Customer Credit Approval Workflow

Why automate?

How Cflow Can Help Automate the Process:

Centralized Credit Application Submission:

Cflow standardizes the application submission and documentation process where all information from the credit applications is captured accurately. This simplifies the overall approval process and enhances data integrity.

Automated Credit Evaluation and Risk Assessment:

Cflow enables automated credit evaluation based on customers’ financial statements, credit history, and risk metrics and points out any discrepancies for further review to ensure accuracy and maintain consistency.

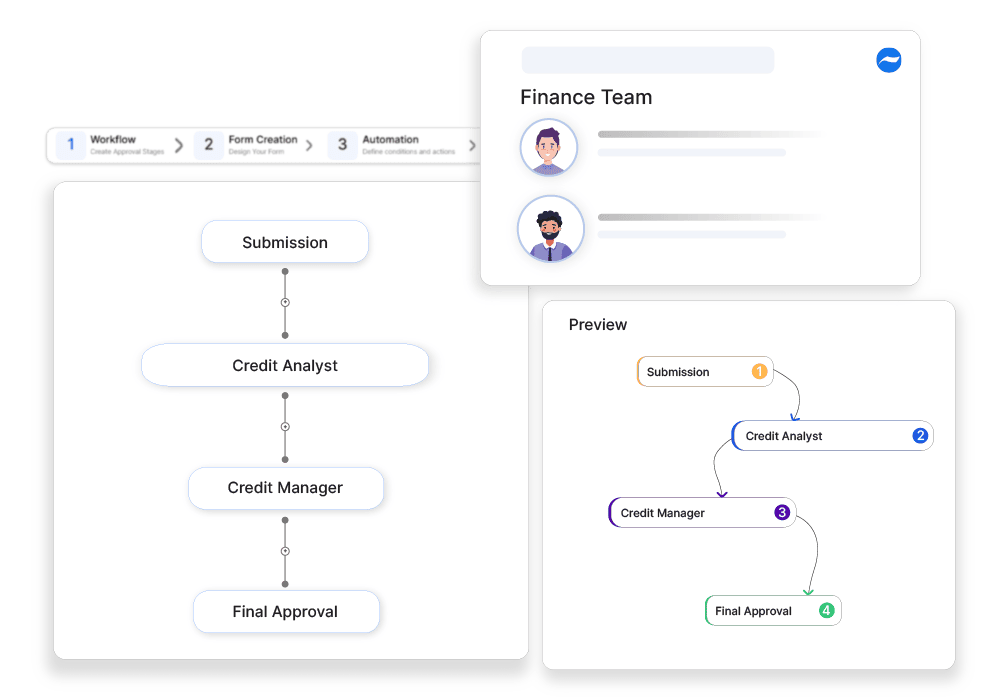

Streamlined Approval Workflows:

Cflow offers a predefined approval workflow to route the credit applications which are reviewed and approved by the finance and risk management team. A thorough review process results in authorizing credit limits in time and facilitates efficient credit management.

Detailed Reporting and Credit Monitoring:

Cflow enables users with detailed reports and credit assessment reports that include approval histories and credit limit monitoring. Transparency provides financial oversight to companies to come up with contingency plans to mitigate risks.

Frequently Asked Questions

What factors determine customer credit limits?

Credit history, financial statements, and payment behavior.

How can businesses reduce credit risk?

By conducting regular credit reviews and setting appropriate terms.

What are common reasons for rejecting a credit request?

Poor credit score, outstanding debts, and insufficient financial history.