Financial Strategy Approval Workflow

Why automate?

How Cflow Can Help Automate the Process:

Centralized Strategy Documentation and Submission:

Cflow lets you document and submit financial strategies in one place, making sure all the key details are captured correctly. This makes the approval process easier and ensures data accuracy.

Automated Financial Analysis and Scenario Planning:

Cflow automatically analyzes the financial impact of proposed strategies, including scenario planning and sensitivity analysis. This ensures strategies are solid and in line with your goals.

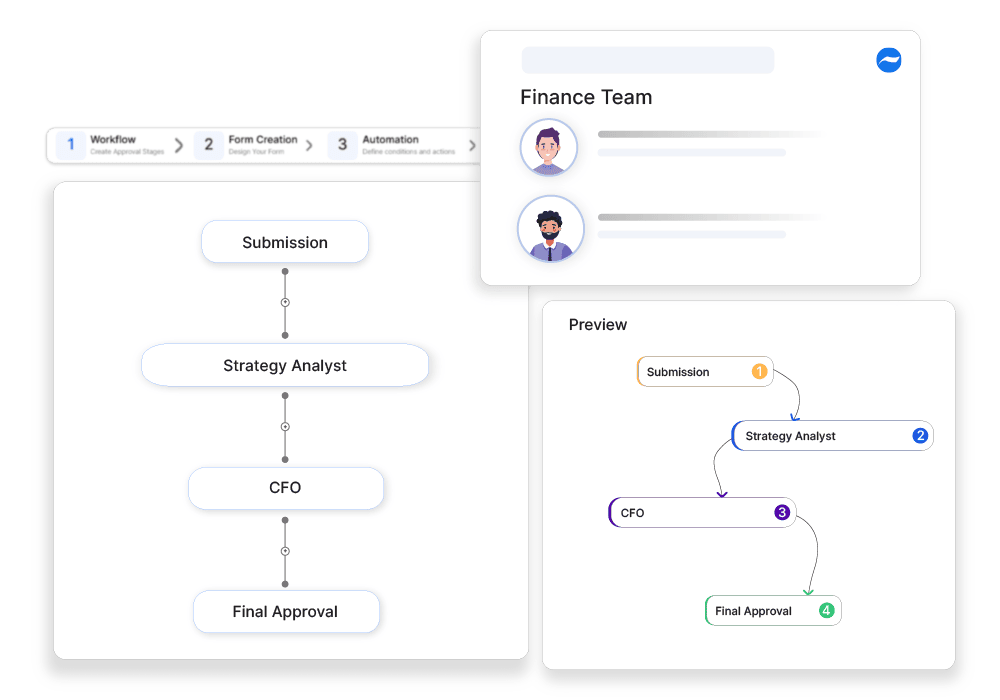

Streamlined Approval Workflows:

Cflow routes financial strategies through an approval workflow involving the finance, executive, and strategic planning teams. This ensures a thorough review and quick approval.

Detailed Reporting and Strategic Monitoring:

Cflow provides detailed reports on financial strategy approvals, including objectives, approval history, and financial analysis. This helps with better oversight and planning, giving you clear insights into your financial direction and performance.

Frequently Asked Questions

How do companies develop financial strategies?

By aligning financial goals with business objectives and market trends.

What are key components of a solid financial strategy?

Budgeting, investment planning, and risk management.

How frequently should financial strategies be updated?

Annually or in response to market shifts.