Mastering The Order To Cash Business Process: Steps, Challenges, Automation, And Best Practices

Key takeaways

- The order to cash business process defines how effectively businesses convert sales into revenue, directly impacting cash flow and customer experience.

- A streamlined order to cash cycle helps reduce payment delays, minimize disputes, and enhance financial visibility.

- Order to cash automation accelerates workflows, reduces manual errors, and improves compliance with global standards.

- Integrating ERP platforms and AI-driven analytics enables companies to optimize order to cash management at scale.

- Companies adopting digital order to cash workflows report faster revenue recognition and higher customer retention rates.

What is the Order to Cash Business Process?

Order to cash business process or O2C or OTC encompases the entire order processing system of a company. The order to cash business process, also known as the O2C cycle, is a cornerstone of financial operations in every organization. At its core, this process encompasses the entire journey of fulfilling customer demand, from order initiation to revenue realization. Activities within the order to case business process can directly impact the supply chain management and inventory management procedures.

Unlike other financial workflows, the order to cash cycle has a direct influence on both business profitability and customer satisfaction. When executed poorly, the O2C workflow leads to bottlenecks such as invoicing errors, delayed shipments, prolonged collections, and reduced cash flow. This not only impacts liquidity but can also strain customer relationships. Conversely, a well-designed order to cash process ensures timely invoicing, streamlined fulfillment, accurate credit management, and quicker payment cycles.

In this detailed blog, we will explore what the order to cash cycle involves, discuss each step in depth, identify key challenges, highlight strategies for optimization, compare it with procure to pay, and examine the transformative role of automation. We’ll also look at future trends that will reshape O2C and how businesses can leverage tools like Cflow to stay ahead.

Table of Contents

Understanding the Order To Cash Business Process in Detail

The order to cash business process, often called the O2C cycle, is the structured workflow that governs how businesses manage customer orders, deliver goods or services, and collect payments. It starts when a customer places an order and ends when the company records the payment in its books. While the process may sound straightforward, it is actually one of the most complex and vital functions of any organization because it connects multiple departments, sales, finance, operations, logistics, and customer service, into a single revenue-focused workflow.

At its core, the order to cash process is designed to achieve two objectives: ensure that customer orders are fulfilled accurately and quickly, and guarantee that payments are collected efficiently. When executed properly, the O2C cycle not only improves cash flow but also strengthens customer trust, since clients receive their orders on time and are billed correctly.

The importance of this process cannot be overstated, the O2C process is affected by all aspects of the business. For starters, order to cash workflow impacts operations throughout the organization, including supply chain management, inventory management, and labor.

Industry studies show that inefficient order to cash workflows can increase Days Sales Outstanding (DSO) by 20–30%, directly straining liquidity and restricting growth. On the other hand, businesses with optimized order to cash systems enjoy faster cash conversion, fewer disputes, and improved financial forecasting accuracy. For organizations operating at scale, the O2C process often influences investor confidence, as it is closely tied to revenue recognition and working capital health.

Another key aspect of the order to cash cycle is its scope. Unlike back-office accounting tasks, O2C is customer-facing. Every step, from order capture to invoicing, represents a touchpoint with the client. Errors in billing, missed shipments, or delayed payment reminders can damage the customer experience. This makes the O2C process not only a financial workflow but also a customer relationship driver.

Modern businesses are also expanding the definition of O2C to include advanced technologies like ERP integration, electronic invoicing, AI-driven credit checks, and automated collections. These innovations are designed to eliminate manual inefficiencies and provide real-time visibility across the entire order to cash workflow. For global organizations, the process must also account for regional tax compliance, multi-currency billing, and diverse payment methods, which further increases its complexity.

In short, the order to cash process is the engine that converts business opportunities into realized revenue. It ensures that sales translate into cash in the bank, provides visibility into receivables, supports compliance with financial regulations, and builds long-term customer loyalty. Without an effective O2C process, even companies with strong sales pipelines struggle to maintain financial stability.

Detailed Steps In The Order To Cash Business Process

The order to cash cycle is a structured sequence of activities that begins with receiving an order and ends with recording payment in the company’s accounts. Each step plays a vital role in ensuring smooth operations, accurate financial reporting, and strong customer satisfaction. Below is a detailed look at the key stages in the O2C process.

Step 1: Order Management And Capture

This is the starting point of the cycle where customer demand is recorded. Orders may come from e-commerce portals, direct sales teams, or call centers. Capturing accurate information about product details, quantities, pricing, and delivery timelines is critical. Mistakes at this stage cascade through the rest of the process, leading to billing errors or delays. Modern businesses rely on digital order capture systems integrated with customer relationship management tools to minimize errors and improve visibility.

Step 2: Credit Management And Risk Assessment

Once an order is captured, businesses need to evaluate the customer’s financial standing. Extending credit without proper checks exposes companies to bad debt risks. Credit management involves reviewing payment histories, setting credit limits, and identifying high-risk accounts. Today, organizations use automated credit scoring models that leverage AI and data analytics to make fast, accurate decisions. This ensures balance between securing revenue opportunities and protecting against financial loss.

Step 3: Order Fulfillment And Logistics

After credit approval, the company proceeds to fulfill the order. This includes picking items from inventory, packaging them, and shipping them to the customer. For service-based businesses, this step involves delivering the agreed service within the promised timeframe. Efficiency at this stage directly impacts customer satisfaction. Integration of enterprise resource planning systems with warehouse and logistics platforms ensures real-time tracking, reduced lead times, and transparency in delivery.

Step 4: Invoicing And Billing Accuracy

Generating an invoice is more than just issuing a bill, it represents a formal financial record that must align with order details and contractual terms. Errors in invoicing often lead to customer disputes and delayed payments. Automated invoicing systems reduce human error, apply correct tax rules, and deliver invoices instantly. Digital invoicing also provides customers with a transparent view of their charges, helping build trust and reducing payment disputes.

Step 5: Payment Collection And Processing

Once the invoice is delivered, the focus shifts to collecting payment. Customers today expect multiple payment options, including online transfers, credit cards, digital wallets, and traditional methods like checks. Clear payment terms and flexible options encourage timely settlement. Many businesses also use automated reminders and payment gateways to minimize delays. A strong payment collection process not only improves liquidity but also reduces the effort required to chase overdue accounts.

Step 6: Cash Application And Reconciliation

Payment collection is only complete when funds are accurately matched to the correct invoice. This step, known as cash application, ensures that accounts receivable records remain accurate. Manual reconciliation is time-consuming and error-prone, particularly when customers make partial or aggregated payments. Automated reconciliation tools use machine learning to identify payment patterns and apply funds correctly. This improves financial reporting accuracy and provides real-time insights into receivables.

Step 7: Reporting And Analysis

The final stage of the O2C process involves analyzing performance and identifying areas for improvement. Key metrics such as Days Sales Outstanding, collection effectiveness index, dispute resolution times, and payment trends are monitored closely. Insights gained from these reports guide strategy, allowing organizations to strengthen credit policies, improve customer communication, and optimize cash flow. Advanced analytics can also forecast customer behavior, helping finance teams anticipate risks and adjust accordingly.

Common Challenges In The Order To Cash Cycle

Although the order to cash cycle is essential for revenue realization, many organizations struggle to manage it efficiently. The process spans multiple departments, requires accurate coordination, and depends on both people and systems working in harmony. Even small inefficiencies in one step can ripple across the entire cycle, slowing down collections and weakening customer relationships. Below are the most common challenges businesses encounter in the O2C process.

1. Data Silos Across Departments

One of the biggest issues is the lack of integration between sales, finance, logistics, and customer service. When each department uses different systems or manual spreadsheets, critical information like order status, invoicing details, and payment records becomes fragmented. This not only delays decision-making but also increases the risk of errors. Without end-to-end visibility, organizations struggle to manage disputes effectively and forecast cash flow accurately.

2. Manual Errors In Order Entry

Many businesses still rely on manual processes to capture and manage orders. Typing errors, incorrect product codes, or mismatched pricing can create billing disputes and customer dissatisfaction. Even a small error in data entry can cause cascading problems, from incorrect fulfillment to delayed payments. These inefficiencies also drain resources, as employees must spend time correcting mistakes rather than focusing on value-added activities.

3. Lengthy Credit Approval Cycles

Credit management is necessary to protect businesses from bad debt, but slow or inefficient approval processes can delay order fulfillment. When credit checks require manual reviews or involve multiple approval layers, the process becomes time-consuming. This leads to frustrated customers and lost sales opportunities. Companies without automated credit assessment tools often face this bottleneck, which hinders their ability to respond quickly to customer demand.

4. Complex Tax And Compliance Requirements

For businesses operating across multiple regions, invoicing is complicated by diverse tax rules, regulatory requirements, and reporting standards. Mistakes in applying the correct tax codes or failing to meet compliance obligations can lead to fines, disputes, or reputational damage. Keeping up with changing regulations also requires constant monitoring, which can overwhelm teams that lack automated compliance systems.

5. Late Or Missed Payments

Delayed payments are one of the most significant challenges in the order to cash process. Customers may withhold payment due to disputes, unclear terms, or inefficiencies in invoicing. Some simply delay payments to manage their own cash flow. Late payments extend Days Sales Outstanding (DSO), reduce working capital, and limit a company’s ability to reinvest in growth. Without effective collection strategies and automated reminders, businesses risk higher levels of bad debt.

6. Limited Visibility Into Receivables

A lack of real-time tracking of invoices, collections, and outstanding payments prevents finance teams from having a clear picture of their receivables. This makes it difficult to forecast cash flow, plan investments, and manage liquidity effectively. When executives do not have access to accurate financial data, decision-making suffers, and the organization becomes vulnerable to cash shortages.

7. Inefficient Dispute Management

Disputes over incorrect orders, billing errors, or delayed deliveries are inevitable in the O2C cycle. However, when companies lack structured dispute resolution mechanisms, these issues take too long to resolve. As disputes drag on, payments are delayed, customer satisfaction declines, and relationships are strained. A reactive approach to dispute management increases administrative costs and negatively impacts the customer experience.

8. Lack Of Standardization

Inconsistent processes across regions or business units can create further inefficiencies. For example, if one division follows strict credit rules while another has looser policies, the organization faces uneven risk exposure. Similarly, variations in invoicing formats or collection strategies lead to confusion and inefficiency. Without standardized workflows, it is nearly impossible to measure performance and scale improvements.

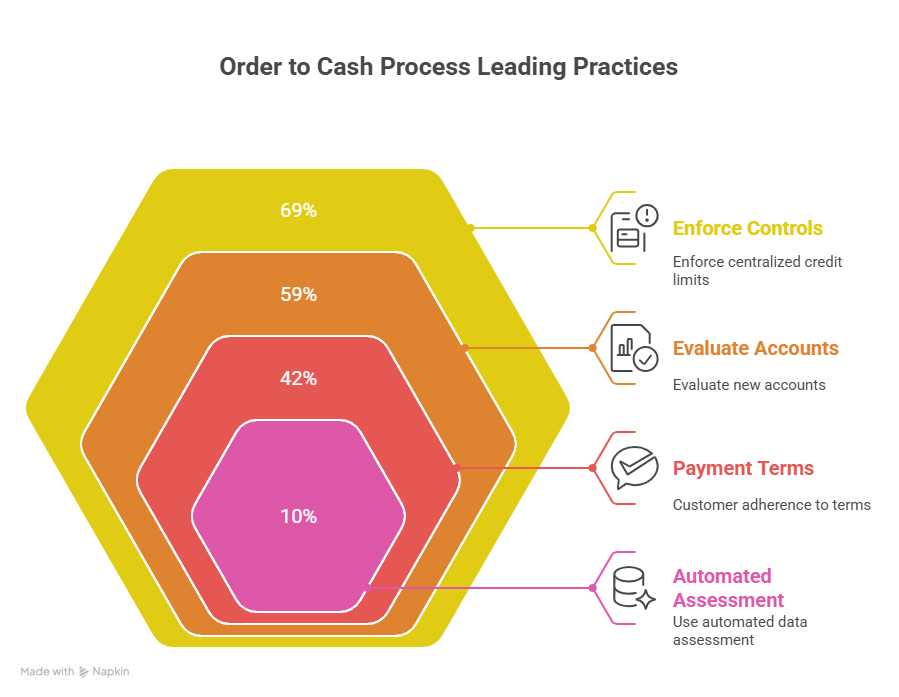

How To Optimize The Order To Cash Process

Improving the order to cash process requires a strategic mix of automation, integration, and intelligent insights. Many businesses face challenges because different departments, such as sales, finance, and operations, work in silos, creating delays, duplication, and errors. To truly optimize the cycle, companies must connect these functions and manage them as one streamlined workflow. Best practices to optimize the process include:

Automate Routine Tasks: Use workflow automation to handle order entry, invoicing, and payment reminders, reducing errors and processing time.

Integrate Systems End-to-End: Connect CRM, ERP, logistics, and finance platforms to ensure consistent data flow and eliminate silos.

Standardize Processes: Establish uniform credit policies, approval workflows, and invoicing formats to minimize disputes and delays.

Leverage Predictive Analytics: Use AI and data-driven insights to forecast payment behavior, assess credit risk, and prioritize collections.

Enhance Visibility With Dashboards: Monitor key performance indicators such as Days Sales Outstanding (DSO), dispute rates, and cash flow in real time.

Strengthen Dispute Management: Implement structured workflows for quick resolution of billing errors, delivery issues, or payment mismatches.

Offer Flexible Payment Options: Provide customers with multiple payment methods, such as online transfers, cards, and digital wallets, to accelerate collections

Improve Customer Communication: Send automated order updates, invoice notifications, and payment reminders to keep customers informed and engaged.

Adopt Self-Service Portals: Allow customers to track orders, download invoices, and make payments directly through a digital platform.

Review And Optimize Regularly: Continuously audit the O2C process, identify bottlenecks, and refine workflows based on performance data.

Benefits Of Order To Cash Automation

Automating the order to cash cycle has become a priority for organizations looking to improve efficiency, reduce costs, and enhance customer satisfaction. Manual processes create bottlenecks and increase the risk of errors, while automation brings speed, consistency, and transparency. By digitizing key steps such as order capture, invoicing, collections, and cash application, businesses can transform O2C into a powerful driver of growth and financial stability. Below are the main benefits of automating the order to cash process.

Faster Cycle Times

Automation significantly reduces the time required to process orders, generate invoices, and reconcile payments. Instead of waiting days for manual approvals and processing, tasks are completed in real time. This acceleration helps businesses improve cash conversion and ensures customers receive their orders and invoices quickly. Faster cycle times also give companies an edge in competitive markets where responsiveness is a key differentiator.

Improved Accuracy And Fewer Errors

Manual data entry is one of the leading causes of invoicing disputes and delayed payments. Automation eliminates this risk by ensuring that information flows seamlessly from order entry to invoicing and payment reconciliation. By reducing human intervention, businesses can achieve higher accuracy in order details, tax calculations, and billing. This leads to fewer disputes, less rework, and stronger customer trust.

Enhanced Compliance And Audit Readiness

For companies operating across multiple regions, keeping up with tax regulations, industry standards, and reporting requirements is a constant challenge. Automated systems can apply the correct tax codes, generate compliant invoices, and maintain detailed audit trails. This ensures that businesses meet regulatory requirements consistently and are always prepared for audits, avoiding fines and reputational damage.

Better Customer Experience

Automation creates a smoother and more transparent process for customers. Real-time updates on order status, automated invoice delivery, and multiple payment options improve the overall experience. Customers value speed and accuracy, and businesses that deliver both are more likely to retain them. By reducing disputes and providing clear communication, automation also strengthens long-term relationships and loyalty.

Greater Financial Visibility

Automated O2C systems provide finance teams with dashboards and reports that offer real-time visibility into receivables, collections, and outstanding payments. This transparency allows businesses to track key metrics such as Days Sales Outstanding, dispute resolution times, and collection effectiveness. With accurate data at their fingertips, executives can make better-informed decisions, forecast cash flow more accurately, and identify trends that impact revenue performance.

Reduced Operational Costs

By automating repetitive tasks such as invoice generation, payment reminders, and reconciliation, businesses lower their reliance on manual labor and minimize administrative overhead. This frees employees to focus on higher-value work such as handling exceptions, analyzing customer behavior, and developing strategies for growth. Over time, automation delivers significant cost savings while boosting productivity.

Stronger Collections And Cash Flow

Automated payment reminders, integration with payment gateways, and intelligent collections strategies improve the timeliness of customer payments. By reducing late or missed payments, companies can lower DSO and strengthen working capital. Faster access to cash gives businesses the liquidity they need to fund operations, invest in innovation, and respond quickly to market opportunities.

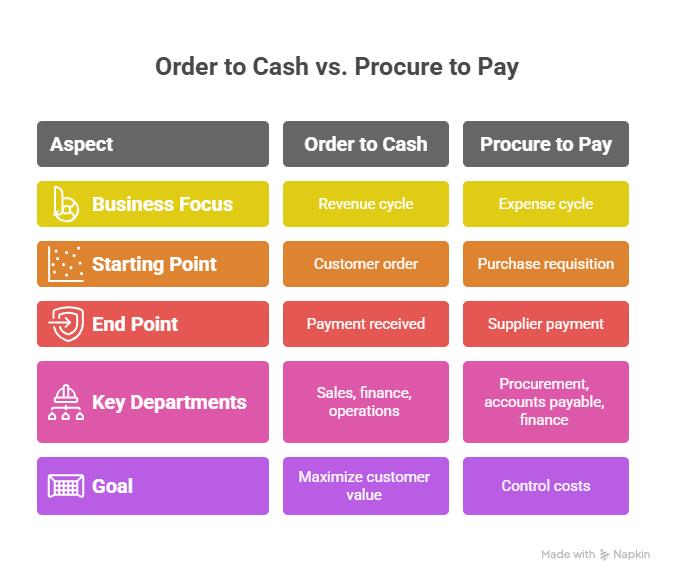

Difference Between Order To Cash And Procure To Pay

Aspect | Order to Cash (O2C) | Procure to Pay (P2P) |

Business Focus | Revenue cycle, customer-facing | Expense cycle, supplier-facing |

Starting Point | Customer places an order | Business raises a purchase requisition |

End Point | Payment received and reconciled | Supplier payment completed |

Key Departments | Sales, finance, accounts receivable, operations | Procurement, accounts payable, finance |

Goal | Accelerate cash inflow, maximize customer value | Control costs and ensure timely supplier payment |

Future Of The Order To Cash Process

The future of O2C lies in AI, machine learning, and blockchain. AI-powered credit scoring, predictive collections, and automated dispute management are already reshaping the landscape. Blockchain technology is expected to provide enhanced transparency, traceability, and fraud prevention in order-to-cash transactions.

The order to cash process is rapidly evolving as businesses adapt to digital-first operations and globalized markets. What was once a largely manual, back-office function is now becoming a strategic driver of customer experience and financial agility. The future of O2C lies in intelligent automation, advanced analytics, and integrated platforms that provide end-to-end visibility. Below are some of the key trends shaping the future of the order to cash cycle.

1. AI-Powered Credit And Risk Management

Artificial intelligence and machine learning are transforming how companies assess customer creditworthiness and payment behavior. Instead of relying on static credit scores, businesses can now use predictive analytics to evaluate risk in real time. This enables faster decisions, more accurate credit limits, and reduced exposure to bad debt.

2. Intelligent Collections And Dispute Management

In the coming years, collections will be increasingly automated with AI-driven reminders, escalation paths, and customer segmentation. Advanced systems will prioritize accounts based on payment likelihood and customize outreach strategies. Similarly, disputes will be resolved faster through automated workflows, self-service portals, and natural language processing tools that analyze and respond to customer claims.

3. Cloud-Based And Integrated Platforms

Organizations are moving toward cloud-based solutions that integrate ERP, CRM, logistics, and finance functions into a single connected system. This trend eliminates data silos and ensures consistency across the entire O2C process. Cloud platforms also offer scalability, enabling businesses to adapt quickly to new markets and customer demands.

4. Blockchain For Transparency And Security

Blockchain technology is expected to bring greater transparency, security, and traceability to financial transactions. By recording every stage of the order to cash process on a secure distributed ledger, businesses can reduce fraud, prevent disputes, and build trust with customers and partners. This will be especially critical for industries like manufacturing, pharmaceuticals, and cross-border trade.

5. Real-Time Financial Visibility

Future O2C systems will provide finance teams with real-time dashboards that track key metrics such as Days Sales Outstanding, dispute resolution times, and cash flow trends. This continuous visibility will enable proactive decision-making, allowing businesses to identify potential issues before they escalate and maintain tighter control over working capital.

6. Customer-Centric O2C Workflows

Customer expectations are reshaping O2C processes. Companies will increasingly design workflows that prioritize customer convenience, offering flexible payment options, personalized communication, and self-service tools. Businesses that can combine financial discipline with customer-centricity will be more successful in retaining clients and accelerating revenue cycles.

7. Regulatory And Compliance Automation

With global tax laws and compliance standards becoming more complex, future O2C systems will embed automated compliance checks into invoicing and reporting. This will reduce the risk of fines, ensure audit readiness, and allow businesses to expand internationally without facing regulatory hurdles.

8. Sustainability And Green Finance Integration

As environmental, social, and governance (ESG) reporting becomes more important, order to cash processes will also evolve to incorporate sustainability metrics. Businesses may include carbon reporting in invoices, adopt eco-friendly billing practices, and integrate ESG compliance into financial workflows.

End-to-end workflow automation

Build fully-customizable, no code process workflows in a jiffy.

How Cflow Streamlines the Order To Cash Business Process

Cflow is designed to simplify and accelerate complex financial workflows such as the order to cash cycle. By combining no-code automation, intelligent routing, and real-time analytics, Cflow provides businesses with a powerful platform to eliminate manual inefficiencies and improve financial performance. From order capture to payment reconciliation, Cflow ensures that every step of the O2C cycle runs smoothly and consistently.

- Seamless Order Capture: Cflow digitizes order intake across multiple channels, ensuring accuracy and reducing the risk of duplicate or incomplete entries. Orders are validated instantly, minimizing errors at the very start of the process.

- Automated Credit Approvals: With customizable rules, Cflow streamlines credit checks and approvals. This prevents delays, reduces risk exposure, and ensures that orders move forward without bottlenecks.

- Accurate Invoicing And Billing: Invoices are generated automatically with the correct pricing, discounts, and tax rules applied. This reduces disputes and speeds up payment cycles.

- Smarter Collections: Cflow automates payment reminders, escalations, and follow-ups. Customers receive timely communication, while finance teams gain visibility into overdue accounts and collection progress.

- Efficient Cash Application: Payments are automatically matched to invoices, even when customers make partial or bulk payments. This improves reconciliation accuracy and reduces manual workload.

- Real-Time Visibility: Dashboards and reports provide finance leaders with insights into receivables, Days Sales Outstanding, and dispute trends, enabling better forecasting and decision-making.

By streamlining the order to cash business process, Cflow not only improves efficiency but also enhances customer satisfaction and strengthens cash flow. Businesses using Cflow gain the agility to scale operations, maintain compliance, and sustain profitability without being slowed down by manual processes.

Final Thoughts

The order to cash business process is not just a financial workflow; it is the engine that powers business growth. From capturing customer orders to recording payments, every step impacts liquidity, profitability, and customer loyalty. Businesses that fail to modernize O2C risk higher disputes, slower collections, and weaker cash flow.

Cflow empowers organizations to overcome these challenges with no-code, AI-driven automation. By digitizing every step of the O2C cycle, Cflow provides businesses with faster revenue recognition, greater visibility, and improved financial health. To unlock the full potential of your order to cash process, start your free trial with Cflow today.

FAQs

1. What is the order to cash process in business?

It is the end-to-end workflow covering order capture, credit checks, fulfillment, invoicing, payment collection, and cash reconciliation.

2. How does order to cash differ from procure to pay?

Order to cash manages customer-facing revenue cycles, while procure to pay handles supplier-related expense cycles.

3. What are the challenges in the order to cash cycle?

Common issues include manual errors, late payments, compliance complexity, and limited visibility into receivables.

4. Why should businesses automate the order to cash process?

Automation reduces errors, accelerates collections, ensures compliance, and improves customer experience.

5. Which metrics are most important for O2C performance?

Key metrics include Days Sales Outstanding (DSO), invoice accuracy, dispute rates, and average payment cycle time.

What should you do next?

Thanks for reading till the end. Here are 3 ways we can help you automate your business:

Do better workflow automation with Cflow

Create workflows with multiple steps, parallel reviewals. auto approvals, public forms, etc. to save time and cost.

Talk to a workflow expert

Get a 30-min. free consultation with our Workflow expert to optimize your daily tasks.

Get smarter with our workflow resources

Explore our workflow automation blogs, ebooks, and other resources to master workflow automation.