Annual Tax Audit Preparation Process

Why automate?

Cflow Automation Benefits:

Checklist-Driven Workflows:

Cflow creates task-based checklists for audit prep based on past audits or regulatory standards.

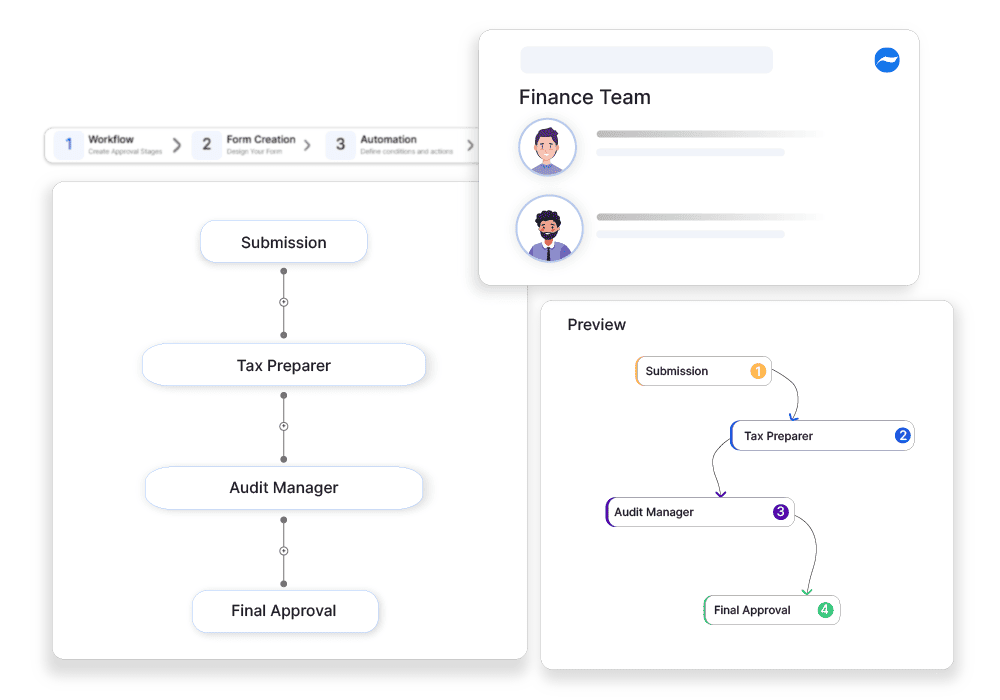

Document Routing:

Each financial record or report is routed for validation before being finalized for audit submission.

Deadline Notifications:

Automated alerts help teams complete their prep on time and avoid last-minute scrambling.

Audit Trail Capture:

Every step, comment, and approval is logged, offering a clear trail for auditors and internal reviewers.

Frequently Asked Questions

What is the annual tax audit preparation process?

A structured method for gathering and reviewing financial records to comply with tax audits.

What are the main challenges in annual tax audit preparation?

Managing large data volumes, ensuring regulatory compliance, and meeting deadlines.

How can institutions streamline the annual tax audit preparation process?

By using tax automation software, maintaining well-organized financial records, and implementing pre-audit checklists.