Financial Performance Review Approval Workflow

Why automate?

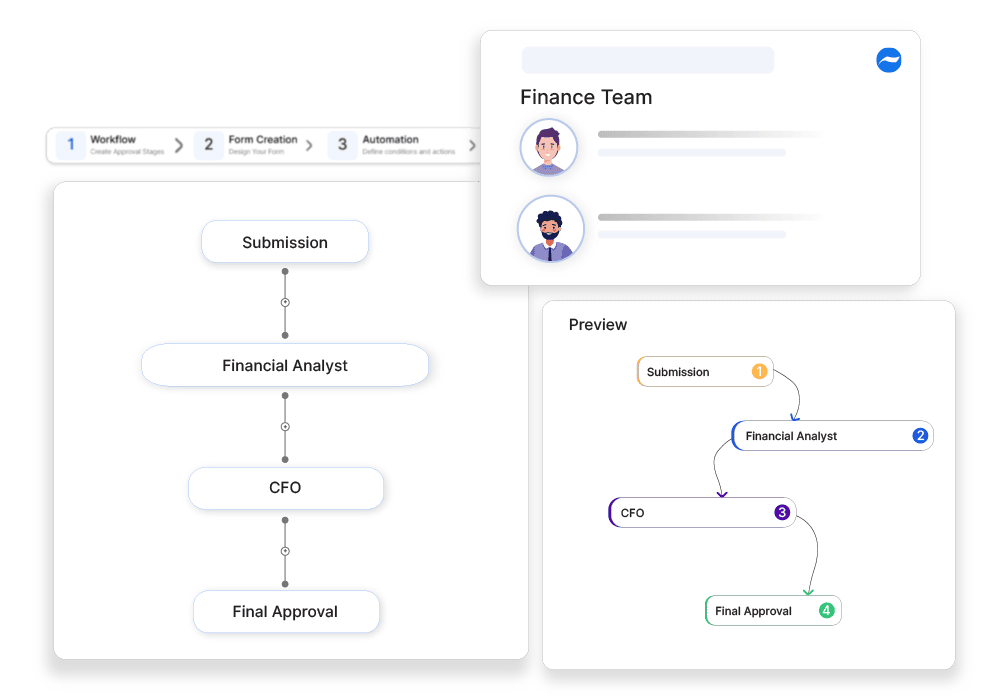

How Cflow Helps Automate the Process

Centralized Reports

Cflow makes it easy to prepare and submit financial reports. All the necessary data is stored in one place, making it simple to review and approve.

Automatic Analysis

Cflow automatically analyzes financial metrics like profitability, liquidity, and solvency. It gives you a clear picture of your financial performance, making sure everything is consistent and accurate.

Streamlined Approvals

Reports follow a set approval process, going through finance, executive, and strategic teams. This ensures timely approvals and keeps everything on track.

Detailed Insights

Cflow provides detailed reports, including analysis, approval histories, and strategic recommendations. This transparency helps with better financial oversight and smarter decision-making.

Frequently Asked Questions

How is financial performance evaluated?

Using profitability ratios, efficiency metrics, and cost analysis.

How often should financial performance be reviewed?

Monthly, quarterly, and annually for long-term insights.

What are warning signs of poor financial performance?

Declining profits, rising debt levels, and negative cash flow trends.