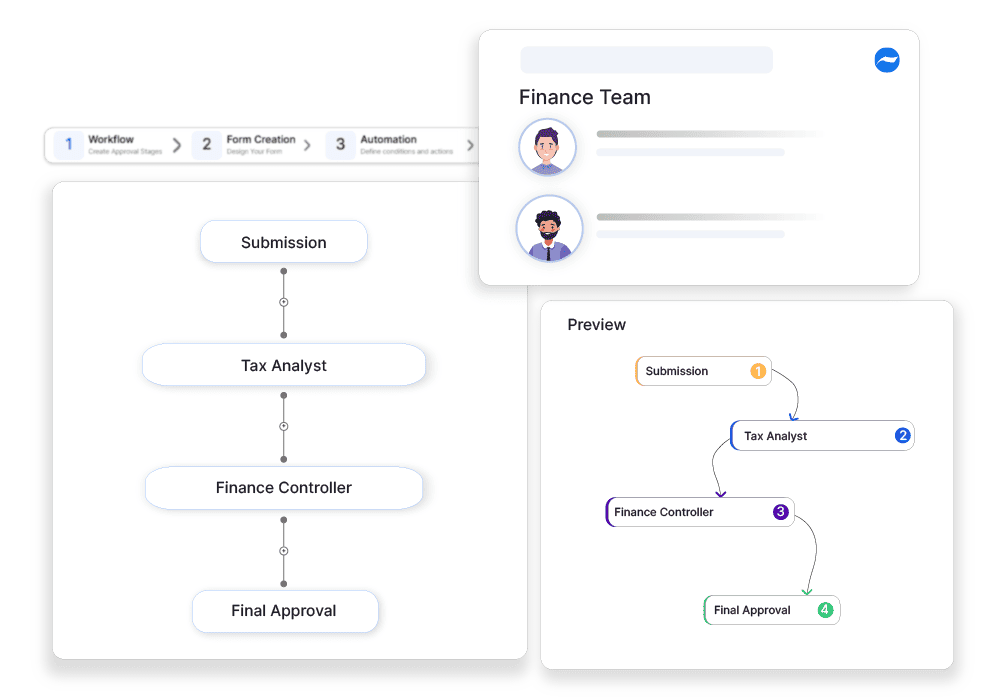

Deferred Tax Asset Reconciliation Workflow

Why automate?

Cflow Automation Benefits:

Calculation Validation:

Ensure every DTA entry is backed by proper supporting data before it hits the books.

Approval Escalations:

High-value or unusual adjustments are routed to senior tax officers for review.

Automated Reconciliation Cycles:

Schedule monthly or quarterly DTA reconciliations through recurring workflows.

Regulatory Compliance:

Maintain a complete record of DTA reviews, approvals, and documentation for audits.

Frequently Asked Questions

What is the deferred tax asset reconciliation workflow?

A structured process to ensure accurate reporting and recognition of deferred tax assets in financial statements.

What are the main challenges in deferred tax asset reconciliation?

Complex tax regulations, tracking temporary differences, and ensuring proper valuation allowance adjustments.

How can institutions streamline deferred tax asset reconciliation?

By using tax automation tools and aligning accounting and tax reporting systems.