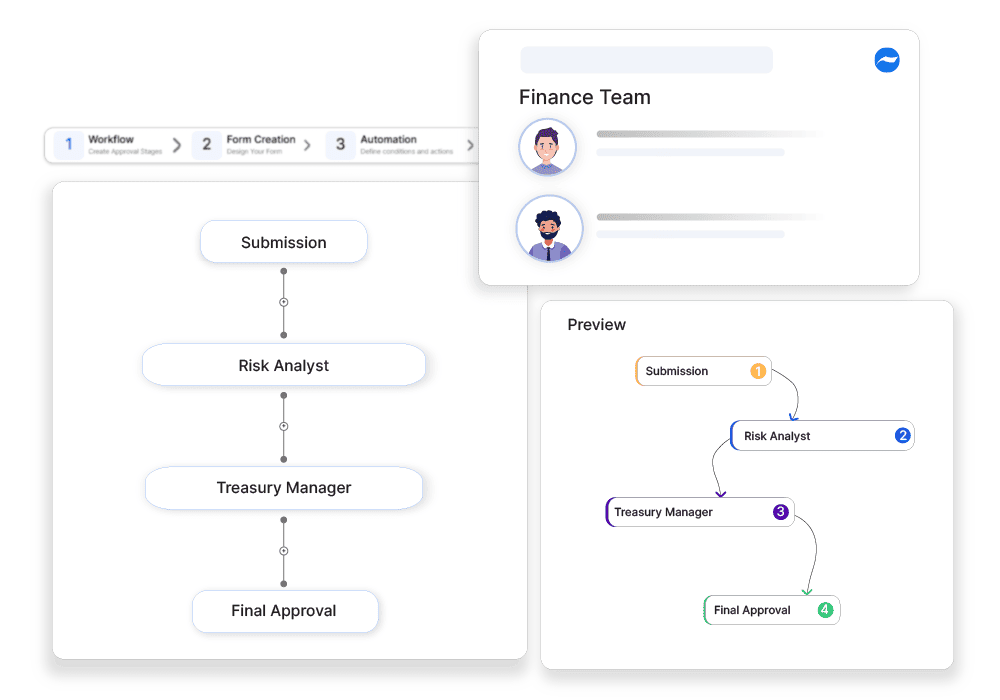

Treasury Risk Mitigation Process

Why automate?

Cflow Automation Benefits:

Real-Time Risk Escalations:

Get alerts and approvals when treasury KPIs exceed predefined tolerance levels.

Diversification Control:

Cflow ensures that new investments or deposits follow predefined risk allocation rules.

Liquidity Tracking:

Cash and market exposure details are routed through review workflows for validation.

Audit-Ready Treasury Records:

All risk decisions and thresholds are stored with full approval history for compliance and audits.

Frequently Asked Questions

What is the treasury risk mitigation process?

A strategy to manage financial risks associated with liquidity, currency, and market fluctuations.

What are the main challenges in treasury risk mitigation?

Predicting market volatility, managing counterparty risk, and ensuring policy compliance.

How can institutions streamline the treasury risk mitigation process?

By using predictive analytics, automating risk monitoring, and implementing hedging strategies.