Builder’s Risk Insurance Claim Approvals

Why automate?

How Cflow Can Help Automate the Process:

Automated Damage Verification:

Cflow automates the verification of builder’s risk claims by cross-referencing the details of the damage against the policyholder’s coverage and construction documentation. This ensures that only valid claims are approved, reducing the risk of errors and speeding up the approval process, allowing construction projects to continue without unnecessary delays.

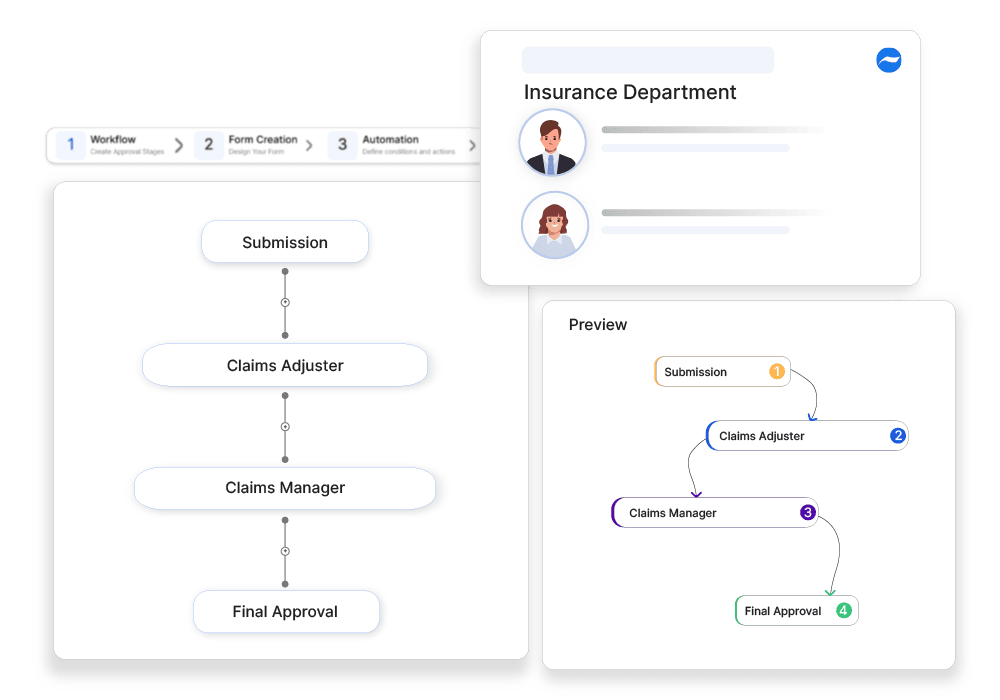

Customized Workflow Creation:

Cflow’s customizable workflow templates allow insurers to create tailored workflows for builder’s risk claims. These workflows can include automated steps for document submission, damage assessment, and final approval, ensuring that each claim is processed efficiently and in accordance with policy guidelines.

Compliance and Regulatory Management:

Builder’s risk claims must comply with various legal and regulatory requirements, and Cflow helps insurers stay compliant by incorporating automated compliance checks into the approval process. This ensures that each claim meets industry standards and legal obligations, reducing the risk of non-compliance and potential legal issues.

Real-Time Tracking and Reporting:

With Cflow’s real-time tracking and reporting features, insurance companies can monitor the progress of builder’s risk claims at every stage. This visibility allows managers to quickly identify and resolve any issues, ensuring that claims are processed without unnecessary delays. Real-time reporting also enhances transparency, enabling insurers to keep construction companies informed about the status of their claims.

Frequently Asked Questions

What is a builder’s risk insurance claim?

A claim covering construction-related risks, including property damage and theft of materials.

What are the main challenges in builder’s risk claims?

Vague policy terms, contractor disputes, and high claim investigation times.

How can businesses ensure smooth builder’s risk claims?

By keeping construction logs, conducting regular inspections, and ensuring clear contract terms.