Currency Fluctuation Impact Assessment

Why automate?

Cflow Automation Benefits:

Risk Trigger Notifications:

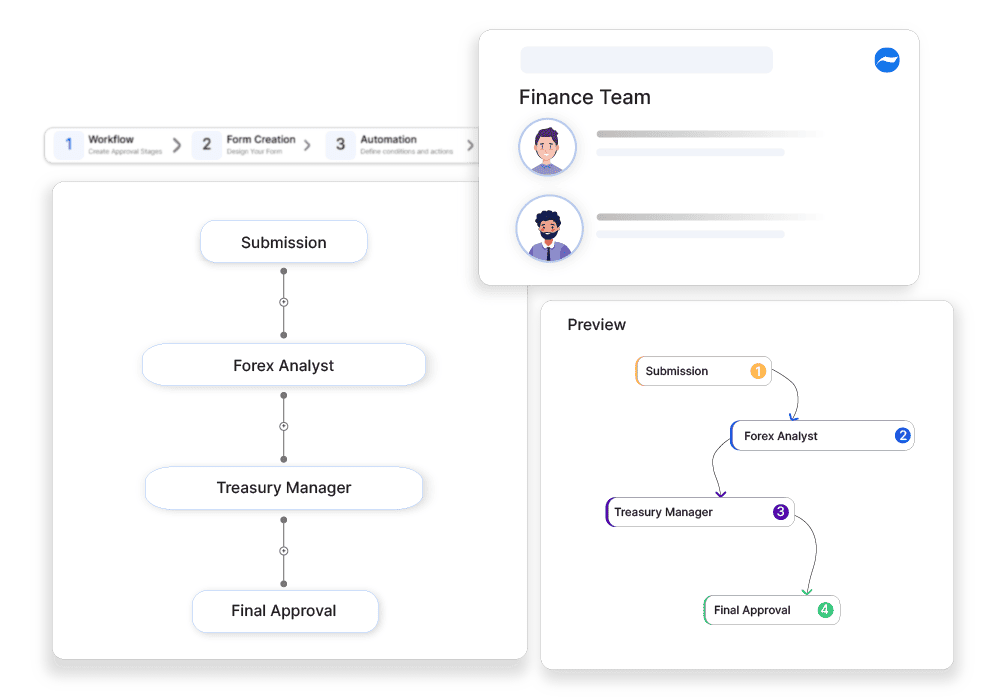

Cflow alerts teams when FX thresholds are breached, initiating an approval workflow.

Data Validation Flow:

Submitted assessments are reviewed by multiple stakeholders, ensuring alignment and accuracy.

Response Strategy Tracking:

Track decisions such as price adjustments or hedging approvals with full documentation.

Reduced Exposure:

Faster reviews allow businesses to act proactively against adverse FX trends.

Frequently Asked Questions

What is currency fluctuation impact assessment?

A process to analyze how exchange rate fluctuations affect financial operations.

What are the main challenges in currency fluctuation impact assessment?

Managing foreign exchange risks, predicting currency trends, and adjusting pricing strategies.

How can institutions streamline currency fluctuation impact assessment?

By using AI-driven currency forecasting, hedging strategies, and automated risk assessment tools.