Global Tax Compliance Coordination

Why automate?

Cflow Automation Benefits:

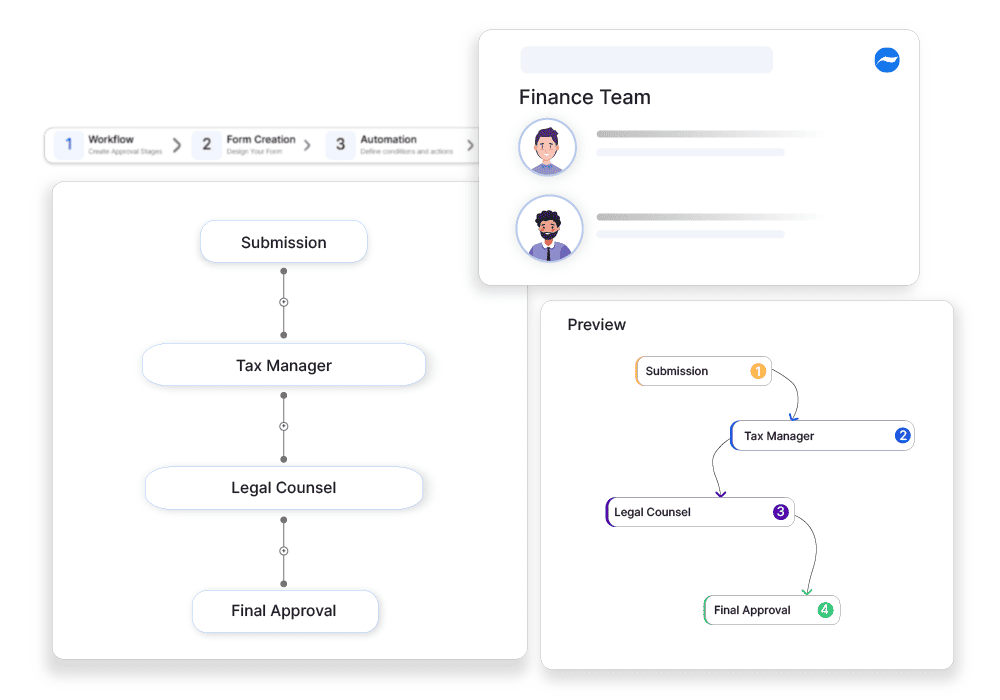

Jurisdiction-Specific Routing:

Each country’s tax forms are sent to relevant local compliance officers and finance heads.

Documentation Control:

Attach receipts, filings, and audit notes to every submission.

Deadline Reminders:

Stay ahead of due dates with automated alerts based on country requirements.

Audit Protection:

Store all submissions, responses, and notes to support global audit trails.

Frequently Asked Questions

What is global tax compliance coordination?

A structured approach to managing tax obligations across multiple jurisdictions to ensure regulatory adherence.

What are the main challenges in global tax compliance?

Keeping up with changing tax laws, managing cross-border taxation, and ensuring accurate reporting.

How can institutions enhance global tax compliance?

By implementing tax compliance software, collaborating with international tax experts, and standardizing tax reporting frameworks.