Corporate Finance Approval Workflow

Why automate?

How Cflow Can Help Automate the Process:

Centralized Transaction Documentation and Submission:

Cflow provides a platform for documenting and submitting corporate finance transactions, ensuring all necessary details, such as transaction terms and due diligence findings, are accurately captured. This centralization simplifies the approval process and enhances data integrity.

Automated Financial Analysis and Due Diligence:

The system can automatically analyze the financial impact of proposed transactions and conduct due diligence checks, flagging any issues for further review. This helps ensure comprehensive evaluation and risk assessment.

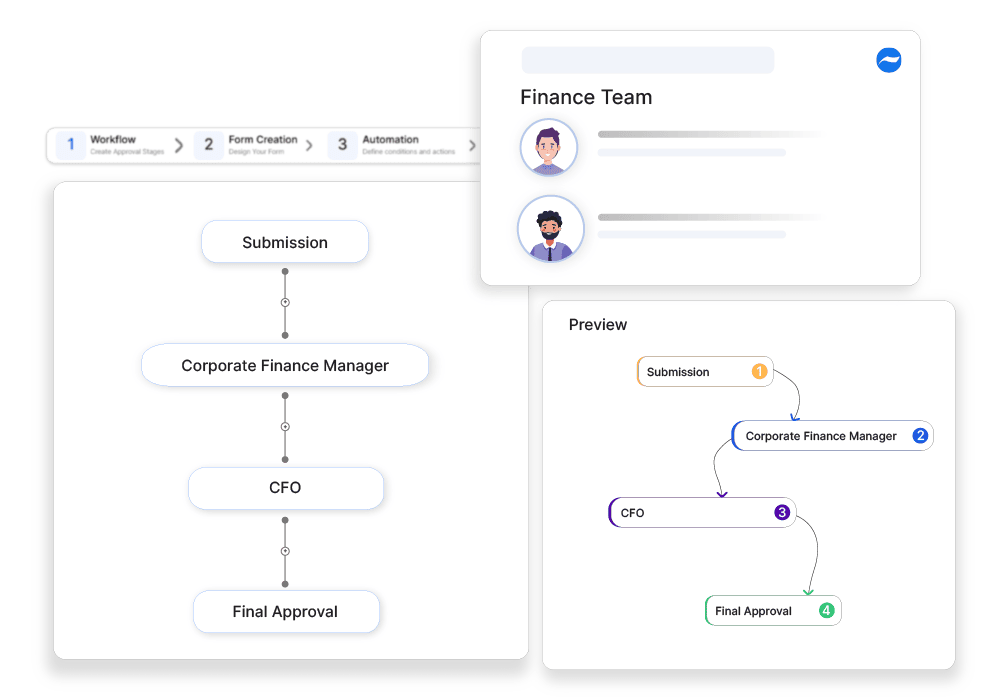

Streamlined Approval Workflows:

Corporate finance proposals are routed through a predefined approval workflow, involving finance, legal, and executive teams. This ensures thorough review and timely approval, facilitating efficient execution of financial transactions.

Detailed Reporting and Strategic Planning:

Cflow provides detailed reports on corporate finance approvals, including transaction details, approval histories, and strategic analyses. This transparency supports better financial oversight and strategic planning, providing insights into the organization’s financial transactions and strategic initiatives.

Frequently Asked Questions

What areas are covered under corporate finance approvals?

Investment decisions, capital structuring, and financial risk management.

What are common financial risks in corporate finance?

Market risks, credit risks, and operational inefficiencies.

How often should corporate financial strategies be reviewed?

Annually, with periodic adjustments based on business needs.