Variance Analysis Approval Workflow

Why automate?

How Cflow Can Help Automate the Process:

Centralized Variance Report Preparation

Cflow streamlines how variance analysis reports are prepared and submitted. It brings everything into one place, ensuring that all data and findings are accurately documented. This consistency makes the approval process smoother and helps avoid any confusion.

Automated Data Verification and Analysis

Cflow can automatically check financial data and calculate variances, highlighting discrepancies and pinpointing possible causes. This ensures the analysis is accurate and provides insights teams can act on quickly.

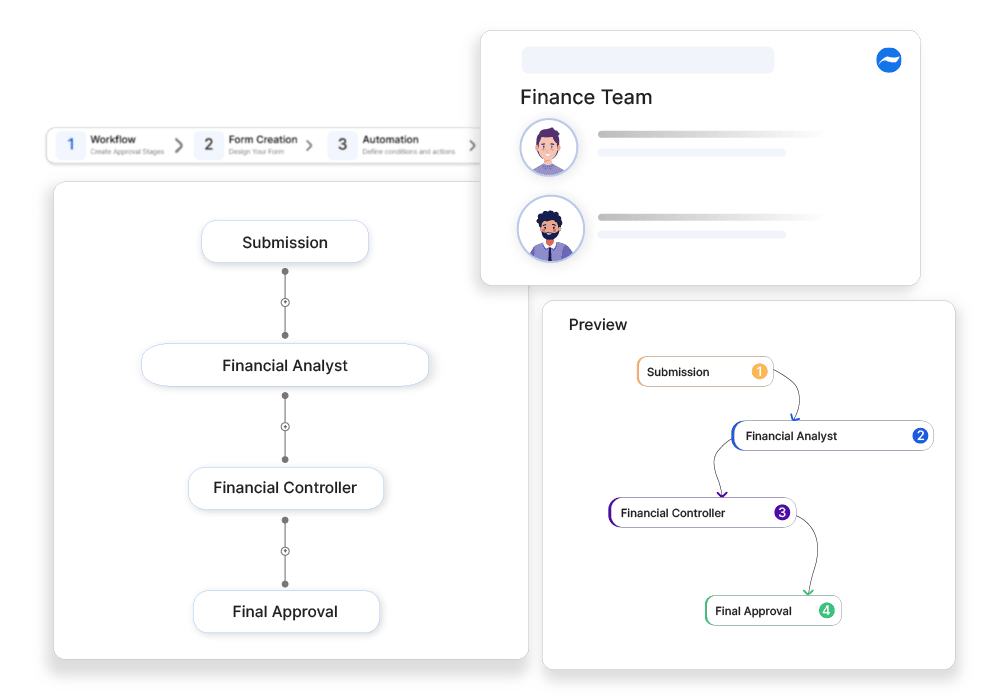

Streamlined Approval Workflows

With Cflow, variance reports move through a clear approval path, involving finance teams and management. This approach ensures thorough reviews and timely decisions, helping organizations take corrective action without delays.

Comprehensive Reporting and Tracking

Cflow doesn’t just handle approvals—it also tracks variance details, approval histories, and corrective actions. This transparency gives teams a clear view of financial performance, helping them plan better and focus on areas needing improvement.

Frequently Asked Questions

What is variance analysis?

It compares actual financial performance against budgeted projections.

What are common causes of budget variances?

Market fluctuations, operational inefficiencies, and unexpected expenses.

How can businesses address negative variances?

By adjusting budgets, reducing costs, or increasing revenue streams.