Mortgage Application Approvals

Why automate?

How Cflow Can Help:

Automated Credit Check Integration

All the necessary verifications on creditworthiness of mortgage applications are automatically done in Cflow. This ensures that only qualified applicants are approved and the approval process is accelerated.

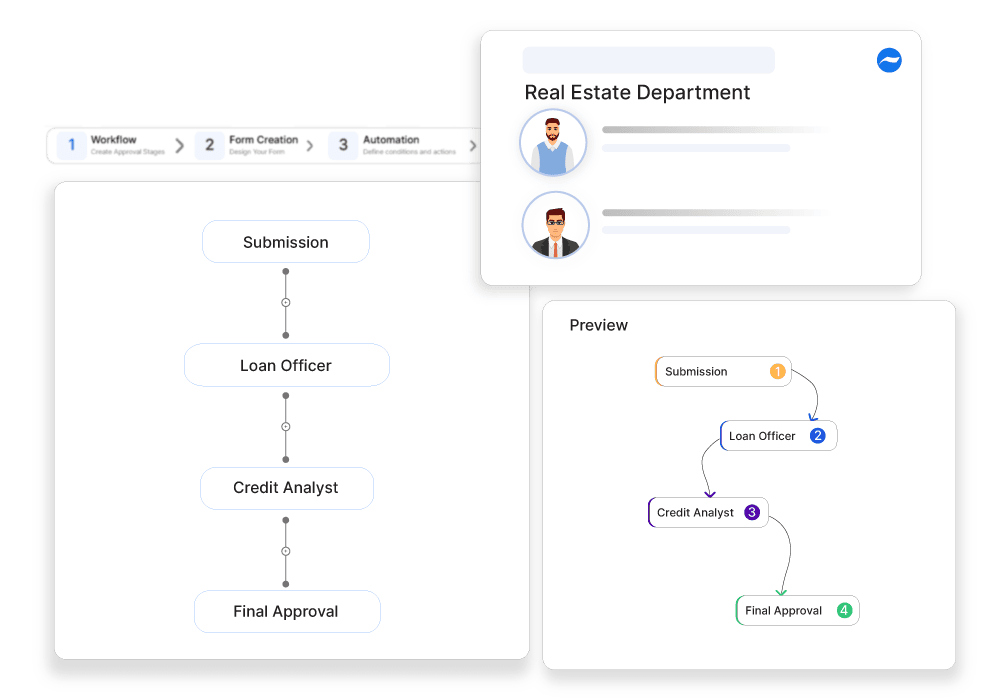

Efficient Approval Workflow

All mortgage applications are automatically routed to appropriate stakeholders in Cflow. Automated routing of applications ensures timely approvals and smooth processing of applications.

Streamlined Document Management

All relevant documents pertaining to mortgage applications are automatically gathered in Cflow, which ensures that all information is included in the application.

Centralized Application Tracking

The centralized platform in Cflow allows for real-time tracking the status of mortgage applications, from submission to approval. Cflow provides a clear audit trail, which makes it easy to monitor the progress of applications and address any issues that arise.

Frequently Asked Questions

What is a mortgage application approval?

A process where a lender reviews and authorizes a borrower’s request for a mortgage loan based on financial qualifications and property value.

What challenges arise in mortgage application approvals?

Incomplete documentation, credit score discrepancies, and delayed verification of financial details.

How can organizations streamline mortgage application approvals?

By automating document verification, using credit assessment software, and setting clear qualification criteria.