Legal Expense Insurance Claim Approvals

Why automate?

How Cflow Can Help Automate the Process:

Automated Claim Verification:

All legal expense insurance claims routed through Cflow are automatically verified against the policyholder’s details and claim details, without the need for manual followup. The preset business rules in Cflow allow for accurate and timely review of each insurance claim, allowing only eligible claims to be approved. This also mitigates the risk of errors and duplications.

Compliance and Regulatory Management:

Regulatory and legal compliance is of great importance in insurance claim processing. Cflow ensures that all expense insurance claims are compliant by incorporating automated compliance checks into the approval process. This way, all claims that are approved by the system are legally compliant and as per regulatory guidelines.

Real-Time Tracking and Reporting:

Insurance agents can easily track and report details of the insurance claim with Cflow. Thanks to the real-time tracking provided by Cflow, all stakeholders are aware of the status at all times. Real-time reporting also enhances transparency, enabling insurers to keep policyholders informed about the status of their claims.

Customized Workflow Templates:

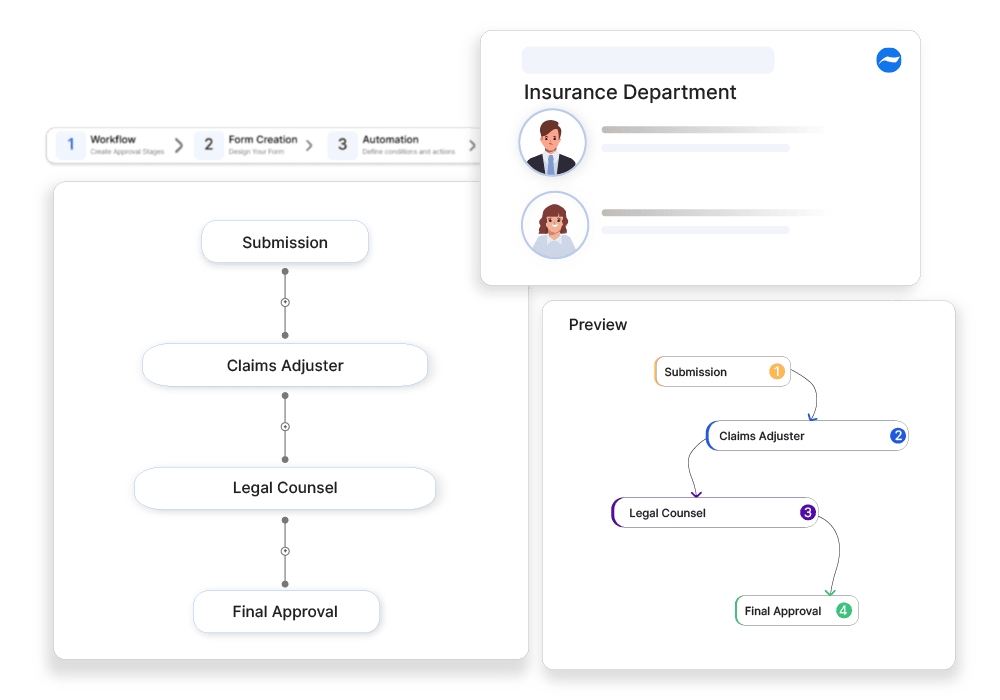

The no code visual workflow builder in Cflow enables insurers to create customized workflows for processing legal expense insurance claims. These workflows can include automated steps for document submission, verification, and final approval, ensuring that claims are processed efficiently and in line with policy guidelines.

Frequently Asked Questions

What is a legal expense insurance claim?

A claim seeking coverage for legal costs related to disputes, lawsuits, or legal advice.

What are the main challenges in legal expense insurance claims?

Coverage limitations, high burden of proof, and delayed claim approvals.

How can businesses ensure smooth legal expense insurance claims?

By clearly documenting legal matters, consulting legal advisors, and understanding policy terms.