Investment Risk Profiling Process

Why automate?

Cflow Automation Benefits:

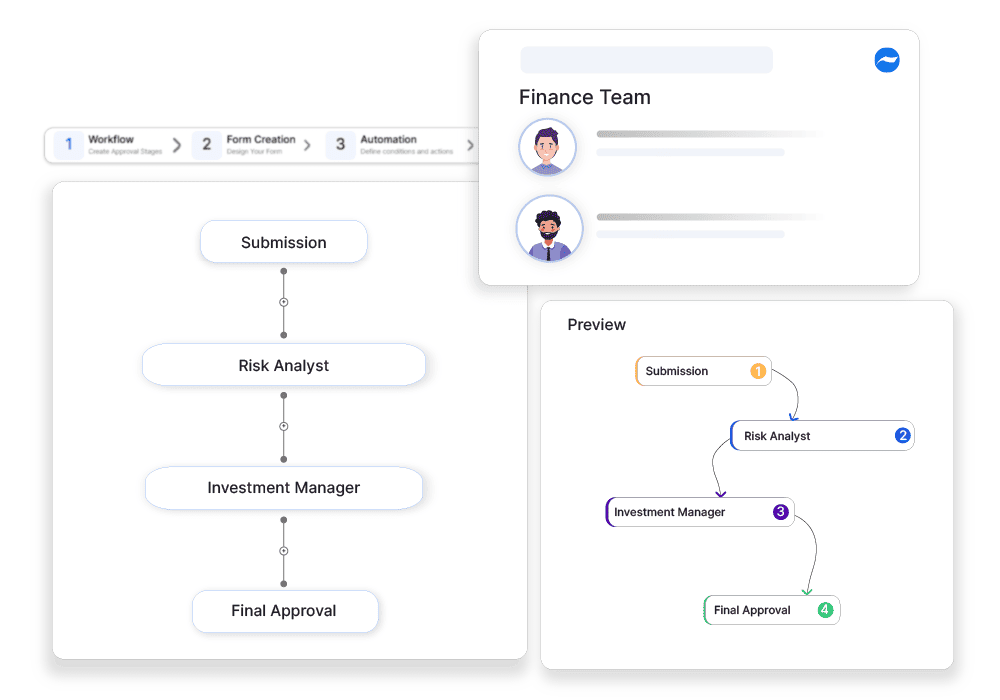

Structured Profiling Workflow:

Cflow standardizes the process of evaluating risk factors and ensures every investment meets policy criteria.

Tiered Approval Logic:

Investments with higher risk scores are automatically escalated to senior management for approval.

Risk Documentation:

Every profiling decision and score is recorded and stored for compliance and audit purposes.

Informed Decision-Making:

Cflow ensures investment decisions are based on data-driven profiles rather than subjective assessments.

Frequently Asked Questions

What is the investment risk profiling process?

A method to assess the risk tolerance and exposure of an investment portfolio.

What are the main challenges in investment risk profiling?

Accurately predicting market risks, aligning investments with risk appetite, and adapting to economic changes.

How can institutions streamline the investment risk profiling process?

By using AI-driven risk assessment tools, automating portfolio rebalancing, and implementing dynamic risk models.