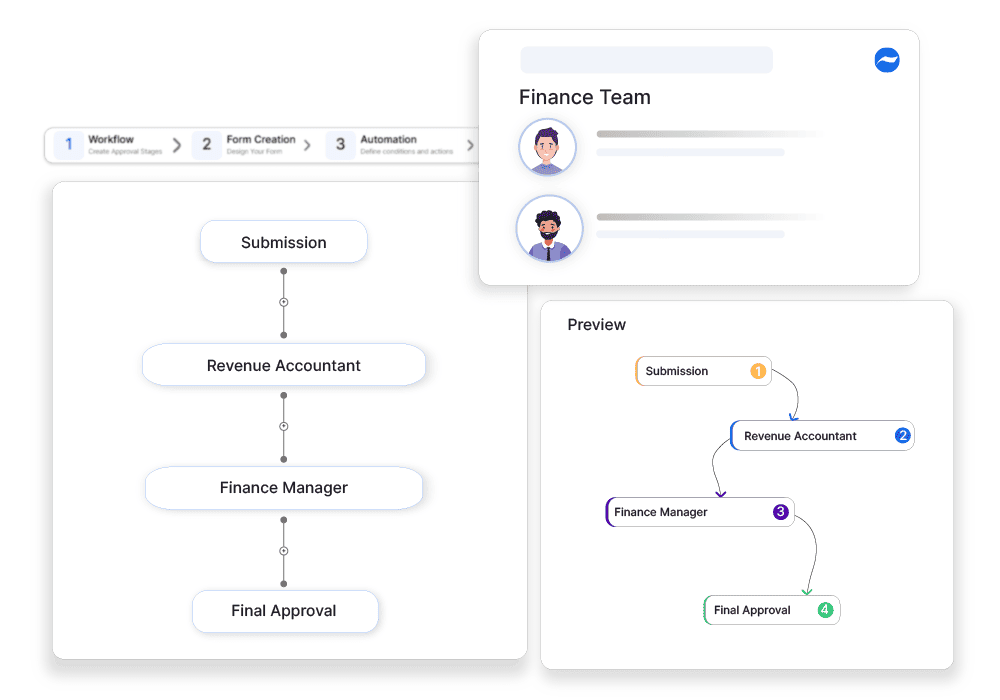

Revenue Deferral Validation Workflow

Why automate?

Cflow Automation Benefits:

Recognition Rule Enforcement:

Only revenue tied to delivered services gets approved for recognition.

Deferred Entry Approvals:

Validate revenue deferrals with supporting contracts and project plans.

Compliance Assurance:

Cflow helps ensure GAAP/IFRS alignment with traceable approvals and documentation.

Reduced Restatements:

Accurate deferral workflows minimize the risk of restating financial results later.

Frequently Asked Questions

What is the revenue deferral validation workflow?

A process to ensure that revenue is recognized in the correct accounting periods according to applicable financial regulations.

What are the main challenges in revenue deferral validation?

Ensuring compliance with accounting standards, tracking deferred revenue accurately, and preventing misstatements in financial reporting.

How can institutions improve revenue deferral validation?

By automating revenue recognition processes, integrating accounting systems, and conducting regular financial audits.