Deferred Compensation Plan Approvals

Why automate?

How Cflow Can Help Automate the Process:

Automated Eligibility Verification:

Cflow automates eligibility checks for deferred compensation plans. It cross-references employee income and job details with the plan’s terms and IRS rules. This ensures only eligible applicants are approved, reducing errors and speeding up the process so employees can start saving sooner.

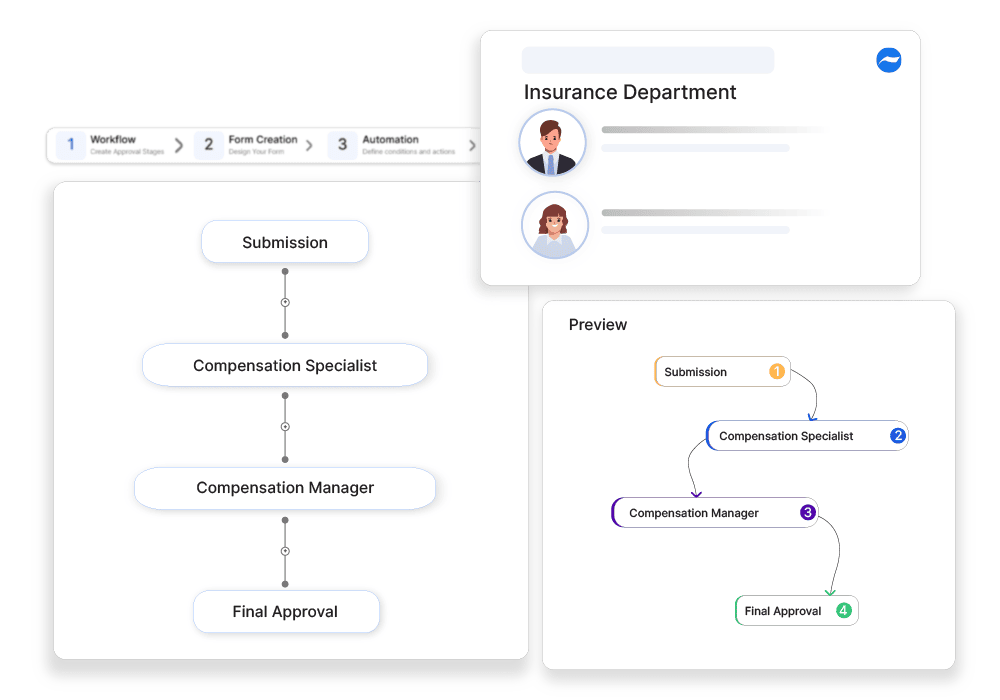

Customized Workflow Templates:

With Cflow, employers can create custom workflows for plan approvals. Custom workflows can be created to handle tasks like enrollment, document submission, and eligibility verification. This makes the process faster, smoother, and fully compliant with regulations.

Compliance and Regulatory Management

Cflow helps employers follow IRS rules and legal requirements. It adds automated compliance checks to the approval process, ensuring every application meets the necessary standards. This reduces the risk of mistakes and penalties.

Real-Time Tracking and Reporting:

Cflow’s real-time tracking shows the progress of each application at every step. This helps managers spot and fix issues quickly, preventing delays. Real-time reports also keep the process transparent, so employees stay updated on their application status.

Frequently Asked Questions

What is a deferred compensation plan approval?

A process to authorize tax-deferred income distributions for employees.

What are the main challenges in deferred compensation plan approvals?

Regulatory compliance, contribution tracking, and payout scheduling.

How can businesses ensure smooth deferred compensation plan approvals?

By ensuring accurate payroll deductions, maintaining compliance records, and automating approval processes.