Business Interruption Insurance Claim Approvals

Why automate?

How Cflow Can Help Automate the Process:

Automated Loss Verification:

Cflow makes it easier to verify business interruption claims by automatically comparing the details of a disruption with the policyholder’s coverage and financial records. This ensures claims are valid and reduces the chance of mistakes. By speeding up approvals, businesses can get the financial help they need without unnecessary waiting. It’s an efficient way to make sure businesses recover faster and insurers stay on track.

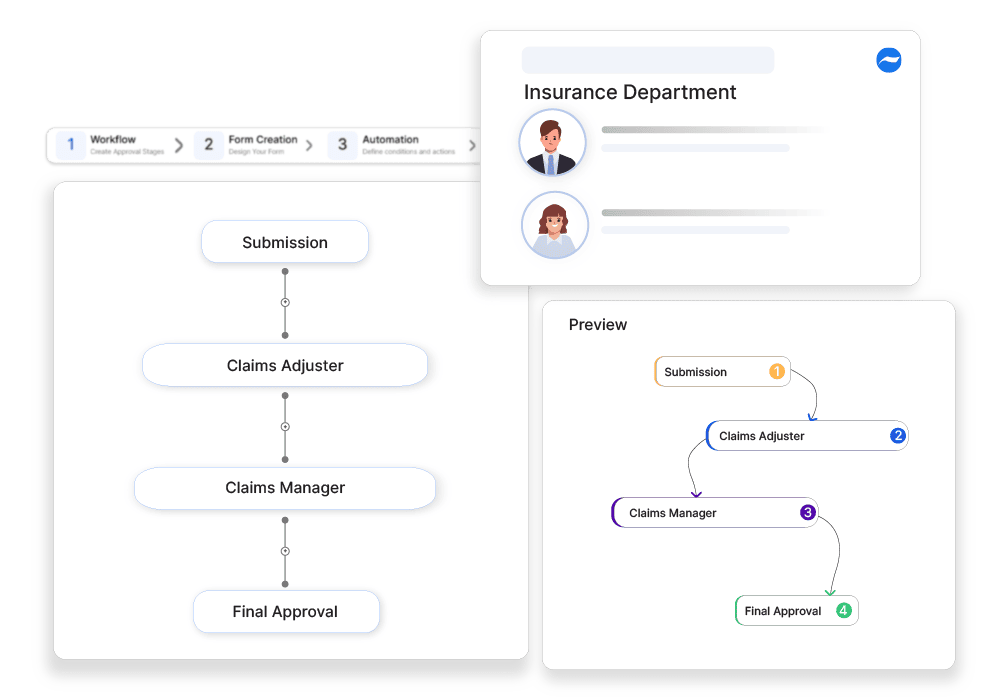

Customized Workflow Templates:

Cflow lets insurers create workflows tailored to business interruption claims. These workflows can be customized to include steps like uploading documents, analyzing financials, and securing final approvals. Everything flows in a way that matches the policy requirements, keeping the process organized and efficient. This ensures claims are handled faster and without any steps being overlooked.

Compliance and Regulatory Management:

Processing business interruption claims requires meeting strict legal and regulatory standards. Cflow takes the guesswork out of compliance by adding automated checks into the approval process. Every claim is reviewed to ensure it meets all requirements, reducing the risk of errors or legal issues. It’s a reliable way to stay compliant while focusing on smooth claim approvals.

Real-Time Tracking and Reporting:

Cflow gives insurers full visibility into the claim process from start to finish. Managers can easily identify and address delays or issues before they become bigger problems. This helps keep claims moving on schedule. At the same time, businesses are kept informed about the progress of their claims, which builds confidence and strengthens communication.

Frequently Asked Questions

What is a business interruption insurance claim?

A claim for financial losses due to unexpected business disruptions like natural disasters or supply chain failures.

What are the main challenges in business interruption claims?

Proving financial losses, policy exclusions, and delayed claim settlements.

How can businesses ensure smooth business interruption claims?

By maintaining financial records, assessing risk factors, and implementing continuity plans.