Tax Filing Approvals

Why automate?

How Cflow Can Help Automate Tax Filing Approvals

Automated Tax Return Review

Cflow can automate the review of tax returns by integrating with tax calculation tools to ensure that all data is accurate and compliant with regulations. This helps maintain accurate and timely tax filings.

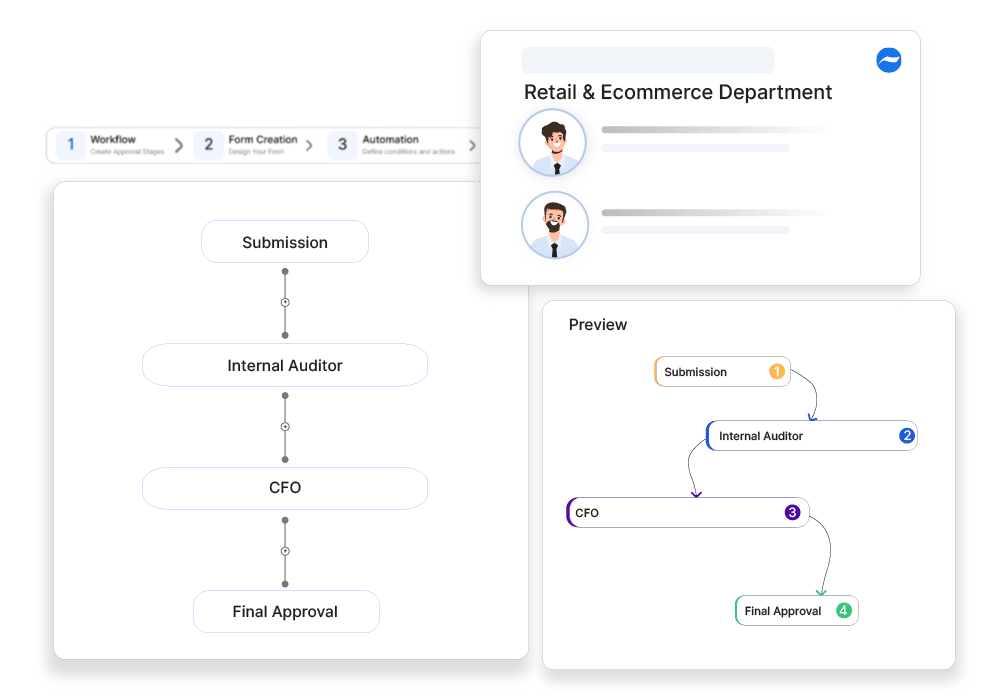

Streamlined Approval Workflow

With Cflow, tax filings can be automatically routed to the appropriate stakeholders, including finance teams and tax advisors, for review and approval. This ensures that all necessary approvals are obtained promptly, reducing delays.

Centralized Filing Management

Cflow provides a centralized platform for storing and managing all tax filing documents and related records. This ensures that all approvals are properly documented and easily accessible, providing a clear audit trail.

Automated Status Tracking and Notifications

Cflow can integrate with tracking tools to automatically manage the status of tax filing approvals and send notifications to stakeholders regarding approval status and required actions. This helps keep all parties informed and ensures efficient processing of tax filings.

Frequently Asked Questions

What is a tax filing approval?

A process where management reviews and authorizes the submission of tax documents to ensure compliance with tax regulations.

What challenges arise in tax filing approvals?

Incomplete financial records, changing tax laws, and submission deadlines.

How can organizations streamline tax filing approvals?

By using tax management software, consulting with tax professionals, and maintaining accurate financial records.