Unclaimed Property Compliance Workflow

Automate unclaimed asset tracking to stay compliant with escheatment laws.

Why automate?

Organizations holding unclaimed checks, credits, or customer balances must eventually report and remit them to the state. Manual tracking risks non-compliance and penalties. Cflow structures the process by routing aging entries for periodic review and approval. Once determined unclaimed, items are escalated for escheatment processing.

Cflow Automation Benefits:

Aging Alerts:

Flag transactions or balances approaching escheatment thresholds for early review.

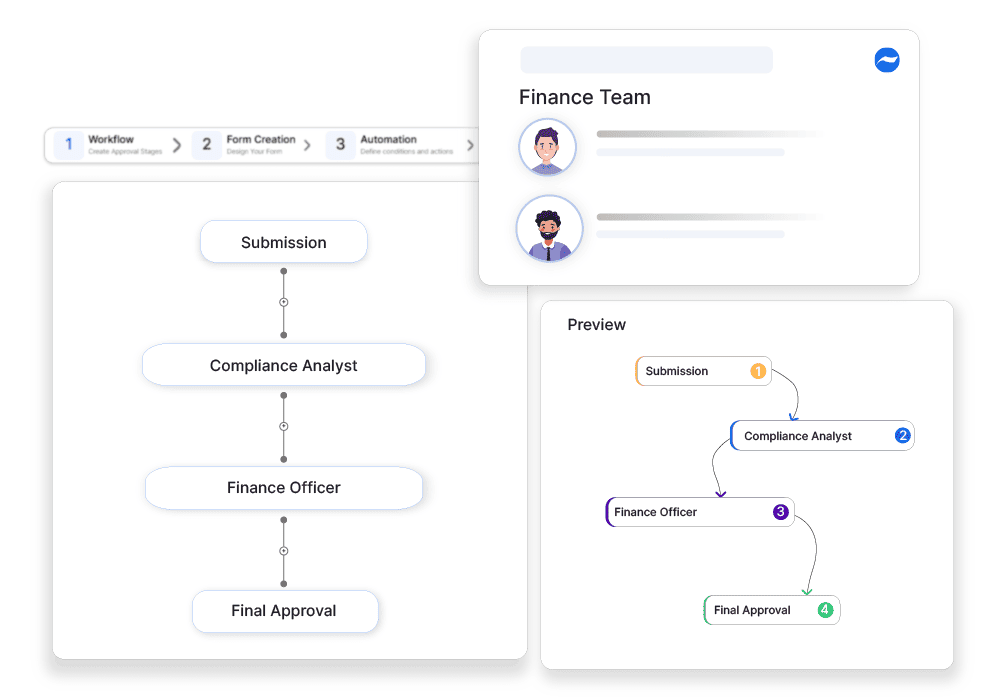

Compliance Review Routing:

Ensure legal, finance, and compliance teams sign off before remitting assets.

State-Specific Filing Logs:

Track jurisdiction-based reporting requirements and timelines.

Liability Minimization:

Avoid fines and penalties by staying ahead of regulatory deadlines.

Frequently Asked Questions

What is unclaimed property compliance?

A process to track and report unclaimed assets in accordance with state and federal laws.

What are the main challenges in unclaimed property compliance?

Tracking dormant assets, complying with varying regulations, and avoiding penalties for non-compliance.

How can institutions enhance compliance?

By automating property tracking, conducting regular escheatment audits, and ensuring timely reporting.