Peer Benchmarking Finance Review

Why automate?

Cflow Automation Benefits:

Standardized Data Submissions:

Departments use a common format to submit metrics for peer comparison, ensuring accuracy.

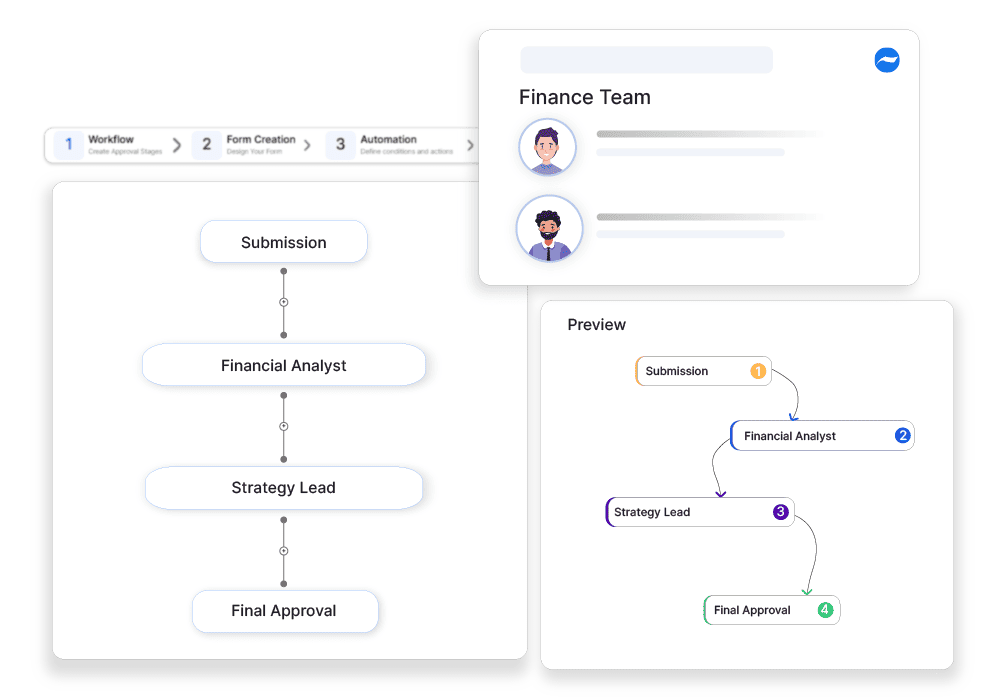

Cross-Functional Review:

Finance, operations, and strategy teams can collaborate on benchmark interpretation before decisions are made.

Insight Approval Logging:

Approved benchmark findings are recorded for follow-up, planning, or presentation use.

Faster Competitive Analysis:

Automated workflows streamline comparison cycles and allow timely strategic responses.

Frequently Asked Questions

What is the peer benchmarking finance review process?

A structured approach to comparing an organization’s financial performance against industry peers to identify strengths and improvement areas.

What are the main challenges in peer benchmarking finance reviews?

Ensuring data accuracy, selecting appropriate peer groups, and maintaining up-to-date financial benchmarks.

How can institutions streamline the peer benchmarking finance review process?

By using automated data collection tools, standardizing comparison metrics, and leveraging industry databases for benchmarking insights.