Stock Option Plan Approval Workflow

Why automate?

How Cflow Can Help Automate the Process:

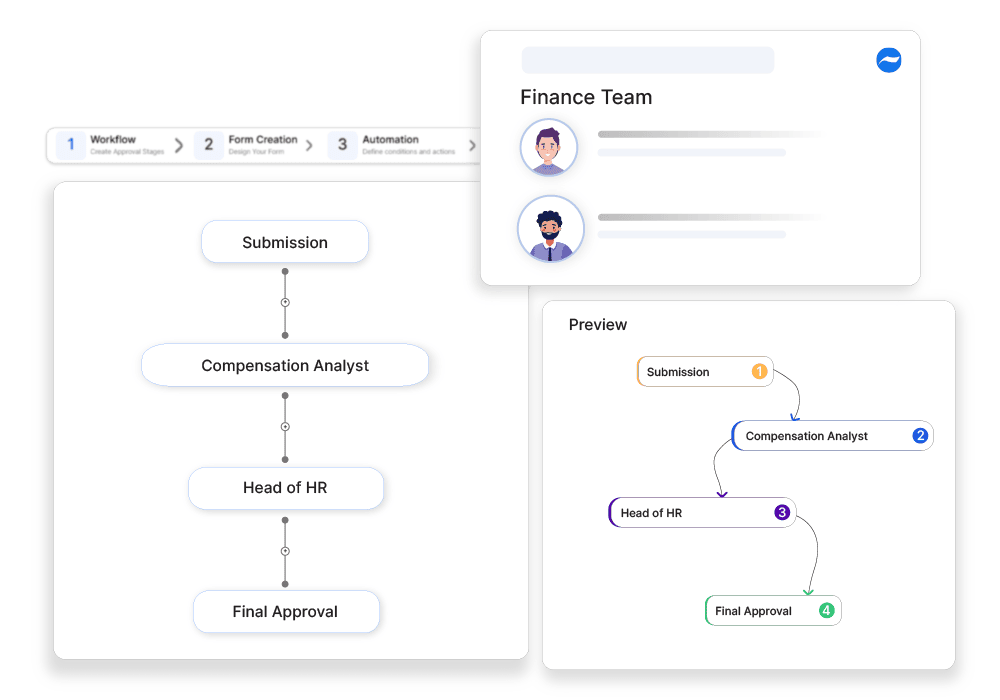

Streamlined Approval Workflows:

Stock option plans are routed through a predefined approval workflow, involving relevant HR, finance, and legal teams. This ensures thorough review and timely approval, facilitating smooth implementation of the plan.

Centralized Plan Documentation and Submission:

Cflow provides a platform for documenting and submitting stock option plans, ensuring that all relevant details, such as grant calculations and eligibility criteria, are accurately captured. This centralization simplifies the approval process and reduces administrative burden.

Automated Compliance and Verification:

The system can automatically verify stock option plans against regulatory requirements, such as tax and securities laws, and company policies, flagging any issues for further review. This helps ensure compliance and accuracy.

Detailed Reporting and Employee Communication:

Cflow provides detailed reports on stock option plan approvals, including grant details, approval histories, and compliance checks. This transparency supports better employee communication and ensures that stock option plans are managed effectively and compliantly.

Frequently Asked Questions

What are the eligibility criteria for stock options?

Criteria include employee tenure, performance benchmarks, and role-based allocations.

Can employees sell stock options immediately?

Most plans include a vesting period before options can be exercised.

What tax considerations apply to stock options?

Taxes vary based on stock classification (e.g., incentive vs. non-qualified options).