Procure to Pay Automation – What it is and Why Do You Need It?

Procurement is a vital business function that encompasses a wide range of activities revolving around obtaining goods and services. The main aim of procurement is to obtain competitive prices for supplies, deliver the most value. To derive maximum value out of the procurement function, you need a streamlined procure-to-pay process. Procure-to-pay automation streamlines the procure-to-pay cycle by eliminating redundancies and inefficiencies.

Read on to understand procure-to-pay process automation in detail, the need for automating to procure-to-pay process, and the benefits of procure-to-pay automation.

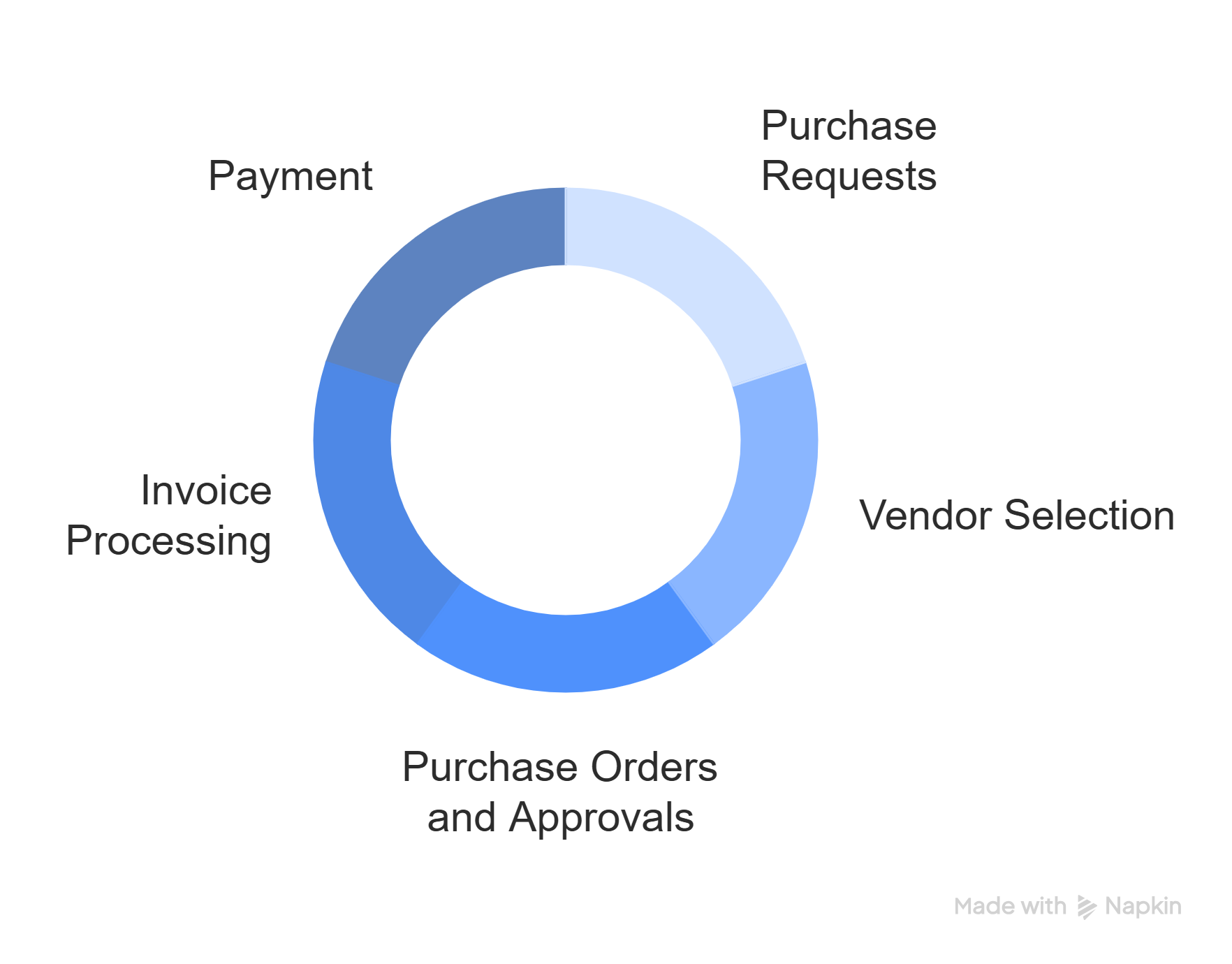

Stages of Procure to Pay Cycle

Before we get into the details of procure-to-pay automation, it is important to understand the stages or steps in the P2P cycle. A detailed understanding of the steps in this process helps decide which step or steps are ripe for automation. The company divides the procure-to-pay cycle into three main stages: requisitioning, purchasing, and payment. Let us look into each of these stages in detail.

Requisitioning

The procurement process begins with the procurement department identifying the need for goods or services. The design or fabrication teams usually communicate their need for raw materials through a purchase request. The procurement team considers the requisition and reviews the vendor database to see which vendor supplies the requested items.

In case there is a vendor available in the database, the team requests a quote from the vendor. If the database does not have a vendor for a product or service, the user selects a new vendor.

Purchasing

Once the procurement team identifies the vendor and obtains the request for proposal (RFP), they compare the RFPs to choose the one offering the most competitive pricing. After approving the requisition, they prepare the purchase order, detailing the quantity, agreed pricing (per line item), and delivery time.

The procurement manager or equivalent authority reviews and approves the prepared purchase order. Then, the team sends the approved purchase order to the vendor. The PO becomes a legally binding contract once the vendor accepts it.

Order fulfillment

The vendor starts working on the purchase order and delivers the goods/services to the buyer as per the agreed timelines. The customer receives the order and verifies the quantity and quality of the delivered items, and prepares the goods receipt. We promptly communicate any discrepancy in the order fulfillment to the vendor.

Payment

The vendor prepares the invoice for the delivered goods once the customer has received the entire order. Upon receiving the invoice from the vendor, the customer verified the details against the purchase order.

The accounts team cross-checks the invoice with the purchase order and the goods received note, then validates and approves it for payment. The accounts payable team receives the invoice and processes the payment after getting the necessary approvals.

In a traditional business setup, all of the above steps are manually carried out by the procurement team and the accounts payable team. The Manual procure-to-pay process is labor-intensive and involves a ton of paperwork. Errors and inconsistencies, coupled with delayed approvals and duplication, render manual P2P processes inefficient and redundant.

Procure-to-pay automation can streamline the process by automating repetitive steps and eliminating errors and inconsistencies associated with human intervention. The following sections delve into details on what is P2P automation, its benefits, and identify the tasks that are suitable for automation.

What is Procure-to-Pay Automation?

So, what is p2p automation? Procure to pay automation or procure to pay process automation uses technology to streamline the entire p2p cycle by eliminating redundancies and automating repetitive steps that do not require human intervention. The procure-to-pay process involves the procurement and accounts payable departments.

In most businesses, procurement and accounts payable functions operate independently and work in silos. This way of siloed working affects the approvals in the procure-to-pay process. By automating to pay process, smoother collaboration is brought about between these 2 departments.

P2P automation adopts software solutions to integrate procurement and accounts payable processes so that delays and bottlenecks are minimized. Some examples of procure-to-pay process automation include – generation of POs, 3-way matching, capturing invoices, updating statuses, and keeping information consistent across multiple processes and departments.

P2P automation reduces the number of repetitive tasks, which gives the procurement and accounts payable teams more time to focus on meaningful activities like problem-solving, management, and other strategic activities.

P2P automation software provides a holistic viewpoint of the procure-to-pay cycle and helps teams focus more on shared goals. Workflow automation solutions can turn time-consuming tasks in the P2P cycle into automated workflows, helping organizations realize cost savings, greater efficiencies, and improved employee satisfaction.

Procure-to-pay automation is essential for smooth and seamless procurement transactions and faster invoice approvals. Not just improving process efficiencies, workflow automation can also help processes align with compliance and regulatory requirements. Automating the procure-to-pay process provides deeper visibility into organizational spend.

Need for Procure to Pay Automation

So, why do you need to automate the procure-to-pay cycle? The immediate reason that might crop up in your mind is overcoming the shortcomings of manual processes. Here is why you need to digitize the procure-to-pay cycle –

1. Managing voluminous procurement data efficiently

The procurement function is a data-intensive process that involves the exchange of multiple documents and data with the accounts payable department. Managing such huge volumes of data by manual means is prone to errors and duplication. Moreover, huge chunks of paper documents are difficult to handle and store.

Automation does away with all this paperwork by digitizing document and data management. All procurement documents like RFIs, RFPs, POs, Invoices, and goods received notes are digitized and stored in a centralized database for anytime, anywhere access.

2. Mitigating the risk of duplication and fraud

In a data-sensitive business function like procurement, there is no scope for manual errors or oversight. Misplaced or lost orders can spell disaster for the procurement team. Automating the procure-to-pay cycle ensures that procurement information is secure and safe, enabling teams to run the procurement function with zero risks and liabilities.

3. Eliminating delays and bottlenecks

Delays in approvals can cost the business dearly. When procurement orders are not approved on time, internal processes are affected; on the other hand, when invoice approvals are delayed, vendor relationships are strained. Manual procurement processes lack visibility into the status of requests; as a result, POs, RFPs, or invoices fall through the cracks.

When the procure-to-pay process is automated, the software issues alerts and notifications to the concerned approval authority of pending approvals or upcoming approval deadlines. This way, delays in approvals are avoided.

4. Adhering to compliance and regulatory requirements

In manual systems that are predominantly run by human resources, adhering to compliance and regulatory requirements is challenging. Automation brings about standardization in the procure-to-pay process, which makes it easy to align with regulatory and compliance requirements.

How to Automate the Procure-to-Pay Process?

For the successful implementation of procure-to-pay automation, a solid P2P automation strategy is required. The plan must outline how your organization will manage the procurement process from start to finish. Procure-to-Pay can be automated in multiple ways as discussed below.

Reliance on manual processes

The main aim of automation is to do away with manual, repetitive tasks. Repetitive, mundane tasks like PO approval, invoice approval, or data entry can be easily and quickly done by software. With these tasks taken over by automation, the procurement and accounts teams can focus on important strategic activities.

Substantial cost and time savings

A robust procure-to-pay strategy can bring about substantial cost savings for the organization. An optimized procure-to-pay cycle enables procurement teams to negotiate better cash discounts, identify suppliers that are a value addition, and leverage economies of scale.

Moreover, when the entire procure-to-pay process is streamlined, organizations can improve cash flow management and identify potential bottlenecks, thereby improving overall financial health.

Timely payments

By implementing intelligent automation solutions, stakeholders can be informed about pending payments or upcoming approval deadlines. The overall operational efficiency of the process is greatly improved when processes are completed on time. When invoices are approved and processed on time, vendor relationships are significantly strengthened.

Compliance

One of the drawbacks of the manual procure-to-pay process is the lack of compliance with regulatory requirements. Whether it is onboarding a new vendor or creating a purchase order, or receiving an RFP, there are certain regulatory requirements that businesses need to adhere to.

Manually ensuring compliance is a cumbersome process, especially when business operations expand. Automation helps ensure 100% compliance at all times, even as business operations scale up.

Supplier management

Maintaining strong supplier relationships is essential for business success. Automation helps maintain and strengthen supplier relationships by ensuring that invoices are paid on time. Updating and maintaining the vendor database can be effectively done through an automated system. This helps you track discounts and leverage them for cost savings.

Implementing no-code workflow automation solutions like Cflow can significantly enhance the effectiveness of the procure-to-pay process. Once you have a solid procure-to-pay automation strategy in place, you can plan out the implementation easily. Here are the steps to implementing a procure-to-pay automation solution.

Identifying the need for automation

This step is mainly concerned with the identification of tasks in the procure-to-pay process that are apt for automation. To arrive at the right decision, you need to gather input from stakeholders, evaluate the task and its dependencies, and also account for the changes that need to be implemented.

Apprise the stakeholders

Procurement and accounts payable team members need to be informed about the changes that automation would bring. Informing the stakeholders and getting them on the same page is a critical factor for the success of automation.

Implementing the automation solution

The best way to implement automation of the procure-to-pay process is to do it in phases, or task by task. Phased implementation allows the team to monitor the effectiveness and performance of the automation solution.

Feedback and KPIs

Gather feedback from the stakeholders about the automation software and make changes wherever required. Also, establishing key performance metrics is a good idea to quantify the effectiveness of procure-to-pay automation.

Procure to Pay Software

The Procure to Pay software is specifically designed to automate the Procure to Pay process. With end-to-end streamlining of all stages, including purchase requisition creation and POs, supplier performance tracking and analysis, and final invoice approval.

Electronic Data Interchange (EDI)

Electronic Data Interchange is a solution that enables the transfer of data, such as digital documents, between business and their suppliers. This significantly reduces the reliance on paper-based and manual data entry.

Robotic Process Automation (RPA)

Robotic Process Automation software automates repetitive P2P tasks, saving time and managing inventory seamlessly. RPA, when combined with EDI, transforms the Procure-to-Pay process to deliver results quickly and efficiently.

Key Benefits of Procure-to-Pay Automation

The latest statistic reveals that automating the procure-to-pay process reduces invoice processing costs by up to 80%. Let us look at the key benefits of automating the procure-to-pay process –

1. Deeper visibility

Automation provides deep insights into the procure-to-pay process by digitizing and centralizing procurement data and information. Deeper visibility enables better and informed decision-making.

2. Improved supplier relationships

Procure-to-pay automation also plays an important role in improving and strengthening supplier relationships. Timely payments to vendors are made possible by automation.

3. Improved data capture

By leveraging advanced technologies like optical character recognition (OCR), the procure-to-pay solution can accurately extract procurement data from invoices and other documents, which minimizes the chances of errors or mismatches.

4. Zero errors and fraud

Procure-to-pay automation comes with built-in controls, validations, and audit trails. This significantly reduces human error and eliminates the risk of invoice fraud. This way, procurement becomes a secure process end-to-end.

5. Consolidation of commerce processes

P2P automation centralizes, standardizes, and streamlines procurement tasks. It reduces fragmentation and inefficiencies in communication, purchasing, and invoicing, enhancing operational efficiency.

6. Lowering Reliance on Manual Process

Automation simplifies processes, requiring minimal to no manual input. Every day tasks, such as manual data entry, three-way matching, and invoice approvals, are automated to free up human resources from mundane tasks. By doing so, human resources can focus on high-value tasks that require human intervention.

7. Improve Compliance

Automation facilitates processes to be compliant with regulations and policies. Rules engine-assisted automation solutions enable businesses to curate and cater Procure-to-Pay automation solutions to compliance requirements.

Every automated purchase request raised goes through the set regulatory guidelines throughout the entire course of the process. Any misalignment will be automatically flagged.

8. Accurate Supply Forecast

Procure to Pay solutions can offer procurement teams forecast trends and market insights, enabling them to predict demand and supplier standards. This can actively save businesses from overstocking or stockouts.

9. Faster Approvals

Process automation helps attain faster approvals, where common internal and supplier-oriented workflows are streamlined with no scope for delays. Automated notifications and reminders usher in faster review and approval of requisition alerts.

10. Substantial Cost Savings

A Procure to Pay solution offers an optimized procurement solution that streamlines the process end-to-end, removing all potential pitfalls. This way, errors and fraud are reduced and negated. With predictive market and supplier performance, businesses can better identify cost-saving opportunities.

Who Benefits from Procure-to-Pay Automation

It is important to note that the automation of the procure-to-pay process is highly beneficial and important to the entire organization, specifically the procurement department. Let’s look at how automation is a scalable aid for the following roles.

Invoice Clerks

Manually generating and approving invoice documents can take hours to complete. The manual routing, logging, and data collection are time-consuming and error-prone. Additionally, this can create a backlog of unprocessed invoices and delayed payments. The system automatically routes only the invoices that match all criteria to the invoice clerks, who can then approve them in bulk.

Accounts Payable

According to statistical data put out by the Institute of Finance and Management, the average cost of the invoice process is directly proportional to the degree of automation. This indicates that the more you automate, the lower the cost of invoice processing. Market research shows that AI and RPA solutions reduce cost by 80%.

Vendor Management Teams

Vendor management teams can completely ease up with automation. The team is in charge of integrating the vendors into the SAP and other legacy platforms. Further, vendor data must be consolidated quickly and efficiently. This is where automation aids in integrating vendor data, terms, and conditions, and compliance regulations. The right vendors can be chosen based on data.

Purchasing Teams

Creating a purchase requisition manually is challenging, considering the requirements that come in. Due to this, your purchase team is losing time processing them. Automation will empower your team to receive requests in a streamlined fashion.

Steps to Automate Your Procure-to-Pay Process

The initial process before we automate the Procure to Pay process is to audit the entire P2P process. This audit will allow the organization to identify the time it takes to complete the tasks currently. A process audit would enable the team to understand and identify the pitfalls in all the processes and help devise ways to resolve them.

1. Purchase Requests

The accounts payable process begins with a purchase requisition. At this stage, the requester raises a purchase request by submitting a form. The form will contain all the details regarding the requested goods or services. The requester must submit a physical form, and the team will take a long time to process it. This is where automation shines.

You can integrate the purchase requisition with ERP systems or Procure-to-Pay software, eliminating the need for manual review and approval.

2. Vendor Selection

Having too many vendors can be difficult to manage. Vendor management teams might have to maintain a comprehensive database including all vendor details. You can easily carry out the vendor selection process through effective filtering. No resource has to sit through and search for the right vendor. An automation platform would ease it by giving vendors along with all the details.

3. Purchase Orders and Approvals

The system automatically creates purchase orders as soon as it approves the requisition and maps the data. This also significantly reduces the chance of manual errors. POs are then routed for approval and sent out to the vendors.

4. Invoice Processing

Automation solutions like Cflow make it highly easy for the accounts payable team to process invoices instantly, eliminating the need for manual data entry or any scope for error. This makes the complete process simple and optimized. The system automatically routes invoice approval requests to the approvers, reducing the time taken for the process.

5. Payment

You can completely automate payments once you set the rules based on the criteria. Integrating the automation platform with ERP systems. This will automatically approve the invoice, followed by the subsequent payment once the EPR system processes it.

Features to Consider in Procure-to-Pay Automation

Here are some of the key features to look out for in a Procure-to-Pay Automation solution.

Automatic Notifications

Automated notifications instantly alert users about every advancement in the workflow. This helps in reducing the time taken for approvals.

Data Log and Audit Trail History

An accounts payable solution is a winner if it offers a data log and audit trail history of all activities. This enables the business to conduct audits and review the process at any time.

Analytics and Forecasting

The tool that you choose for automating the accounts payable process must be able to provide reports and analytics of the process, vendor performance, and market trends.

Customizable Workflows

Teams can design and customize workflows on automation platforms based on their specific needs, adding or removing stages at any time.

Centralized Storage

An AP automation system requires a comprehensive and centralized storage system to store and retrieve every document and data efficiently. Moreover, this also helps in invoice matching and faster payments.

Compatibility

The procure-to-pay software that you choose must be compatible with the existing tools, like accounting and ERP systems. This will ensure a seamless flow of data and documents.

Technologies used in P2P Automation

Some of the key technologies used in automation the procure-to-pay process are as follows –

1. Artificial Intelligence and Machine Learning

AI in procurement and supply chain is changing the industry significantly. These technologies use algorithms to analyze and predict trends and enable an optimized decision-making process. Teams can strategically source and negotiate using market data insights, and they can identify and adopt cost-saving practices through data-backed purchase decisions.

2. Cloud-based Platforms

Cloud-based platforms offer convenience, facilitating the integration of finance and procurement workflows as one system. Such a unified, cloud-based system enables scalability and better process performance.

3. Optimal Character Recognition (OCR)

OCR technology is a lifesaver in procurement. The system extracts all documents, such as purchase requisitions, purchase orders, invoices, and receipts, and converts them into a machine-readable structure, enabling faster data processing.

Conclusion

Given the importance of the procure-to-pay process in the success of a business, it is critical to update and upgrade the P2P cycle by adopting modern technology. A no-code workflow automation software like Cflow can turn things around for your business by streamlining key business workflows through automation.

Automating to pay process is essential for smooth business operations and control over organizational spending. The visual form builder, along with a host of automation features in Cflow, makes it the preferred and trusted automation partner for small, medium, and enterprise businesses.

Want to find out how? Sign up for the free trial of Cflow.