Expense Variance Flagging System

Automate variance checks to control unexpected spikes in operational spending.

Why automate?

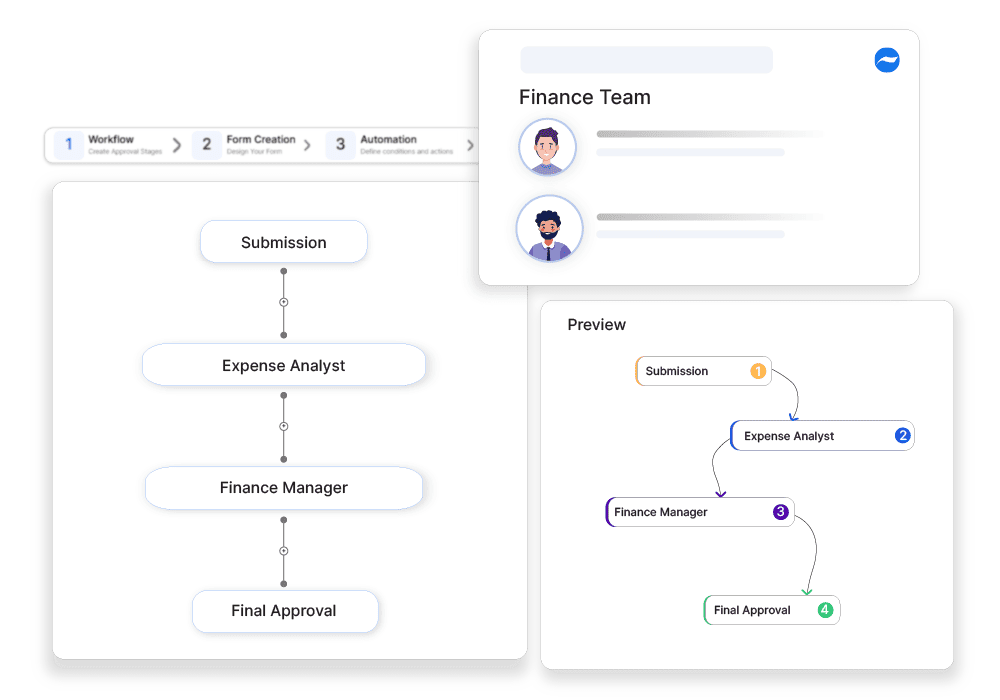

Comparing actuals against budgeted expenses helps identify overspending, but manually checking this across departments is time-consuming and error-prone. Unnoticed variances can lead to budget overruns. Cflow automatically flags entries that exceed set variance thresholds and routes them to department heads or finance leads for explanation or approval. This keeps spending aligned with budgets and enables early corrective action.

Cflow Automation Benefits:

Threshold-Based Flagging:

Set limits on variance percentages and auto-flag entries that exceed them.

Automated Routing for Review:

Outliers are routed to responsible managers for validation or adjustment.

Budget Compliance Enforcement:

Track which departments are consistently over budget and take preventive measures.

Audit-Friendly Logs:

Document all variance explanations and approvals for financial reviews.

Frequently Asked Questions

What is the expense variance flagging system?

A system that identifies and flags deviations from expected expense patterns.

What are the main challenges in expense variance flagging?

Reducing false positives, ensuring accurate data analysis, and managing fraud risks.

How can institutions streamline expense variance flagging?

By using AI-driven anomaly detection, real-time monitoring, and automated alerts.