Insurance Policy Approvals

Why automate?

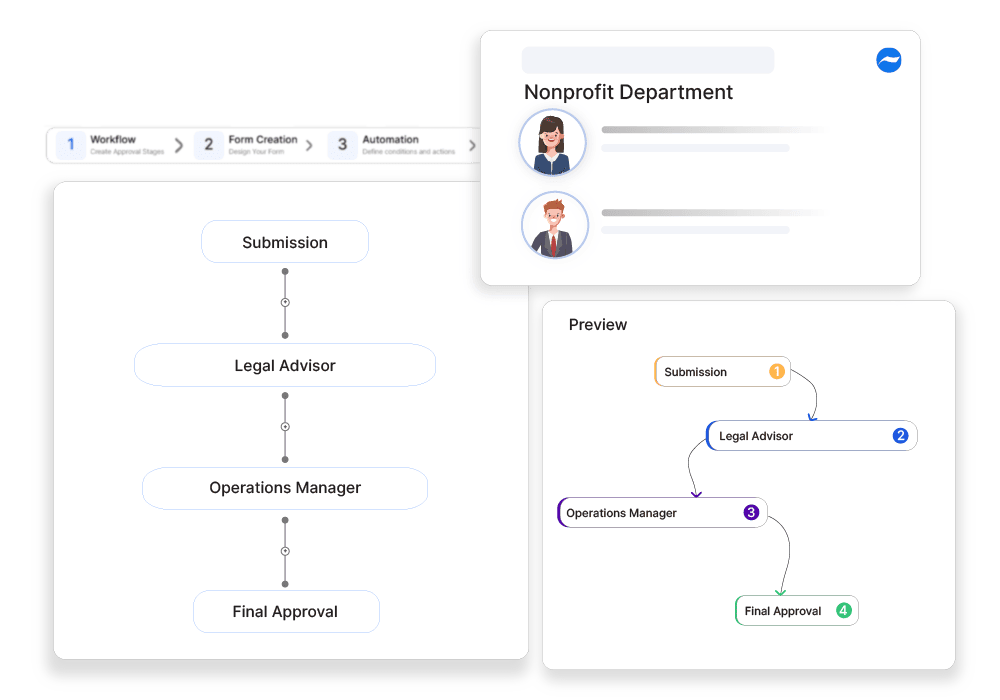

How Cflow Can Help:

Comprehensive Coverage:

The review and approval process can be automated in Cflow. Automation ensures that all policies are reviewed and approved quickly that too in accordance with the company’s risk management guidelines.

Real-Time Monitoring:

Users gain complete, real-time visibility into insurance policy approval statuses, which allows them to monitor the status of approvals and ensure alignment.

Efficient Risk Management:

The automated workflows in Cflow ensure that all insurance policies are managed efficiently, protecting the company’s financial stability and operational continuity.

Risk Mitigation:

The risk factor associated with insurance policy approval is mitigated by automating the approval process. This way insurance policies provide adequate coverage, reducing the risk of gaps in coverage and financial exposure.

Frequently Asked Questions

What is an insurance policy approval?

A process where management reviews and authorizes insurance policies for business protection.

What challenges arise in insurance policy approvals?

High premiums, inadequate coverage, and complex terms.

How can organizations streamline insurance policy approvals?

By comparing multiple providers, conducting risk assessments, and negotiating terms.