improve the accuracy of their financial statements, streamline the process of preparing financial statements, and gain deeper insights into their financial performance and stability.

📚 Roles and Responsibilities of Accountants 📚

Accountants help businesses manage money, stay organized, and make smart financial decisions. Here are the key roles and responsibilities in simple terms:

Keep financial records: Track all income, expenses, and transactions.

Prepare financial reports: Create balance sheets, profit & loss reports, and cash flow statements.

Manage budgets: Help plan budgets and monitor spending.

Ensure compliance: Follow accounting rules, tax laws, and company policies.

Handle payments: Manage invoices, bills, payroll, and bank reconciliations.

Analyze finances: Identify trends, errors, or areas to save money.

Support decision-making: Give management clear financial information.

Assist with taxes and audits: Prepare tax documents and support internal or external audits.

What is Financial Accounting?

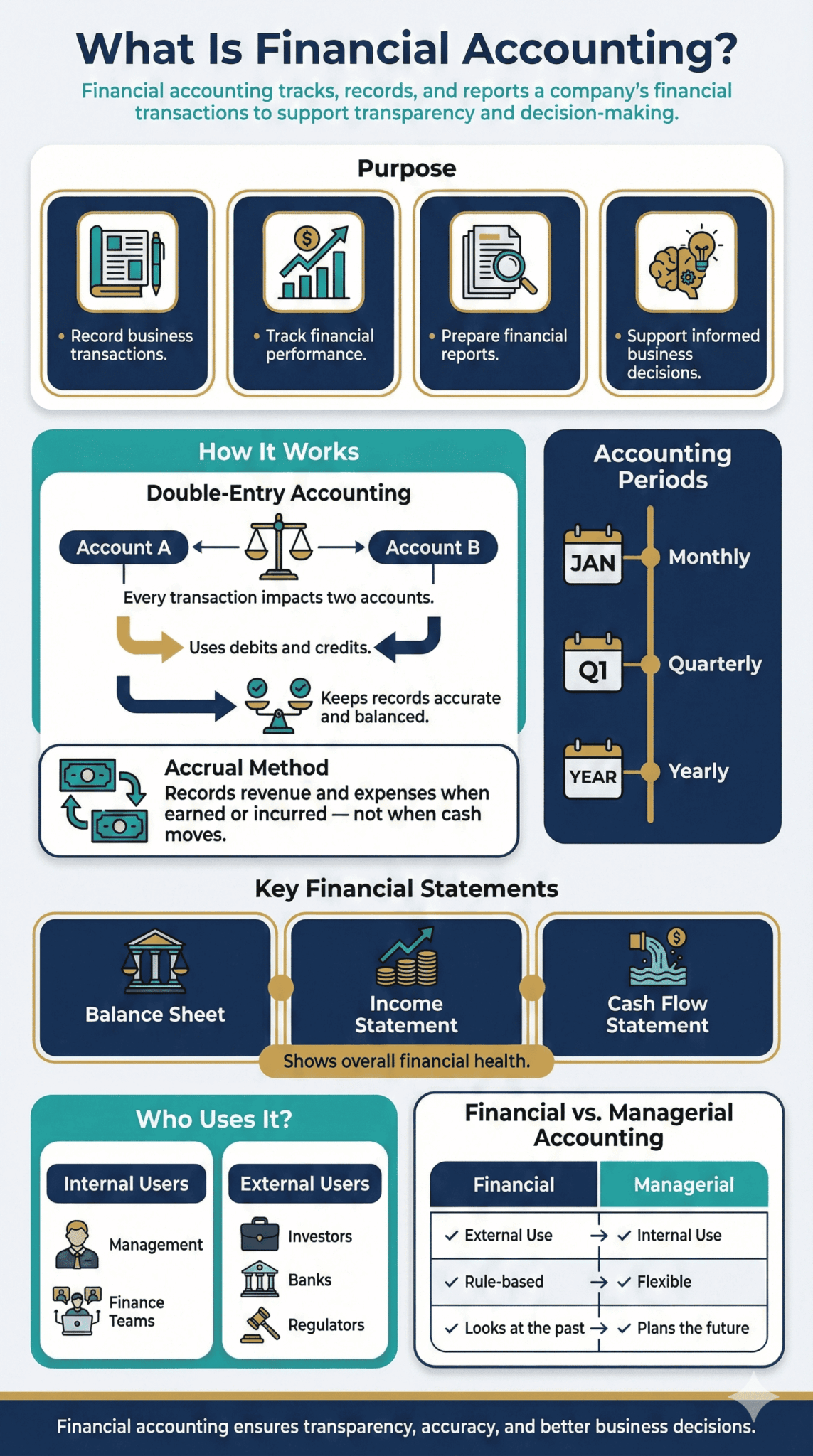

As mentioned above, financial accounting is a type of accounting that deals with the recording of transactions that are needed for the preparation of trial balance and final accounts of the company. The primary functions of an accounting system are to track, report, execute, and predict financial transactions. Double entry accounting is the fundamental method used to record these transactions, ensuring that each transaction affects at least two accounts through corresponding debits and credits.

The basic function of financial accounting is to also prepare financial statements that help company leaders and investors to make informed business decisions. Financial accounting is a type of accounting that includes documenting, summarizing, and reporting transactions that arise from business operations for a period. The accounting period, which can be monthly, quarterly, or annually, is crucial because it defines the specific time frame for which financial statements are generated and audits are conducted. These transactions are outlined in the preparation of the balance sheet, income statement, and cash flow statement.

When recording transactions, accrual basis accounting is often used, which means revenue and expenses are recorded when they are earned or incurred, not necessarily when cash is exchanged.

The historical function of accounting classifies financial data into income, expense, assets, and liabilities. The main difference between financial and managerial accounting is that the former intends to provide information to parties outside the organization, while the latter provides information for the company’s management to make informed decisions. Reporting financial transactions is essential, as it forms the foundation for creating financial reports that inform both internal management and external stakeholders about a company’s financial health.

Is financial accounting the same as accounting?

The accounting function records and monitors all the business’ financial transactions. The accounting department sets policies and procedures for expenses, data management, and the generation of financial reports. Financial accounting on the other hand focuses specifically on generating financial transaction reports based on financial data.

There are 4 main types of financial statements that every business needs to prepare.

Income statement:

The company’s net income for a certain period is called the income statement. Sales revenue is recorded on the income statement as the total amount earned from goods or services sold, and it plays a crucial role in determining net income. The total expenses are deducted from the total revenue for the period to reflect in the income statement. The profit and loss statement is the same as the income statement.

Balance sheet:

This financial statement shows the assets and liabilities of the company as of a particular date and time. The shareholder’s equity is also reflected in this statement. The balance sheet provides a snapshot of the business’s financial position, offering insights into the company’s financial health for both internal and external stakeholders. It is essential for safeguarding the company’s assets by ensuring proper management and security of financial resources. Assets of a company include cash, prepaid expenses, notes and accounts receivable, machinery and equipment, intangible assets, building and infrastructure, and vehicles. Liabilities can include accounts payable, notes payable, unearned revenue, deferred tax, current taxes, and mortgages.

Cash flow statement:

Cash flow statements provide details of the company’s income and debts over a specific period. Only cash transactions are reflected in the cash statement. Only the short-term viability of a company is reflected by the cash flow statement.

Statement of retained earnings:

The amount left after dividends are paid to stockholders.

Principles of Financial Accounting

Accounting rules and accounting standards provide the uniform frameworks that guide financial reporting, ensuring consistency, transparency, and comparability across organizations and regions. In the United States, the Financial Accounting Standards Board (FASB) is responsible for establishing and maintaining the financial accounting standards known as GAAP, which are recognized by regulatory agencies. Internationally, the International Accounting Standards Board (IASB) develops and maintains international accounting standards, specifically the International Financial Reporting Standards (IFRS), which serve as global accounting rules for public companies.

The functions and objectives of financial accounting are based on a set of principles. Five important accounting principles referred to as generally accepted accounting principles (GAAP) are listed below:

Revenue principle:

All income to the business is recorded when a client or customer accepts goods or services, not necessarily when they pay for it.

Expense recognition principle:

All expenses are recorded when a business confirms goods or services from a third party, not necessarily when they are billed for it.

Matching principle:

Each bit of revenue earned should be matched with corresponding expenses. The agency’s expenses for a particular project must be matched with the project costs.

Cost principle:

Historical costs of assets and liabilities must be considered, and not current and resell costs. This is referred to as the cost accounting principle.

Objectivity principle:

Only factual and verifiable data must be used for financial accounting rather than subjective or estimated figures.

End-to-end workflow automation

Build fully-customizable, no code process workflows in a jiffy.

Why is Financial Accounting Important?

With the understanding of financial accounting comes the question of its importance in running a business. The objective of the financial accounting function is to generate statements containing important financial data that provide insights into the financial stability of the business. Financial accounting statements are meant for internal and external circulation. The importance of financial accounting for the business is described below:

Financial accounting is a legal requirement: Financial statements like the balance sheet, cash flow statement, and income statement are a legal mandate for companies that are registered. The annual report of the company usually includes these statements. Producing accurate financial statements is essential for tax compliance and meeting regulatory requirements, helping companies avoid legal penalties and maintain transparency.

Representation of financial stability: Financial statements are circulated internally with management and externally with investors, auditors, banks, lawyers, and suppliers. The reports generated by accounting are used by lenders, investors, auditors, and regulatory agencies to assess a company’s financial stability. The financial stability of the company can be gauged from the data presented by financial statements.

Transparency: By publishing data on accounts and transactions, transparency in disclosing financial records performance increases. Transparency in financial reporting increases trust among stakeholders and aids in compliance with regulations.

Compliance: Businesses need to comply with laws, tax regulations, and international financial reporting standards (IFRS). Accounting reports are scrutinized by tax authorities to ensure compliance and to assess tax liabilities, making accurate reporting crucial.

Data-driven decision-making: The reports and statements provided by the financial accounting function empower the management to make data-based business decisions. Financial accounting helps manage and analyze the company’s finances and supports the creation of financial statements that reflect the company’s activities.

Financial accounting is an essential business function that enables professionals to understand their financial inflow and outflow.

All companies use accounting to report, track, execute, and predict financial transactions. Accounting department functions revolve around storing and analysis of financial information and overseeing monetary transactions.

To simply explain the functions of accounting in business, we can say that it creates a fiscal history for any company. Accounting creates a fiscal history for any company by tracking expenditures and profits. The main functions of accounting deal with tracking and reporting information for internal and external uses. Financial accounting provides insights into the company’s financial health and the business’s financial health, supporting transparency and strategic planning.

💼 Role of Accounting in Business

Accounting plays a crucial role in helping businesses operate smoothly, make informed decisions, and stay financially healthy. Here are the key roles of accounting in any business:

Tracks Financial Transactions: Records every sale, expense, payment, and receipt to keep finances organized.

Measures Business Performance: Shows whether the business is making a profit or loss.

Supports Decision-Making: Provides accurate financial data that helps management plan, invest, and set goals.

Helps Manage Cash Flow: Monitors money coming in and going out to avoid shortages and maintain stability.

Ensures Compliance: Helps businesses meet legal, tax, and regulatory requirements.

Prepares Financial Reports: Generates balance sheets, profit & loss statements, and cash flow reports.

Builds Financial Transparency: Gives owners, investors, lenders, and stakeholders a clear picture of the company’s financial health.

Controls Costs: Identifies unnecessary spending and helps improve operational efficiency.

Supports Budgeting: Helps businesses plan budgets and control expenses throughout the year.

Reduces Risks: Detects financial errors or fraud through proper internal controls.

What are the functions of financial accounting?

The functions of financial accounting may be classified as Historical or stewardship functions and managerial functions. Historical accounting functions are communicating financial information, recording financial transactions, finding net results, exhibiting financial affairs, analyzing financial data, and summarizing and classifying financial data. Managerial finance accounting functions include control of financial policy, formation of planning, preparation of the budget, cost control, evaluation of employee performance, and prevention of errors and fraud.

Accountants perform various functions of accounting. The three groups of functions performed by accountants may be classified as reporting, analysis, and budgeting. The functions of accounting in a business include the following:

Business costs and revenue:

This is the main function of financial accounting. Tracking business spending concerning income helps keep a tab of business costs and revenue. Like managing personal finances, accountants record expenses and payments to maintain accurate and updated records of company funds. The main function of bookkeeping is to record what expenses and payments are undertaken by the business.

Accounts receivable:

Proper financial accounting ensures that the payments due to the company are received on time. A management accountant tracks the business profits and metrics like days sales in accounts receivable regularly to ensure that revenue flow into their bank accounts is not interrupted.

Accounts payable:

The accounts payable function focuses on paying the company’s bills. This function ensures that the business completes all the payments due on time and verifies that payments are done only to legitimate requirements. Setting the due date for the payments is also part of the accounts payable function. Clarity on payments helps in the effective management of funds.

Payroll:

“The payment of employees’ paycheques is part of the payroll function, which may also require businesses to create pay stub records for accurate documentation. The salaries of employees are deducted from the company fund. In addition to paycheques, employee benefits are also paid from the company fund. The accounting function helps decide how employees are compensated for their work based on how their wages affect a company’s profits.

Financial reporting:

Storage and calculation of financial data are usually done using digital systems. A publicly owned company is required to prepare and submit quarterly and yearly reports for shareholders containing information on assets, profits, and losses of the business. Private firms also need to prepare financial reports to understand the financial resources of their firm.

Financial analysis:

Companies use financial accounting for performance analysis. This analysis is performed by an external or an internal person by considering the entire business operations. Financial analysis helps identify process loopholes and bottlenecks and determine ways to improve process outcomes, by considering the financial outcomes of processes. Financial analysis may also suggest changes to employee departments or ways to streamline production processes to reduce wastage.

Compliance and tax audits:

Registered businesses need to comply with tax and compliance regulations, with the Internal Revenue Service serving as the primary agency responsible for enforcing federal tax laws in the United States. Accountants must ensure that financial reports meet legal and regulatory standards to avoid penalties and audits. The laws and standards laid down by the Internal Revenue Services and the Securities and Exchange Commission are to be adhered to by all businesses. Adherence to all the monetary and legal regulations is ensured by the financial accounting function. This function reports the financial workings of the company and ensures that all local, national, and international compliance regulations are adhered to in all financial transactions.

Fraud prevention:

Money mismanagement or wastage is curbed by the financial accounting function. The company’s assets are safeguarded from internal and external fraud by incorporating cybersecurity measures. Accountants need to be aware of ways to ensure the security and safety of digital financial data. They also need to track financial data to ensure that employees are not mismanaging or wasting the company’s resources for personal gain or profit.

Financial budgeting:

Setting the company’s financial budget is the responsibility of the accounting function. Accounting is responsible for setting a company’s budget based on past financial data and future income projections. Preparing the organizational budget is based on financial data from the past and projections for future growth. Accountants are also in charge of preparing department-wise budgets and for special projects across the organization.

Determining profitability, liquidity, and solvency:

Documents prepared by the financial accounting function provide a clear view of the financial position of the company. The main aim is to ascertain the financial performance and position of the enterprise and convey the information to all the stakeholders.

Various functions of accounting are involved in managing the financial resources of the business optimally. Accounting plays a key role in the strategic planning, growth, and compliance requirements of a company. The role of accounting in a business is to enable management with financial data that forms the background for future growth strategies. The data provided by the financial accounting function about the company’s assets, liabilities, cash position, and profits help in making data-driven strategic decisions.

Conclusion

A high degree of accuracy, consistency, and security is required to handle financial and accounting functions. Accounting data is crucial for budgeting and forecasting future revenues and cash flows. Manual methods of financial accounting cannot provide the accuracy and consistency required in handling sensitive financial data. Automating the functions of accounting helps businesses save time and money and ensures the accuracy of data.

from Cavintek is a bpm tool that provides quick and effective workflow automation solutions for businesses of varying types and sizes. This solution can be completely customized to meet the unique workflow demands of each company. Leveraging the power of automation for important business processes like accounting and finance improves business outcomes. Sign up for the free demo to see Cflow in action.

Frequently Asked Questions

1. What are the 5 major types of accounting?

The five major types of accounting are:

- Financial accounting – focuses on recording and reporting business transactions,

- Cost accounting – deals with analyzing and controlling costs,

- Management accounting – aids in internal decision-making,

- Tax accounting – focuses on tax compliance and planning, and

- Social accounting – tracks the social and environmental impact of business activities.

2. What is the difference between financial and management accounting?

Financial accounting provides reports like income statements and balance sheets for external stakeholders such as investors and regulators. In contrast, management accounting helps internal teams make operational decisions using data like cost analysis and budget forecasts.

3. Why is financial accounting important for a business?

Financial accounting ensures legal compliance, improves transparency, supports decision-making, and offers insights into a company’s financial health through standardized reports like balance sheets, income statements, and cash flow statements.

4. What are the key principles of financial accounting?

Financial accounting is governed by five core principles:

- Revenue recognition

- Expense recognition

- Matching principle

- Cost principle

- Objectivity principle These ensure consistency, accuracy, and integrity in financial reporting.

5. How does cost accounting help a business?

Cost accounting helps businesses calculate the unit cost of goods or services, enabling better pricing decisions, cost control, and efficient resource allocation. It plays a key role in budgeting and profitability analysis.

6. What are the main functions of accounting in a business?

The main functions include tracking income and expenses, managing accounts receivable and payable, payroll processing, financial reporting, budgeting, compliance, fraud prevention, and conducting financial analysis to guide strategy and performance improvement.

What should you do next?

Thanks for reading till the end. Here are 3 ways we can help you automate your business:

Do better workflow automation with Cflow

Create workflows with multiple steps, parallel reviewals. auto approvals, public forms, etc. to save time and cost.

Talk to a workflow expert

Get a 30-min. free consultation with our Workflow expert to optimize your daily tasks.

Get smarter with our workflow resources

Explore our workflow automation blogs, ebooks, and other resources to master workflow automation.