Understanding the Total Cost of Ownership: What It Is and Why It Matters

Key takeaways

- The Total Cost of Ownership (TCO) concept helps organizations assess the full financial impact of an asset or solution over time.

- It includes not just the purchase price, but also operation, maintenance, support, and eventual disposal costs.

- TCO analysis equips businesses to make well-informed decisions by considering long-term value rather than just upfront expenses.

- Total cost of ownership calculation is especially important when choosing enterprise software, IT infrastructure, or large-scale equipment.

- A clear understanding of TCO helps eliminate hidden costs, improves vendor comparisons, and ensures strategic sourcing.

- Companies using low-maintenance platforms like Cflow can drastically reduce their ownership costs over time.

Table of Contents

What is Total Cost of Ownership?

Total Cost of Ownership (TCO) is a financial estimate intended to help buyers and owners determine the direct and indirect costs of a product, service, or system. Introduced widely by Gartner in the IT world, the model has since expanded across industries for smarter budgeting and investment.

TCO encompasses more than the sticker price. It includes recurring costs like utilities, training, support, and retirement of the asset. This comprehensive cost assessment allows decision-makers to choose not just the cheapest solution, but the most cost-effective one over time.

For instance, when comparing two enterprise software tools, TCO helps analyze not just the license fee, but also customization, integration, support, downtime, and upgrade costs over a 5–10 year span. This blog covers what Total Cost of Ownership (TCO) means, how to calculate it, why it’s crucial in procurement, how it compares to ROI, and how tools like Cflow help reduce TCO.

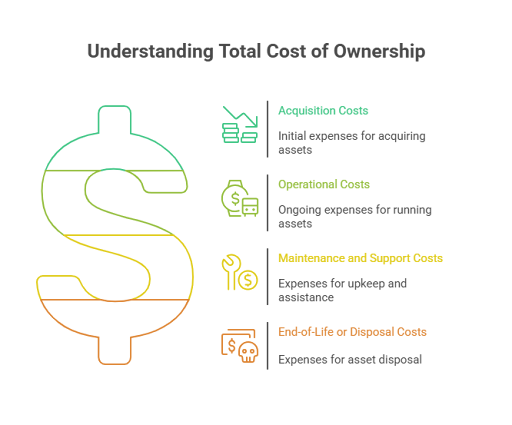

Components of a Total Cost of Ownership Model

A comprehensive Total Cost of Ownership model provides businesses with a framework to evaluate not only the direct purchase price of an asset or service but also every additional cost incurred throughout its lifecycle. It supports smarter budgeting, more accurate forecasting, and ensures that procurement decisions are based on value rather than upfront savings. This model is particularly useful for evaluating technology, infrastructure, software, and long-term service contracts.

To properly assess TCO, all related expenses should be broken down into categories:

1. Acquisition Costs

Acquisition costs refer to all upfront expenses associated with selecting, purchasing, and implementing the asset or service. These costs are often clearly visible but may still be underestimated. Examples include the purchase price, customization fees, implementation charges, and setup costs such as training, configuration, and licensing. For physical goods, delivery and installation charges also fall under this category.

Base price or licensing fee

Customization or setup cost

Installation and configuration charges

Initial training and onboarding

Taxes and shipping for hardware

2. Operational Costs

Operational costs are the ongoing costs incurred during the active use of the asset. These are often where the bulk of hidden costs reside. They include costs like energy or bandwidth consumption, software renewals, staffing, and time required to operate the system, and periodic compliance fees. These costs can vary significantly based on how the asset is used, making it crucial to track and forecast them accurately.

Software subscriptions or annual renewals

Electricity, bandwidth, or fuel for operation

Employee time required to operate the solution

Regulatory compliance or certifications

Upgrades or added features over time

3. Maintenance and Support Costs

This category covers everything needed to sustain performance and resolve issues throughout the product’s lifecycle. It includes vendor-provided support services, regular software updates or hardware servicing, warranties, and the cost of unplanned downtime or repairs. Organizations should also account for internal staff time spent on maintenance and recurring training sessions to keep teams updated.

Preventive and corrective maintenance

Third-party service provider support

Extended warranties

Downtime and loss of productivity

Internal or external training refreshers

4. End-of-Life or Disposal Costs

When an asset reaches the end of its usable life, additional costs arise related to decommissioning, data migration, equipment disposal, or service termination. There may be contractual penalties for ending agreements early or physical costs related to removing and replacing equipment. Some assets may also retain a resale value, which offsets the total cost slightly. Including these costs in the TCO model ensures a complete financial picture from acquisition to retirement.

Uninstallation and data migration

Equipment disposal or recycling

Contract termination penalties

Resale or residual value (negative or positive)

Factoring all these categories into the decision-making process provides a holistic view of ownership.

Why Does TCO Matter to Your Business?

Total Cost of Ownership is more than just a procurement metric—it’s a strategic lens that helps organizations view every purchase through a long-term value filter. Whether you’re investing in new technology, equipment, or service contracts, understanding the full scope of ownership costs helps you allocate budgets wisely and avoid unpleasant surprises down the road.

From budgeting to vendor negotiations, a strong grasp of TCO empowers decision-makers to weigh alternatives more fairly and justify investments with a complete cost picture. It encourages accountability across departments by spotlighting the true impact of operational, maintenance, and support costs.

Most importantly, focusing on TCO allows you to link procurement decisions to organizational goals. For growing businesses, it ensures agility by choosing scalable tools. For mature enterprises, it safeguards efficiency by preventing bloated systems with high upkeep. In short, businesses that embed TCO thinking into their operations are better equipped to manage resources, reduce risk, and maximize ROI.

Total Cost of Ownership in Procurement Decisions

Many procurement teams traditionally focus on securing the lowest price, but this short-sighted view often leads to higher long-term costs. TCO shifts this thinking by asking: “What will this cost us over its entire life?”

By applying TCO in procurement:

- Buyers avoid surprises like high support fees or low resale value

- Procurement decisions prioritize value and reliability over price alone

- Organizations can negotiate smarter contracts with clearly defined lifecycle costs

For example, a printer with a lower purchase price might end up costing more due to expensive ink cartridges, high energy usage, or frequent breakdowns. A TCO evaluation helps select a solution that offers lower lifetime expenses.

In supplier evaluation, TCO also provides a framework to score vendors not just on upfront pricing but also on maintenance responsiveness, service quality, and product longevity.

TCO plays a critical role in procurement strategy, especially when managing long-term vendor relationships or high-value capital purchases. When procurement teams rely solely on upfront cost, they risk selecting solutions that are inexpensive today but expensive to maintain, operate, or replace tomorrow.

Incorporating TCO into procurement evaluations encourages a shift from price-based negotiation to value-based partnerships. It allows organizations to engage vendors on deeper service aspects—such as uptime guarantees, support responsiveness, integration ease, and product durability.

TCO also strengthens internal business cases. When procurement professionals present a full ownership breakdown, stakeholders gain confidence in the long-term value of their investments. This data-driven approach can help secure budget approvals and align decisions with overall business goals.

Additionally, using TCO-based comparisons helps standardize supplier evaluations. It creates a structured, transparent scoring model where suppliers are evaluated not just by price, but by the real-world cost of using their product or service.

Calculating Total Cost of Ownership: Step-by-Step

To make the most out of a TCO analysis, it’s important to apply a structured and methodical approach. Here’s how each step should be expanded for greater clarity and effectiveness:

Step 1: Define the Scope

Start by clearly identifying the asset or service you are analyzing. Establish boundaries such as the intended lifecycle (e.g., 3 years, 5 years, 10 years) and the organizational departments impacted. This ensures that the analysis remains relevant and doesn’t overreach into unrelated cost areas.

Step 2: Identify Cost Components

Divide the total ownership into logical categories, such as acquisition, operations, maintenance, and disposal. Within each category, list sub-elements (e.g., license fees, energy use, repair costs, staff time) so that nothing important is overlooked. Each element should tie back to the broader cost drivers identified during your scope definition.

Step 3: Assign Monetary Values

Estimate a realistic monetary figure for each cost item. Use vendor-provided quotes, historical data from similar past purchases, or reliable benchmarks. When dealing with variable costs like energy or labor, build in ranges or use averages to improve accuracy.

Step 4: Apply Time Adjustments

Costs that occur in future years should be adjusted using Net Present Value (NPV) or discounted cash flow methods. This helps reflect the time value of money and presents a truer economic impact over the lifecycle. Depreciation schedules can also be included to align financial and accounting perspectives.

Step 5: Compare Alternatives

Conduct a parallel TCO analysis for all viable solutions or vendors. Use a comparison matrix or chart to visualize which option offers the best value over time. Go beyond just numbers and consider qualitative factors like vendor reputation, support quality, or integration ease, while keeping the cost estimates front and center.

TCO calculations should be updated periodically, especially when new usage patterns or unexpected costs emerge. Leveraging automation tools or spreadsheets can simplify this process and make your findings easier to share with stakeholders.

Challenges in Calculating TCO

While the Total Cost of Ownership is a valuable decision-making tool, accurately calculating it can be complex. One of the biggest challenges is failing to define a consistent scope across departments. Different teams may interpret the TCO framework differently, leading to misalignment and incomplete data capture.

Another challenge lies in identifying hidden or indirect costs. Operational and maintenance expenses such as downtime, retraining, support contracts, or opportunity costs are often underestimated or excluded. Additionally, forecasting future costs like licensing renewals, utility consumption, or depreciation requires assumptions that may change over time, adding uncertainty to the calculation.

Quantifying intangible elements, such as employee productivity or customer satisfaction impacted by the system, adds further complexity. These soft costs may significantly affect TCO but are difficult to measure with precision.

Lastly, many businesses don’t have integrated systems to track and compile all relevant cost components in one place. Without automation or centralized data, calculating TCO becomes a time-consuming, error-prone manual task.

Understanding and overcoming these challenges is essential to maximize the accuracy and usefulness of any TCO analysis.

Examples of TCO

Understanding TCO becomes easier with relatable examples. Take the case of purchasing a vehicle for your business. While one car might have a lower sticker price, it could cost more over five years due to poor fuel efficiency, high maintenance, and insurance costs. Another car with a slightly higher purchase price might offer lower fuel and maintenance expenses, ultimately leading to a lower total cost of ownership.

In IT, a company may choose between on-premise and cloud-based servers. While on-premise solutions have predictable upfront capital costs, they also come with continuous expenses like IT support, energy consumption, hardware upgrades, and system failures. Cloud solutions typically have lower upfront costs and predictable monthly fees, often making them more cost-efficient over the long term.

TCO helps uncover these cost layers and reveals the option that truly delivers value over time.

Another classic example is in enterprise software selection. Suppose Company A selects a cheaper CRM tool with a lower subscription rate. However, the tool requires heavy customization, lacks native integration with other tools, and incurs high customer support costs. Company B, on the other hand, opts for a slightly more expensive CRM that is intuitive, integrates seamlessly with existing tools, and requires minimal training. Over three years, Company B ends up saving money and time, while Company A struggles with inefficiencies, high support bills, and low adoption rates.

TCO also plays a role in manufacturing. A factory evaluating two machines must factor in not just purchase and delivery but also energy use, maintenance frequency, cost of downtime during servicing, and expected lifespan. Often, the more expensive machine proves more cost-effective when all these elements are considered.

How to Use TCO

TCO should be used at every stage of procurement and capital planning. During vendor evaluation, comparing the TCO of each option enables fair, informed decision-making beyond price tags. When preparing internal business cases, showing the long-term savings of a higher upfront investment can win stakeholder approval.

It also serves as a budgeting tool. Knowing the long-term costs of ownership helps departments allocate funds appropriately for support, upgrades, and eventual replacement. TCO can even guide contract negotiations by highlighting hidden fees and allowing buyers to push for better lifecycle value.

Ultimately, using TCO allows businesses to align operational decisions with financial strategy, ensuring they don’t just purchase the cheapest solution—but the smartest one.

TCO analysis is also a valuable tool for strategic planning. For instance, when launching a new business unit, calculating TCO for key infrastructure investments helps in projecting long-term capital and operational expenditure. It ensures leaders aren’t just budgeting for year one, but for the entire duration of use.

TCO can also influence vendor accountability. By highlighting support and upgrade costs, organizations can negotiate service-level agreements that align with expected outcomes. This transparency can lead to better vendor performance and more predictable budgeting over time.

For CIOs, CFOs, and operations leaders, TCO serves as a foundation for smarter resource allocation, encouraging cross-functional collaboration and financial discipline.

TCO vs ROI: What’s the Difference?

Understanding the distinction between Total Cost of Ownership (TCO) and Return on Investment (ROI) is crucial when making informed business decisions. While both metrics are financial tools used in project evaluation and capital planning, they serve distinctly different purposes. TCO helps you understand the full financial burden of owning and operating a solution, while ROI focuses on the benefits you gain relative to what you spend.

TCO provides a cost-centric view. It helps you uncover not only the initial purchase price, but all associated costs over the life of the asset—such as maintenance, support, training, energy consumption, and eventual disposal. It’s especially valuable when evaluating long-term or complex investments like software platforms, infrastructure upgrades, or outsourced services.

ROI, on the other hand, is used to measure the profitability or value generated by that investment. It’s outcome-driven and calculated by comparing the financial gains (or savings) achieved against the total investment costs. ROI is vital for making a case to executives or stakeholders who want to understand the tangible returns.

In essence:

- TCO is backward-looking- and present-focused, focused on costs.

- ROI is forward-looking, focused on value.

When used together, these two tools provide a balanced and strategic framework for decision-making. You can evaluate which solution is less costly over time (TCO) and which one offers greater returns or business impact (ROI).

Aspect | TCO | ROI |

Focus | Total lifecycle cost | Net gain from investment |

Scope | Expenses only | Revenue vs. cost |

Goal | Cost control | Value generation |

Use Case | Procurement, budgeting | Investment justification |

By leveraging both TCO and ROI, businesses can confidently balance cost-efficiency with value creation—ensuring every dollar spent delivers measurable returns while aligning with long-term strategic goals.

End-to-end workflow automation

Build fully-customizable, no code process workflows in a jiffy.

Total Cost of Ownership in IT and Software

Technology and software purchases are particularly prone to hidden costs. That’s why understanding TCO is crucial for IT managers and CIOs.

On-premise software often seems affordable initially, butit involves:

- Hardware purchases

- Licensing and maintenance fees

- Dedicated IT staff

- Regular updates and patches

- Downtime management

Cloud-based SaaS solutions like Cflow offer:

- Subscription pricing that aligns with usage

- Automatic updates and security patches

- Reduced dependency on internal IT resources

- Shorter deployment and onboarding times

When calculating TCO for software, don’t forget integration complexity, training requirements, user adoption, and scalability. SaaS platforms typically lower TCO by removing the burden of system upkeep, allowing businesses to scale faster.

How to Reduce Total Cost of Ownership

Lowering your TCO doesn’t mean settling for less—it means spending smarter. Here are proven ways to reduce TCO:

Automate manual tasks

Manual workflows can lead to duplication, rework, and delays. By automating approvals, document routing, and data entry, companies can reduce labor dependency and boost productivity. Automation also ensures consistency, reduces errors, and frees up employees to focus on higher-value tasks.

Choose scalable tools

Scalable systems allow businesses to expand their use without requiring complete replacement. This minimizes reinvestment as operations grow. Choosing platforms that support modular upgrades ensures you only pay for features you need, when you need them.

Streamline support and training

Tools with intuitive user interfaces reduce onboarding and support costs. Vendors that offer comprehensive documentation, responsive helpdesks, and built-in guides can prevent recurring training expenses and reduce ticket volumes.

Consolidate vendors and systems

Using a single solution for multiple workflows or teams simplifies licensing and support. It also eliminates redundant tools that drive up subscription, maintenance, and integration costs.

Evaluate long-term value

Instead of choosing the lowest-priced option, evaluate durability, customer reviews, service responsiveness, and upgrade paths. A slightly more expensive solution may offer greater stability and require fewer resources over time.

Implement cloud-based solutions

Cloud software eliminates the need for expensive infrastructure and ongoing maintenance. It provides access to the latest updates, security patches, and compliance features without manual intervention, reducing IT overhead and upgrade costs.

Optimize vendor relationships

Long-term, value-focused relationships with vendors often come with volume discounts, flexible SLAs, and bundled services. Proactive vendors who understand your business can offer tailored support and minimize disruption, which lowers ongoing ownership costs.

Regularly monitor and review usage

Track system usage and adoption rates. Underutilized software licenses or overlapping tools can be identified and discontinued. This keeps recurring costs aligned with actual business needs.

Use automation to reduce overhead

Beyond workflow automation, businesses can automate analytics, alerts, approvals, and reporting. This reduces reliance on manual reviews and accelerates process cycles, translating into lower operational costs.

Plan for the end-of-life early

Having a defined strategy for phasing out tools or equipment allows time to migrate data, transfer ownership, and find cost-effective alternatives. Planning prevents emergency purchases or rushed decisions that could inflate costs.

Reducing TCO is a continuous effort. It requires organizations to periodically revisit their processes, vendor contracts, and resource usage to ensure efficiency and sustainability.

Why Cflow is a Low-TCO Workflow Automation Platform

Cflow is built with TCO reduction in mind, making it ideal for businesses seeking high value at lower cost. Here’s how it helps:

No-code configuration

You don’t need IT developers to build or modify workflows. Anyone can automate tasks with drag-and-drop simplicity.

Cloud-based infrastructure

You save on servers, hosting, and ongoing maintenance by accessing everything online. It’s secure and always updated.

Automatic upgrades

Cflow handles new features, security patches, and regulatory compliance—no manual work needed.

Fast onboarding and training

Its intuitive UI reduces learning curves and allows users to become productive quickly.

Flexible pricing

You only pay for what you use. Cflow’s pay-as-you-grow model ensures affordability at every stage of business growth.

By simplifying operations and eliminating costly overhead, Cflow makes automation accessible and sustainable.

Final Thoughts

Understanding the Total Cost of Ownership transforms how businesses approach procurement, budgeting, and technology investment. Rather than just chasing the cheapest product, TCO encourages thoughtful evaluation of value across an asset’s entire life.

From enterprise IT to cloud-based automation, applying TCO principles can eliminate hidden costs, improve supplier decisions, and maximize long-term ROI. As the demand for agile, scalable tools increases, platforms like Cflow stand out for offering powerful capabilities with a low TCO footprint.

Ready to automate smarter? Sign up for Cflow and see how it can reduce your ownership costs while increasing efficiency.

FAQs

1. What is total cost of ownership (TCO)?

TCO refers to all direct and indirect expenses involved in purchasing, using, maintaining, and retiring an asset over its lifecycle.

2. How is TCO calculated?

TCO is calculated by summing up acquisition, operational, maintenance, and end-of-life costs, adjusted for time and usage patterns.

3. Why is TCO important in procurement?

TCO helps avoid costly surprises by providing a realistic financial view of ownership. It supports vendor comparisons based on long-term value.

4. How does TCO differ from ROI?

TCO focuses on total cost incurred; ROI emphasizes the value received. Together, they offer a complete picture of cost-effectiveness.

5. Can workflow automation reduce TCO?

Yes. Workflow automation minimizes manual effort, IT maintenance, training, and delays—resulting in significant TCO savings.

What should you do next?

Thanks for reading till the end. Here are 3 ways we can help you automate your business:

Do better workflow automation with Cflow

Create workflows with multiple steps, parallel reviewals. auto approvals, public forms, etc. to save time and cost.

Talk to a workflow expert

Get a 30-min. free consultation with our Workflow expert to optimize your daily tasks.

Get smarter with our workflow resources

Explore our workflow automation blogs, ebooks, and other resources to master workflow automation.