Loan Modification Request Approvals

Why automate?

How Cflow Can Help Automate Loan Modification Request Approvals

Automated Financial Assessment

Cflow facilitates automated financial assessment ensuring that the term adjustments are compliant with the industry standards and borrower has a thorough understanding of the new terms. This ensures modifications are sustainable and is beneficial for both sides.

Streamlined Document Management

Cflow offers a centralized document management solution ensuring that all essential information related to loan term modifications such as financial hardship letters, income statements, and existing loan documents are stored securely for future reference.

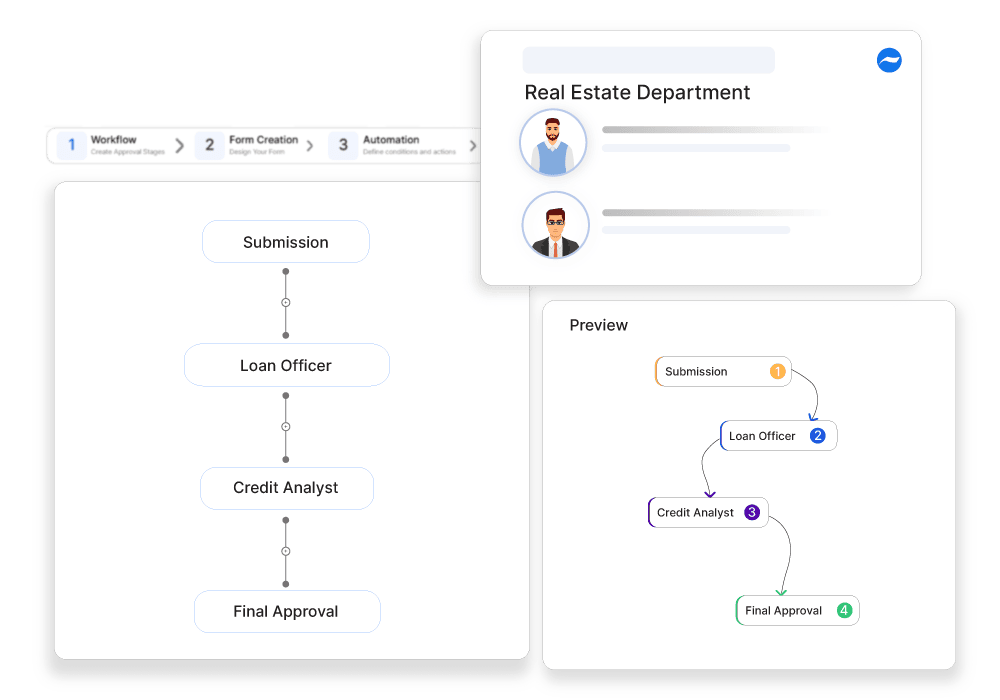

Efficient Approval Workflow

Cflow enables an efficient approval process by routing the requests to relevant stakeholders for approval. This reduces delays and modifications are done and implemented effectively.

Centralized Compliance Tracking

Cflow offers centralized compliance tracking to ensure that the loan terms and their modifications adhere to the financial and regulatory requirements. It helps protect the lender from legal challenges and protects borrowers’ interests.

Frequently Asked Questions

What is a loan modification request approval?

A process where a lender reviews and authorizes changes to the terms of an existing loan to help the borrower manage payments.

What challenges arise in loan modification request approvals?

Incomplete financial information, lack of borrower communication, and regulatory compliance issues.

How can organizations streamline loan modification request approvals?

By providing clear submission requirements, automating financial reviews, and improving borrower communication.