Foreign Exchange Transaction Approval Workflow

Why automate?

How Cflow Can Help Automate the Process:

Centralized Transaction Submission and Documentation:

Cflow offers a centralized platform where users can submit and document forex transaction requests. It ensures all necessary transaction information is captured including transaction amounts and exchange rates. This simplifies the approval process and improves data accuracy.

Automated Market Analysis and Risk Assessment:

Cflow automates analyzing marketing conditions and assessing potential risks associated with forex transactions. The risks flagged in the analysis process are reviewed further for mitigation. This ensures that transactions are done at optimal rates within the risk tolerance levels.

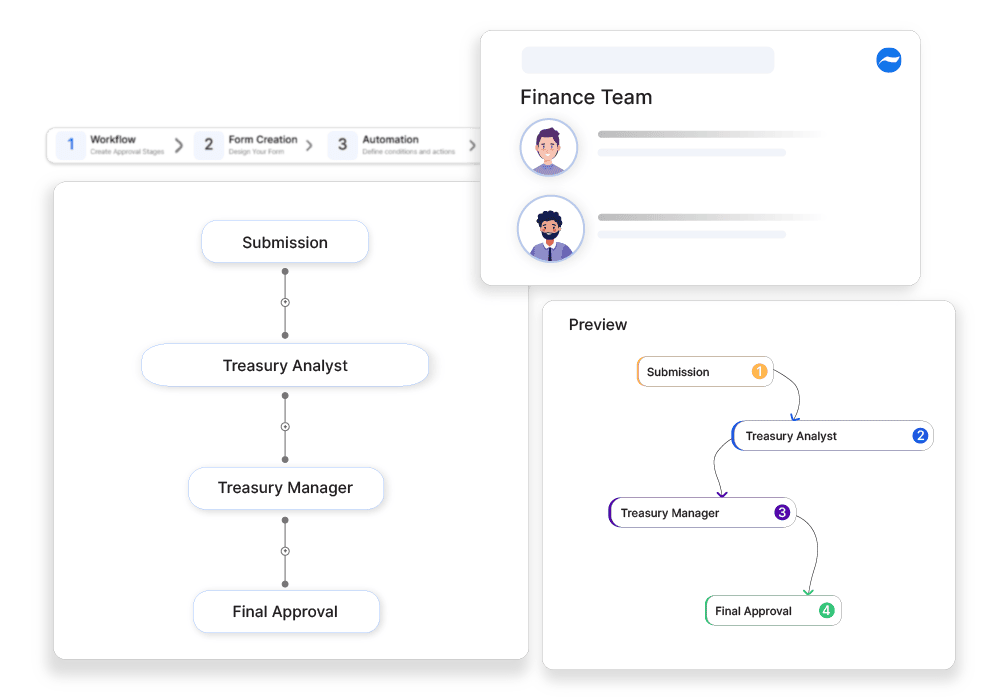

Streamlined Approval Workflows:

Cflow offers a predefined approval workflow for routing the forex transaction requests which is reviewed and approved by relevant finance, treasury, and risk management teams.

Detailed Reporting and Compliance Tracking:

Users can get detailed reporting on forex transaction approvals, including transaction details, approval statuses, and compliance checks. This helps manage currency exchanges better, improves regulatory compliance, and provides insights to formulate risk management strategies.

Frequently Asked Questions

What factors affect foreign exchange rates?

Market conditions, interest rates, and geopolitical events.

How can businesses minimize foreign exchange risks?

By using hedging strategies, multi-currency accounts, and forward contracts.

What compliance rules apply to foreign exchange transactions?

Regulations vary by jurisdiction, including anti-money laundering (AML) policies.