Accrued Accounts Payable: What It Means and Why It Matters in Modern Finance

Key takeaways

- Accrued accounts payable represent expenses a company owes but hasn’t yet received an invoice for.

- These liabilities are a core component of accrual accounting and impact cash flow visibility.

- Understanding accrued accounts payable helps maintain accurate financial statements and meet reporting standards.

- Automating accrual tracking can streamline compliance, reduce manual errors, and improve monthly close efficiency.

Table of Contents

What is Accrued Accounts Payable in Accounting?

Accrued accounts payable refers to expenses that a business has incurred but not yet paid for, often because the invoice hasn’t been received. This concept comes from accrual accounting, where transactions are recorded when they occur—not when cash is exchanged.

For example, a business may receive services in March but won’t get the invoice until April. To match the expense to the correct accounting period, the finance team records it as an accrued liability. It appears on the balance sheet under current liabilities and ensures that financial statements reflect the company’s true financial position.

Accrued accounts payable are essential in providing a realistic view of what a business owes, especially at the end of a reporting period. Ignoring these can lead to inaccurate profits, understated liabilities, and misinformed business decisions.

In this blog, we’ll explore how accrued accounts payable works, how it differs from regular accounts payable, how to record it properly, and the role of automation in managing these liabilities.

Why are Accrued Accounts Payable Essential in Accrual Accounting

In accrual accounting, expenses and revenues are recognized when they are earned or incurred, not when payment is made or received. This principle allows businesses to match expenses to the revenues they generate, offering a clearer picture of financial health.

Accrued accounts payable are a perfect example of this concept. By recording obligations before receiving invoices, companies avoid underreporting their liabilities and overstating profits. This is particularly important during month-end and year-end closings when accurate reporting is critical.

Without recording these accruals, companies run the risk of producing misleading financial reports that don’t reflect all incurred expenses. Over time, this can affect stakeholder trust, hinder strategic planning, and even trigger audit flags.

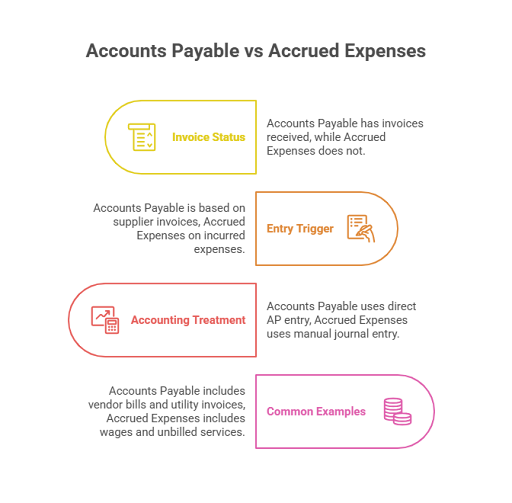

Difference Between Accounts Payable and Accrued Expenses

It’s easy to confuse accounts payable with accrued expenses, as both represent amounts a company owes. However, they differ based on timing and documentation.

Accounts payable typically includes obligations backed by an invoice, like supplier bills. Accrued expenses are liabilities for which the invoice hasn’t yet been received, like accrued salaries or consulting services completed but not yet billed.

Understanding the distinction helps businesses manage both types of liabilities accurately and streamline their financial close process.

How to Record Accrued Accounts Payable in Journal Entries

Recording accrued accounts payable is a key part of the monthly and year-end closing process. Since the expense has been incurred but the invoice is yet to arrive, finance teams must create an adjusting journal entry to reflect the obligation accurately in the books.

This entry ensures that financial statements capture all liabilities for the period and that expenses are properly matched with the revenues they relate to. Here’s how the process works in practice:

Steps to Record Accrued Accounts Payable in Journal Entries:

Identify the expense incurred

Begin by determining what goods or services have been received but are not yet invoiced. This could be anything from contracted services, maintenance work, utilities, or even bonuses earned by employees. Accurate identification is the foundation of a valid accrual.

Estimate the cost or amount payable

If the invoice is unavailable, estimate the cost using supporting documents such as contracts, historical data, supplier quotes, or hours worked. The estimate should be as accurate and reasonable as possible to ensure financial reporting integrity.

Create a journal entry for the accrual

Once the amount is estimated, record the accrual with a journal entry. The typical format is:

Debit the appropriate expense account (e.g., Consulting Fees, Salaries, Utilities)

Credit an accrued liabilities account or accrued accounts payable

This entry increases the expense for the current period and also increases liabilities, reflecting the obligation.

Review and approve the accrual entry

Depending on your organization’s process, the entry may need to be reviewed by a controller or finance manager. Approval workflows ensure accuracy and compliance with internal accounting policies.

Post the entry to the general ledger

Once approved, the entry is posted to the general ledger. This ensures it reflects in the financial reports generated for the period.

Reverse the accrual in the next accounting period

When the actual invoice is received in the following period, you must reverse the original accrual to avoid duplicate expenses. This reversal is typically done through an automated or manual journal entry:

Debit the accrued liabilities account

Credit the same expense account (if applicable)

Then the actual invoice is recorded as a standard accounts payable entry.

Reconcile with the invoice and adjust if needed

After the invoice is received and entered, compare it with the original estimate. If there’s a variance, make a correcting entry to reflect the difference accurately in the period the invoice was received.

By following these steps, companies can ensure that all expenses are accounted for in the right period, maintain compliance with accounting standards, and produce reliable financial reports. Proper accrual accounting not only improves audit readiness but also enhances visibility into true operational costs.

Examples of Accrued Accounts Payable in Business Operations

Accrued accounts payable appear in many routine business scenarios. A few practical examples include:

- Employee bonuses: When bonuses are earned in December but paid in January, they are accrued in the previous fiscal year.

- Utilities: Businesses often receive utility bills after the service period ends. Accruals ensure the expense is logged in the correct month.

- Professional services: A law firm may complete work for a company in March, but bill them in April. The company still needs to reflect the cost in March.

- Freight or logistics: Shipping services completed at month-end but not yet invoiced are another common type of accrual.

By identifying and recording these cases consistently, companies ensure compliance with accounting standards and maintain accurate profit margins.

Impact of Accrued Accounts Payable on Financial Statements

Accrued accounts payable have a direct and significant impact on a company’s financial statements. While they may seem like small adjustments during month-end close, they play a critical role in ensuring that financial reporting reflects the company’s true obligations and financial performance.

On the Balance Sheet

Accrued accounts payable are recorded as current liabilities because they represent expenses that the company is obligated to pay within the near term, typically within one accounting cycle. These liabilities increase the total obligations shown on the balance sheet, which provides investors, auditors, and internal stakeholders with a clear picture of the company’s short-term financial health.

Failing to include accrued liabilities leads to an understatement of total liabilities, which in turn may make the company appear more financially stable than it actually is. This misrepresentation can impact decisions related to lending, investment, and regulatory compliance.

Furthermore, the increase in current liabilities will also affect important financial ratios such as the current ratio (current assets divided by current liabilities) and the quick ratio. If accruals are not recorded properly, these ratios may present an overly optimistic view of liquidity, misleading stakeholders about the organization’s ability to meet its short-term obligations.

On the Income Statement

The income statement is where the timing of expense recognition becomes essential. Accrued accounts payable ensure that expenses are recorded in the period they are incurred—even if the cash has not yet been paid or the invoice hasn’t been received.

This matching principle is fundamental to accrual accounting. It allows expenses to be aligned with the revenues they help generate. For example, if a consulting service was used in December to complete a client project, but the invoice is received in January, accruing the expense ensures that the December income statement reflects the full cost of that project.

If accruals are missed, the company’s expenses for that period will be understated, resulting in inflated profits. This may seem favorable in the short term, but it creates distortions that can catch up in the next reporting period. Eventually, this leads to inconsistent profit margins, unreliable financial forecasts, and complications during audits or financial reviews.

On the Statement of Cash Flows

While accrued accounts payable affect the balance sheet and income statement, they do not directly impact the cash flow statement until the actual payment is made. However, the cash flow statement may reflect their impact indirectly under the operating activities section when analyzing changes in working capital.

For example, an increase in accrued liabilities signals that the company is recording more expenses without corresponding cash payments—effectively conserving cash in the short term. This is important for assessing cash flow from operations, especially during times when liquidity management is critical.

Overall Financial Impact

When managed well, accrued accounts payable improve the accuracy, consistency, and transparency of financial statements. They provide a more realistic view of obligations and performance, which helps:

- Investors assess risk accurately

- Auditors validate expense matching and liability recognition

- Management teams plan budgets and forecasts with better precision

- Companies remain compliant with accounting standards and tax regulations

On the other hand, if accruals are recorded inconsistently or inaccurately, the consequences can range from misinformed decision-making to audit issues and regulatory scrutiny. That’s why companies must have structured accrual processes in place and ideally automate them for accuracy and efficiency.

In short, accrued accounts payable are more than just bookkeeping adjustments—they are a cornerstone of responsible financial reporting.

End-to-end workflow automation

Build fully-customizable, no code process workflows in a jiffy.

How to manage Accrued Accounts Payable in ERP Systems

Enterprise Resource Planning (ERP) systems can simplify the process of managing accrued accounts payable, but only if set up correctly. Here’s how businesses can get the most out of their ERP tools:

Start by configuring expense recognition rules that align with accounting policies. Most modern ERP platforms allow automation of recurring accruals for items like utilities, rent, or contract services. These templates reduce manual journal entries at month-end.

Ensure cross-department collaboration by granting visibility to both procurement and finance teams. This ensures that any services received—but not yet invoiced—are identified and accrued appropriately.

Reporting dashboards in ERP systems can also be customized to display aging accruals, pending reversals, and variances between accruals and actual invoices. This helps teams monitor liabilities and investigate discrepancies before close.

Lastly, train staff on how to flag transactions that require accruals. Many accruals go unrecorded simply because users don’t recognize the need for them. Building this awareness into workflows ensures better coverage and fewer missed expenses.

When to Recognize Accrued Accounts Payable

Recognizing accrued accounts payable requires judgment and consistency. The key is timing—accruals should be recorded when an expense is incurred, even if the invoice has not yet been received.

This usually occurs at the end of a financial period. Finance teams often conduct reviews during month-end or quarter-end to identify unbilled expenses that should be accrued. They may consult department heads or review service contracts to identify obligations.

Accruals must also be material. Small or one-off costs may not require accrual treatment, depending on the company’s accounting policy. However, recurring services like consulting, maintenance, or utilities almost always qualify.

Timely recognition ensures that financial statements are complete and aligned with generally accepted accounting principles or international financial reporting standards.

Common Mistakes in Recording Accrued Accounts Payable

Even experienced finance teams can make mistakes when handling accruals. Some of the most common issues include:

- Missing accruals: Overlooking services rendered at month-end simply because the invoice hasn’t been received.

- Duplicate entries: Recording both an accrual and the invoice as separate expenses, leading to overstatement.

- Failure to reverse accruals: Not reversing accruals when the actual invoice is posted can distort financials.

- Inconsistent application: Applying accrual logic to some departments or vendors but not others creates an imbalance.

Avoiding these pitfalls requires strong internal controls, review checklists, and clear communication between departments. Automated workflows and ERP alerts can also reduce the risk of manual errors.

Best Practices to Manage Accrued Accounts Payable

Effectively managing accrued accounts payable is essential for maintaining accurate financial records, minimizing reporting delays, and ensuring compliance with accounting standards. Without a structured process, businesses can overlook obligations, misstate liabilities, or face audit discrepancies. Implementing best practices can help streamline this process and improve overall financial control.

Establish clear accrual policies and procedures

Every organization should define a standard policy outlining when and how to accrue liabilities. This includes setting thresholds for materiality, timelines for review, and the types of expenses that must be accrued. Having written procedures ensures consistency across departments and reduces confusion at the end of each reporting period.

For example, a policy might require that any unbilled service over $1,000 incurred before the month-end must be accrued. By creating such rules, finance teams can avoid last-minute guesswork and ensure more reliable financial statements.

Collaborate with department heads for accuracy

Many accruals rely on input from business units outside the finance department. Encourage regular communication with department heads to identify incurred expenses, such as unbilled consulting services, marketing activities, or maintenance work. These individuals are often closer to the actual transactions and can provide the most accurate estimates of unrecorded liabilities.

Creating a monthly pre-close checklist or using shared forms to collect input can help streamline this collaboration and prevent missed accruals.

Maintain detailed supporting documentation

Accrual entries should always be backed by reliable documentation, even if the invoice has not yet been received. This could include emails confirming services rendered, contract terms, time logs, or vendor communication.

Maintaining this documentation ensures transparency and provides auditors with the justification needed for each accrual. It also allows for smoother reconciliation once the actual invoice arrives.

Automate recurring accruals

Recurring expenses such as rent, utilities, or service contracts are predictable and ideal candidates for automation. Setting up recurring journal entries within your accounting software or ERP system ensures that these accruals are recorded on time, every time, without manual intervention.

Automation reduces the risk of missed accruals and frees up finance staff to focus on more complex or ad hoc accruals that require deeper analysis.

Perform regular reconciliations and reviews

After month-end or quarter-end, it’s essential to reconcile accruals with actual invoices. Compare the estimated amounts with what was ultimately billed, and adjust future accruals based on any discrepancies.

Regular reviews help refine estimation accuracy over time and provide insight into vendor billing patterns. They also serve as an internal control to ensure that reversals are processed correctly and liabilities are not overstated.

Leverage workflow automation tools

Using a no-code automation platform like Cflow enables finance teams to build custom workflows for accrual approvals, documentation uploads, and review cycles. These tools ensure that accruals follow a structured path, reduce manual touchpoints, and support faster, more accurate financial close processes.

By integrating Cflow with ERP systems, organizations can create a unified view of both billed and unbilled liabilities, improving control and transparency across all financial operations.

Train teams and create accountability

Finally, make sure all team members involved in the accrual process understand their roles and responsibilities. From data entry to approvals and reversals, each step should have a clear owner. Providing training on your organization’s accrual policies and tools increases compliance and builds confidence in the reporting process.

When everyone—from procurement to finance—understands the importance of timely and accurate accruals, the entire organization benefits from cleaner, more dependable financial reporting.

Incorporating these best practices not only improves the quality of your financial statements but also positions your business for better decision-making, smoother audits, and scalable financial operations.

How Automation Helps Manage Accrued Accounts Payable Efficiently

Managing accrued accounts payable manually is labor-intensive and prone to delays. Automation offers a better alternative by enabling companies to streamline recurring tasks, improve accuracy, and reduce cycle times.

With automated workflows, finance teams can set up rules to trigger accruals based on expense types, contract dates, or delivery receipts. These rules eliminate the need to review every transaction manually at month-end.

Automation also helps with audit readiness. Each accrual is backed by a digital trail that includes approval history, documentation, and reversal logic. This transparency improves compliance and speeds up external reviews.

The Cflow Advantage

Managing accrued accounts payable often involves juggling multiple tasks—gathering data from departments, estimating costs, entering journal entries, tracking reversals, and ensuring proper documentation. These steps, when done manually, increase the chances of oversight, delay, and inconsistency. That’s where Cflow brings a transformative edge.

Cflow is a no-code workflow automation platform designed to simplify complex finance processes like accrual tracking, purchase approvals, invoice management, and month-end reconciliation. With Cflow, finance teams gain better control over unbilled liabilities and can automate the full lifecycle of accruals with accuracy and ease.

Here’s how Cflow enhances accrued accounts payable management:

1. Customizable accrual workflows

Cflow allows users to create tailored workflows to handle different types of accruals—recurring services, unbilled labor, vendor contracts, and more. These workflows can be set to auto-trigger based on predefined conditions, such as project deadlines or expense thresholds.

2. Automated alerts and reminders

Finance teams can configure reminders for departments to submit accrual data before the close cycle. Automated alerts ensure no entries are missed, and nothing sits idle in approval queues—keeping the process on track.

3. Centralized documentation and audit trail

Every journal entry, approval, estimate, or modification is logged within Cflow. Supporting documents such as service agreements, email confirmations, or time logs can be uploaded and linked to the workflow. This creates a complete audit trail and simplifies internal reviews and external audits.

4. Seamless ERP integration

Cflow integrates with leading ERP and accounting platforms, ensuring that approved accruals flow directly into your general ledger without redundant data entry. This eliminates silos between procurement, accounting, and finance, and maintains consistency across all systems.

5. Real-time reporting and analytics

The platform’s visual dashboards provide a real-time view of outstanding accruals, aging liabilities, upcoming reversals, and discrepancies between estimated and actual amounts. These insights empower teams to improve accuracy over time and close books faster.

Cflow is not just a process automation tool—it’s a strategic enabler for finance teams looking to modernize their month-end workflows. By reducing manual effort and increasing transparency, Cflow helps businesses ensure timely accruals, accurate reporting, and stronger financial governance.

Final Thoughts

Accrued accounts payable are a vital part of financial reporting. They ensure that companies reflect all expenses accurately—even before receiving invoices. While often overlooked, managing these liabilities properly has a significant impact on budget control, cash flow visibility, and audit compliance.

As accounting teams face tighter deadlines and greater scrutiny, automation becomes a valuable ally. A no-code solution like Cflow enables businesses to streamline accrual processes, integrate with ERP systems, and maintain accurate records across departments.

Want to simplify your financial close and reduce the complexity of tracking unbilled expenses? Sign up for a free trial of Cflow and experience a smarter way to manage accrued accounts payable.

FAQs

What is the purpose of accrued accounts payable?

It ensures expenses are recorded in the correct accounting period even if the invoice hasn’t been received, maintaining accurate financial reporting.

How do you reverse an accrued accounts payable?

Once the actual invoice is recorded, the initial accrual entry is reversed through a journal entry, preventing duplicate expense reporting.

Can automation help with managing accruals?

Yes. Automation tools can identify recurring expenses, apply rules, and manage approval workflows—reducing manual errors and speeding up reporting.

What should you do next?

Thanks for reading till the end. Here are 3 ways we can help you automate your business:

Do better workflow automation with Cflow

Create workflows with multiple steps, parallel reviewals. auto approvals, public forms, etc. to save time and cost.

Talk to a workflow expert

Get a 30-min. free consultation with our Workflow expert to optimize your daily tasks.

Get smarter with our workflow resources

Explore our workflow automation blogs, ebooks, and other resources to master workflow automation.