Cash Management Approval Workflow

Why automate?

How Cflow Can Help Automate the Process:

Centralized Forecasting and Submission

With Cflow, teams can easily prepare and submit cash flow forecasts in one platform. This reduces back-and-forth communications and ensures everyone has access to accurate data during the approval process.

Proactive Liquidity Monitoring

Cflow continuously tracks cash movements and liquidity levels, providing real-time insights. This ensures that decision-makers can spot and address potential issues early, preventing disruptions.

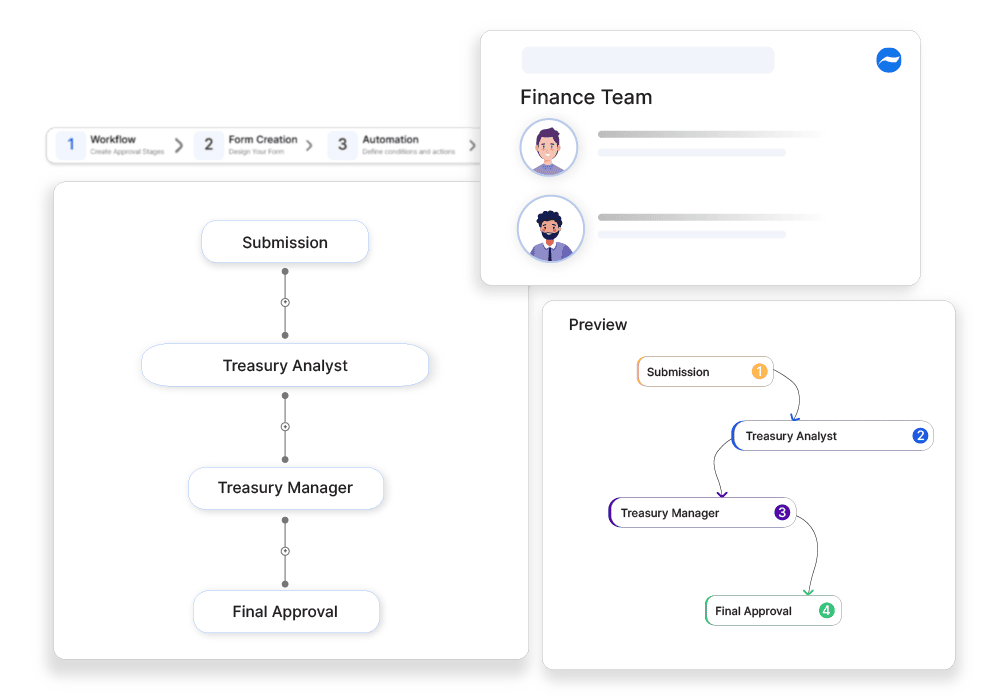

Simplified Workflows

Cash-related approvals, such as investments or debt repayments, follow a structured and predefined process in Cflow. This eliminates unnecessary delays and ensures that approvals are handled by the right stakeholders at the right time.

Detailed Record-Keeping

Cflow automatically maintains records of approvals and financial actions. This makes it easier to track past decisions, generate reports, and meet compliance requirements, all while improving accountability.

Frequently Asked Questions

What are the key objectives of cash management?

Ensuring liquidity, optimizing cash flow, and minimizing financial risks.

How do companies improve cash flow management?

By optimizing receivables, controlling expenses, and leveraging short-term financing.

What are common cash management challenges?

Unpredictable revenue streams and high operational costs.