Expense Fraud Detection Process

Expense Fraud Detection Process

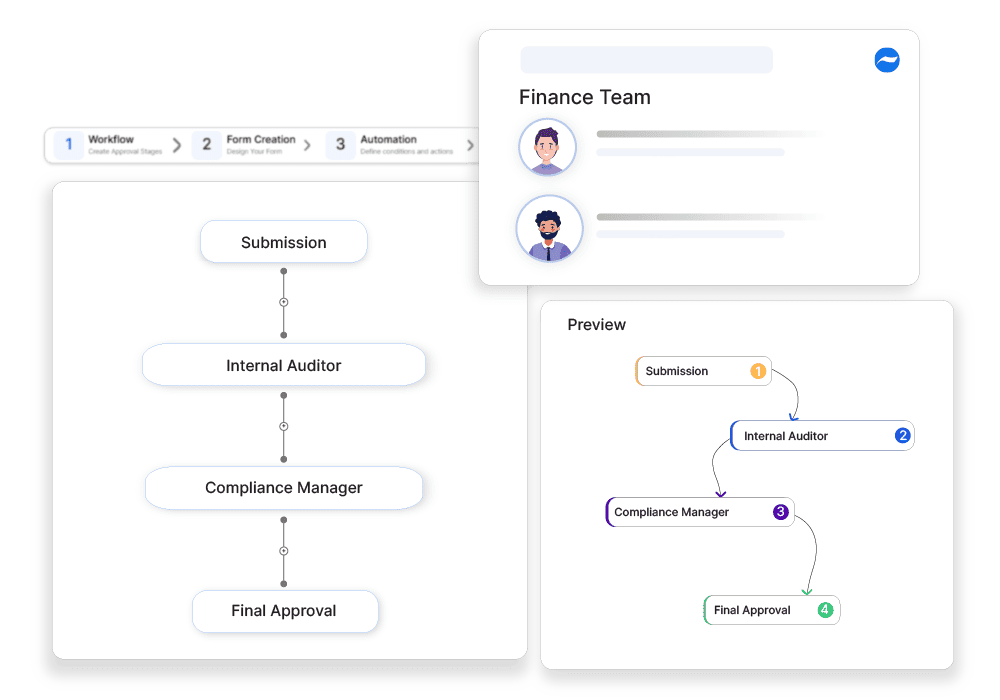

Automate expense fraud detection to ensure compliance and prevent unauthorized financial transactions.

Why automate?

Expense fraud can significantly impact an organization’s bottom line, especially when processes rely on manual verification. This workflow typically includes reviewing submitted expense reports, validating them against company policy, checking for duplicate or inflated claims, and routing them for approval. Manual review is slow and often inconsistent, allowing fraudulent or unauthorized claims to slip through the cracks. Delays in identifying anomalies also hinder timely corrective action. By automating the Expense Fraud Detection Process, organizations can implement predefined rules and patterns that flag unusual claims for further scrutiny.Cflow streamlines this workflow by routing each expense report through automatic validation checks. Suspicious entries can be flagged based on predefined rules, such as duplicate submission, unusual expense categories, or thresholds exceeded. These flagged items are then escalated to finance managers for review and resolution. With real-time tracking, audit logs, and instant notifications, Cflow ensures that nothing slips past unnoticed. This not only speeds up the expense approval cycle but also reduces the risk of policy violations and intentional misuse. Finance teams can now focus on resolving genuine issues rather than scanning every submission manually.

Cflow Automation Benefits:

Automated Red Flags:

Cflow helps to automate detection of suspicious claims based on thresholds, duplicates, or unusual categories, alerting reviewers before approval.

Policy Compliance Checks:

Cflow ensures that submitted expenses are validated against company policies, automatically flagging non-compliant claims before they reach approvers.

Audit-Ready Reports:

Every expense claim, flagged entry, and decision is logged by Cflow, making audits smoother and more transparent for the finance team.

Faster Resolutions:

By streamlining the approval process and highlighting anomalies, Cflow allows finance teams to take timely action and minimize potential financial leakage.

Frequently Asked Questions

What is the expense fraud detection process?

A system designed to identify and prevent fraudulent expense claims within an organization.

What are the main challenges in expense fraud detection?

Detecting sophisticated fraud patterns, minimizing false positives, and ensuring compliance with company policies.

How can institutions streamline the expense fraud detection process?

By implementing AI-driven fraud detection tools, setting clear spending policies, and automating expense audits.