Financial Benchmarking Approval Workflow

Why automate?

How Cflow Can Help:

1. All Your Data in One Place:

Cflow lets you store all your benchmarking numbers in one system. No more hunting through spreadsheets or chasing updates. It’s simple and keeps everything consistent.

2. Instant Comparisons:

The system automatically checks your performance against industry standards. You’ll know what’s working and what isn’t without spending hours analyzing it yourself.

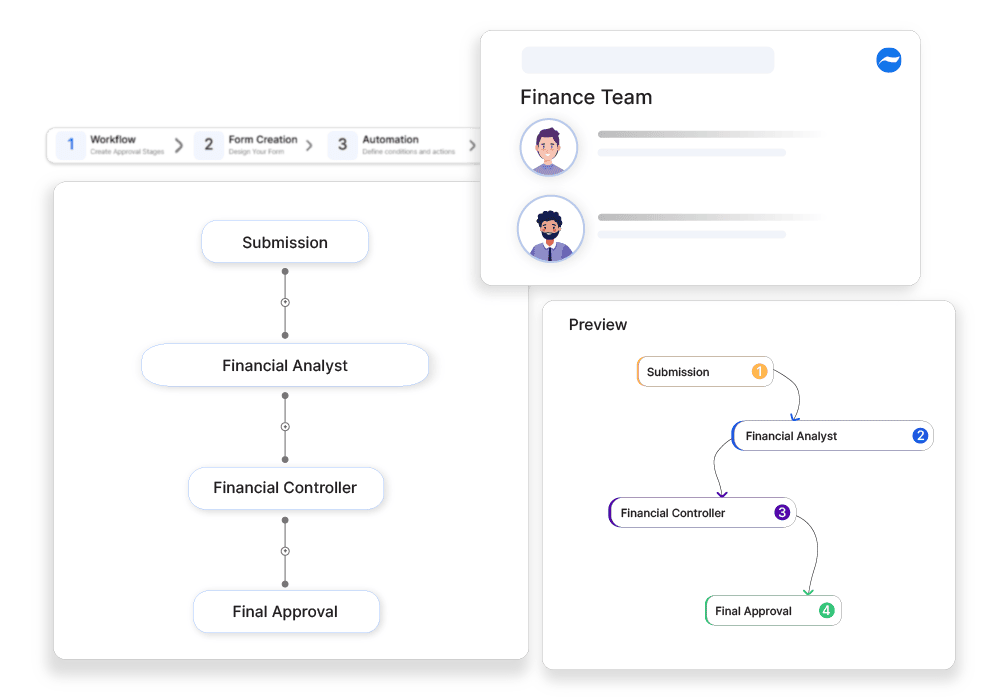

3. Faster Approvals:

With Cflow, your reports go to the right people in the right order. No bottlenecks, no confusion—just smooth approvals.

4. Clear, Actionable Reports:

Cflow gives you reports that aren’t just numbers. You get insights, recommendations, and a full picture of your performance. It’s the kind of information you can actually use to make decisions.

Frequently Asked Questions

What is financial benchmarking?

A method to compare financial performance against industry standards.

Why is financial benchmarking important?

It helps identify inefficiencies and improvement opportunities.

How do companies benchmark financial performance?

By analyzing KPIs such as profitability, liquidity, and cost efficiency.