Accounts Receivable Approval Workflow

Why automate?

How Cflow Can Help Automate the Process:

Automated Verification and Reconciliation:

The verification of all invoice details against sales orders and contracts data is automatically done in Cflow. Any discrepancies are flagged for further review automatically. This helps ensure that invoices are accurate and compliant with agreements.

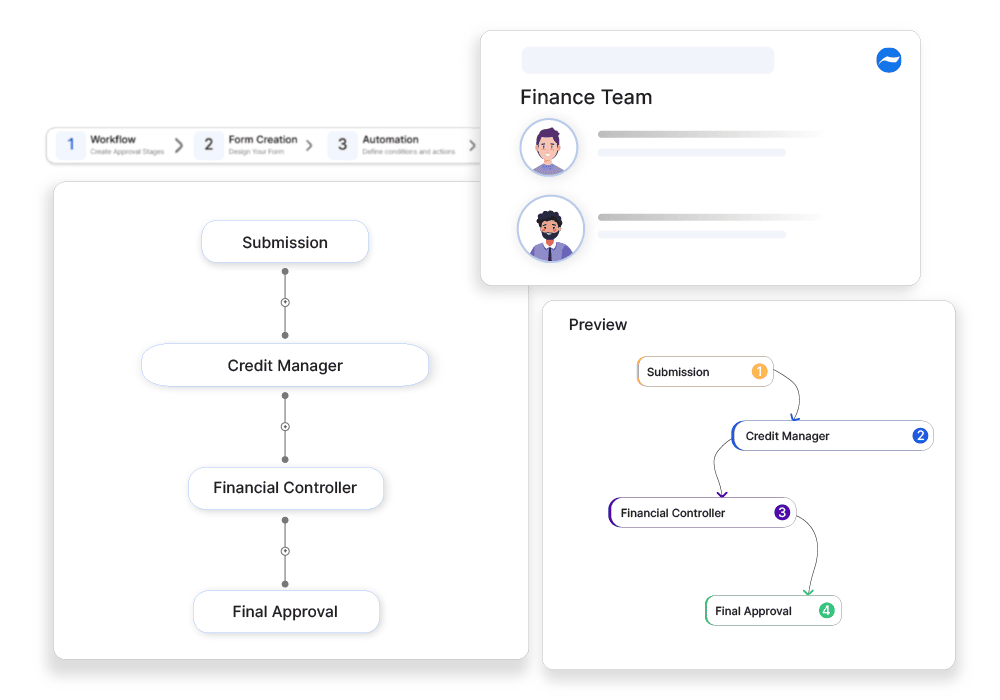

Streamlined Approval Workflows:

Accounts receivable transactions, including adjustments or write-offs, are routed through a predefined approval workflow, involving finance and management teams. This ensures thorough review and timely approval.

Centralized Invoice Generation and Submission:

Cflow provides a platform for generating and submitting customer invoices, ensuring all necessary details are accurately captured. This standardization simplifies the invoicing process and enhances data consistency.

Detailed Reporting and Collections Tracking:

Cflow provides detailed reports on accounts receivable approvals, including invoice statuses, outstanding balances, and collection activities. This transparency supports better cash flow management and customer relationship management, providing insights into payment patterns and potential issues.

Frequently Asked Questions

What factors influence credit terms for customers?

Factors include payment history, creditworthiness, and transaction size.

How do companies manage overdue receivables?

Strategies include follow-ups, payment reminders, and engaging collection agencies.

What risks are associated with accounts receivable?

Risks include cash flow disruptions and bad debt write-offs.