Escrow Fund Management Process

Automate escrow fund tracking to ensure secure transactions and transparent financial handling.

Why automate?

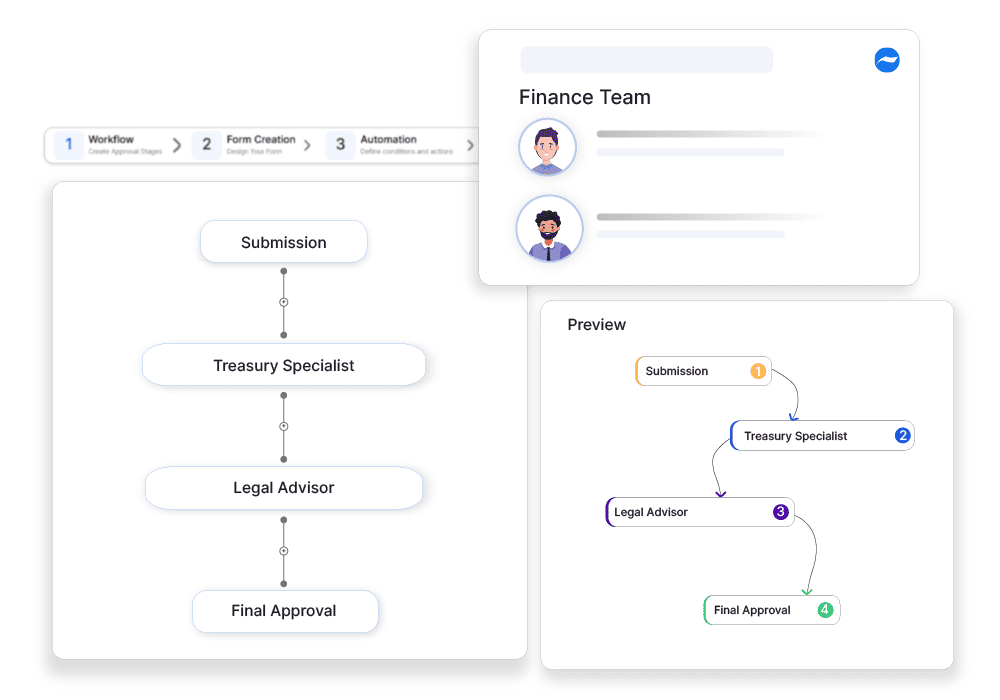

Escrow funds are held temporarily during high-stake transactions such as real estate deals or vendor agreements. Manual tracking risks delayed disbursements, miscommunication, or legal non-compliance. Cflow enables finance and legal teams to initiate, monitor, and approve fund deposits and releases through structured workflows. Each action is documented with terms, timelines, and approval status.

Cflow Automation Benefits:

Milestone-Based Approvals:

Release funds only when pre-defined conditions or milestones are verified and approved.

Secure Documentation:

Store escrow agreements, receipts, and release authorizations in one place.

Multi-Party Sign-Offs:

Cflow supports joint approvals between internal teams and third parties.

Full Audit Trail:

Maintain a detailed history of all escrow-related actions and decisions.

Frequently Asked Questions

What is the escrow fund management process?

A structured approach to managing funds held in escrow for regulatory compliance or contractual obligations.

What are the main challenges in escrow fund management?

Ensuring proper fund allocation, maintaining compliance, and tracking disbursements.

How can institutions streamline escrow fund management?

By using escrow management software, automating fund releases, and maintaining detailed records.