Working Capital Approval Workflow

Why automate?

How Cflow Can Help Automate the Process:

Centralized Data Collection and Analysis:

Cflow enables the centralized collection and analysis of working capital data, including cash flows, inventory levels, and receivables. This standardization enhances data accuracy and supports better decision-making.

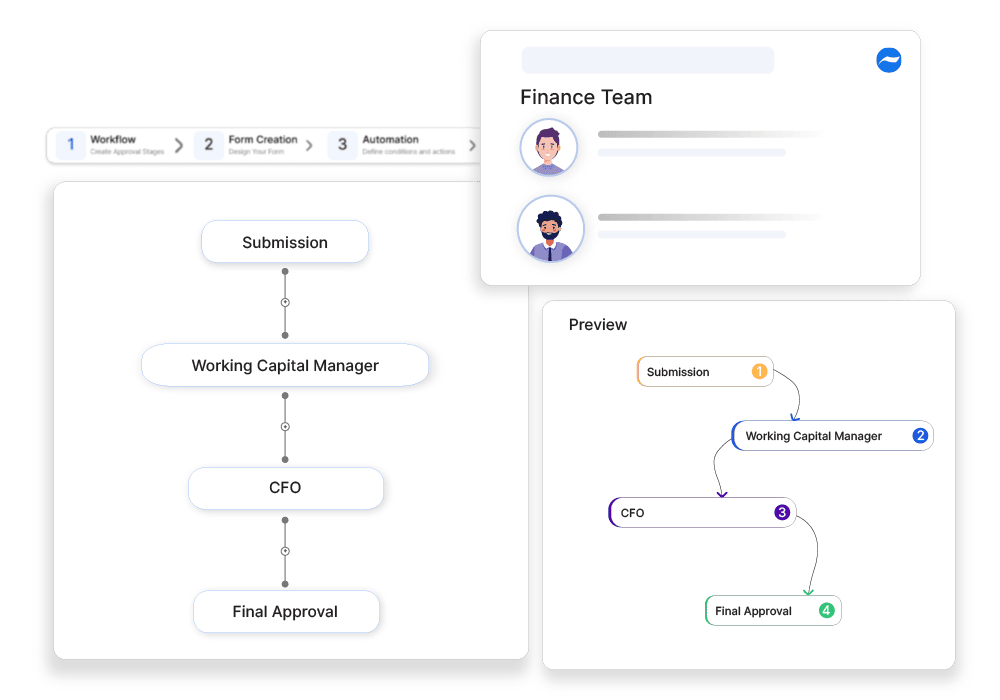

Streamlined Approval Workflows:

Working capital management proposals, such as cash flow adjustments or short-term financing arrangements, are routed through a predefined approval workflow, involving relevant finance and operational teams. This ensures thorough evaluation and timely approval.

Comprehensive Reporting and Liquidity Monitoring:

Cflow provides detailed reports on working capital approvals, including analysis of cash flows, inventory management, and liquidity positions. This transparency supports better liquidity management and operational planning, providing insights into the organization’s financial health.

Automated Compliance and Risk Checks:

The system can automatically verify working capital components against internal policies and risk management criteria, flagging any issues for further review. This helps ensure compliance and mitigate financial risks.

Frequently Asked Questions

How is working capital determined?

It is calculated by subtracting current liabilities from current assets to assess liquidity.

What are the key challenges in managing working capital?

Challenges include cash flow shortages, slow receivables, and overstocking of inventory.

What strategies improve working capital efficiency?

Efficient invoice processing, supplier negotiations, and optimized inventory control.